The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

© 2012 <strong>Kantar</strong> <strong>Retail</strong><br />

WHY Buy Groceries <strong>Onl<strong>in</strong>e</strong>?<br />

<strong>The</strong> Shopper Perspective<br />

In general, shopp<strong>in</strong>g onl<strong>in</strong>e is thought <strong>of</strong> as a way to ei<strong>the</strong>r purchase goods <strong>in</strong> a very convenient way OR<br />

purchase <strong>the</strong>m at a lower price. While this is obviously a false dichotomy as both reasons <strong>in</strong>fluence onl<strong>in</strong>e<br />

purchas<strong>in</strong>g, it is <strong>in</strong>formative to ask shoppers to choose which is more important: time or money.<br />

When ask<strong>in</strong>g shoppers to <strong>in</strong>dicate which side <strong>of</strong> <strong>the</strong> “save time vs. save money” issue best describes why <strong>the</strong>y<br />

shop onl<strong>in</strong>e, onl<strong>in</strong>e grocery shoppers are decidedly more likely than <strong>the</strong> average onl<strong>in</strong>e shopper (56% vs. 46%)<br />

to fall <strong>in</strong>to <strong>the</strong> “save time” camp—suggest<strong>in</strong>g that <strong>the</strong>se shoppers may be will<strong>in</strong>g to pay a small premium for<br />

<strong>the</strong> convenience <strong>of</strong> onl<strong>in</strong>e grocery shopp<strong>in</strong>g. Based on <strong>the</strong> fee structure <strong>of</strong> most onl<strong>in</strong>e grocers <strong>in</strong> <strong>the</strong> <strong>United</strong><br />

States today, particularly <strong>the</strong> “traditional grocers” who <strong>of</strong>fer home delivery, this is how it is currently play<strong>in</strong>g<br />

out <strong>in</strong> <strong>the</strong> marketplace as grocers charge an additional fee to cover delivery costs.<br />

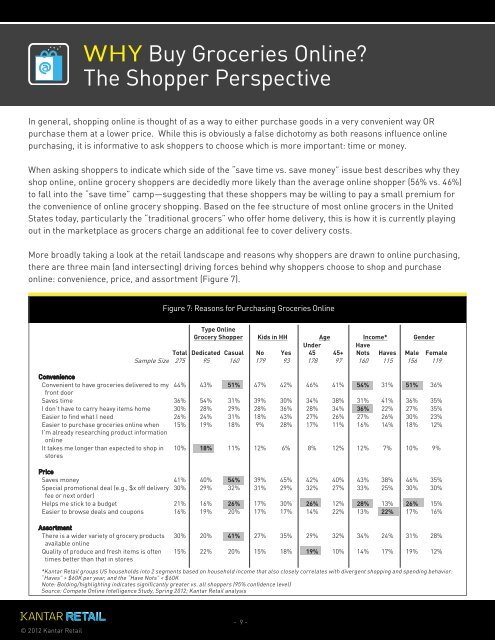

More broadly tak<strong>in</strong>g a look at <strong>the</strong> retail landscape and reasons why shoppers are drawn to onl<strong>in</strong>e purchas<strong>in</strong>g,<br />

<strong>the</strong>re are three ma<strong>in</strong> (and <strong>in</strong>tersect<strong>in</strong>g) driv<strong>in</strong>g forces beh<strong>in</strong>d why shoppers choose to shop and purchase<br />

onl<strong>in</strong>e: convenience, price, and assortment (Figure 7).<br />

Figure 7: Reasons for Purchas<strong>in</strong>g Groceries <strong>Onl<strong>in</strong>e</strong><br />

Type <strong>Onl<strong>in</strong>e</strong><br />

<strong>Grocery</strong> Shopper Kids <strong>in</strong> HH Age Income* Gender<br />

Under<br />

Have<br />

Total Dedicated Casual No Yes 45 45+ Nots Haves Male Female<br />

Sample Size 275 95 160 179 93 178 97 160 115 156 119<br />

Convenience<br />

Convenient to have groceries delivered to my<br />

front door<br />

44% 43% 51% 47% 42% 46% 41% 54% 31% 51% 36%<br />

Saves time 36% 54% 31% 39% 30% 34% 38% 31% 41% 36% 35%<br />

I don’t have to carry heavy items home 30% 28% 29% 28% 36% 28% 34% 36% 22% 27% 35%<br />

Easier to f<strong>in</strong>d what I need 26% 24% 31% 18% 43% 27% 26% 27% 26% 30% 23%<br />

Easier to purchase groceries onl<strong>in</strong>e when<br />

I’m already research<strong>in</strong>g product <strong>in</strong>formation<br />

onl<strong>in</strong>e<br />

15% 19% 18% 9% 28% 17% 11% 16% 14% 18% 12%<br />

It takes me longer than expected to shop <strong>in</strong><br />

stores<br />

10% 18% 11% 12% 6% 8% 12% 12% 7% 10% 9%<br />

Price<br />

Saves money 41% 40% 54% 39% 45% 42% 40% 43% 38% 46% 35%<br />

Special promotional deal (e.g., $x <strong>of</strong>f delivery<br />

fee or next order)<br />

30% 29% 32% 31% 29% 32% 27% 33% 25% 30% 30%<br />

Helps me stick to a budget 21% 16% 26% 17% 30% 26% 12% 28% 13% 26% 15%<br />

Easier to browse deals and coupons 16% 19% 20% 17% 17% 14% 22% 13% 22% 17% 16%<br />

Assortment<br />

<strong>The</strong>re is a wider variety <strong>of</strong> grocery products<br />

available onl<strong>in</strong>e<br />

Quality <strong>of</strong> produce and fresh items is <strong>of</strong>ten<br />

times better than that <strong>in</strong> stores<br />

30% 20% 41% 27% 35% 29% 32% 34% 24% 31% 28%<br />

15% 22% 20% 15% 18% 19% 10% 14% 17% 19% 12%<br />

*<strong>Kantar</strong> <strong>Retail</strong> groups US households <strong>in</strong>to 2 segments based on household <strong>in</strong>come that also closely correlates with divergent shopp<strong>in</strong>g and spend<strong>in</strong>g behavior:<br />

“Haves” > $60K per year, and <strong>the</strong> “Have Nots” < $60K<br />

Note: Bold<strong>in</strong>g/highlight<strong>in</strong>g <strong>in</strong>dicates significantly greater vs. all shoppers (95% confidence level)<br />

Source: Compete <strong>Onl<strong>in</strong>e</strong> Intelligence Study, Spr<strong>in</strong>g 2012; <strong>Kantar</strong> <strong>Retail</strong> analysis<br />

- 9 -