The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

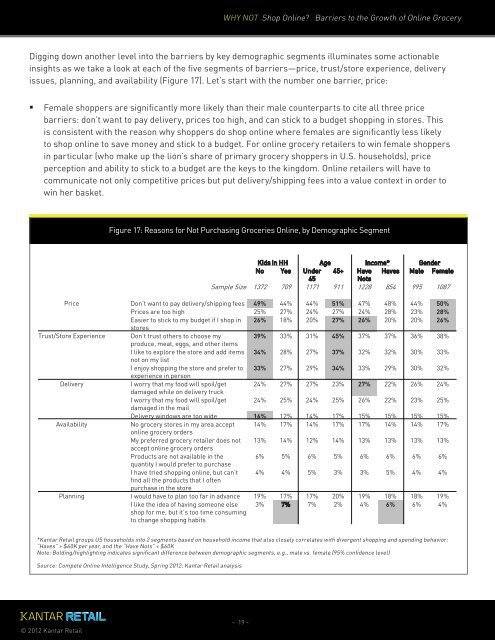

Digg<strong>in</strong>g down ano<strong>the</strong>r level <strong>in</strong>to <strong>the</strong> barriers by key demographic segments illum<strong>in</strong>ates some actionable<br />

<strong>in</strong>sights as we take a look at each <strong>of</strong> <strong>the</strong> five segments <strong>of</strong> barriers—price, trust/store experience, delivery<br />

issues, plann<strong>in</strong>g, and availability (Figure 17). Let’s start with <strong>the</strong> number one barrier, price:<br />

Female shoppers are significantly more likely than <strong>the</strong>ir male counterparts to cite all three price<br />

barriers: don’t want to pay delivery, prices too high, and can stick to a budget shopp<strong>in</strong>g <strong>in</strong> stores. This<br />

is consistent with <strong>the</strong> reason why shoppers do shop onl<strong>in</strong>e where females are significantly less likely<br />

to shop onl<strong>in</strong>e to save money and stick to a budget. For onl<strong>in</strong>e grocery retailers to w<strong>in</strong> female shoppers<br />

<strong>in</strong> particular (who make up <strong>the</strong> lion’s share <strong>of</strong> primary grocery shoppers <strong>in</strong> U.S. households), price<br />

perception and ability to stick to a budget are <strong>the</strong> keys to <strong>the</strong> k<strong>in</strong>gdom. <strong>Onl<strong>in</strong>e</strong> retailers will have to<br />

communicate not only competitive prices but put delivery/shipp<strong>in</strong>g fees <strong>in</strong>to a value context <strong>in</strong> order to<br />

w<strong>in</strong> her basket.<br />

© 2012 <strong>Kantar</strong> <strong>Retail</strong><br />

WHY NOT Shop <strong>Onl<strong>in</strong>e</strong>? Barriers to <strong>the</strong> Growth <strong>of</strong> <strong>Onl<strong>in</strong>e</strong> <strong>Grocery</strong><br />

Figure 17: Reasons for Not Purchas<strong>in</strong>g Groceries <strong>Onl<strong>in</strong>e</strong>, by Demographic Segment<br />

*<strong>Kantar</strong> <strong>Retail</strong> groups US households <strong>in</strong>to 2 segments based on household <strong>in</strong>come that also closely correlates with divergent shopp<strong>in</strong>g and spend<strong>in</strong>g behavior:<br />

“Haves” > $60K per year, and <strong>the</strong> “Have Nots” < $60K<br />

Note: Bold<strong>in</strong>g/highlight<strong>in</strong>g <strong>in</strong>dicates significant difference between demographic segments, e.g., male vs. female (95% confidence level)<br />

Source: Compete <strong>Onl<strong>in</strong>e</strong> Intelligence Study, Spr<strong>in</strong>g 2012; <strong>Kantar</strong> <strong>Retail</strong> analysis<br />

Kids <strong>in</strong> HH Age Income* Gender<br />

No Yes Under 45+ Have Haves Male Female<br />

45<br />

Nots<br />

Sample Size 1372 709 1171 911 1228 854 995 1087<br />

Price Don’t want to pay delivery/shipp<strong>in</strong>g fees 49% 44% 44% 51% 47% 48% 44% 50%<br />

Prices are too high 25% 27% 24% 27% 24% 28% 23% 28%<br />

Easier to stick to my budget if I shop <strong>in</strong><br />

stores<br />

26% 18% 20% 27% 26% 20% 20% 26%<br />

Trust/Store Experience Don’t trust o<strong>the</strong>rs to choose my<br />

produce, meat, eggs, and o<strong>the</strong>r items<br />

39% 33% 31% 45% 37% 37% 36% 38%<br />

I like to explore <strong>the</strong> store and add items<br />

not on my list<br />

34% 28% 27% 37% 32% 32% 30% 33%<br />

I enjoy shopp<strong>in</strong>g <strong>the</strong> store and prefer to<br />

experience <strong>in</strong> person<br />

33% 27% 29% 34% 33% 29% 30% 32%<br />

Delivery I worry that my food will spoil/get<br />

damaged while on delivery truck<br />

24% 27% 27% 23% 27% 22% 26% 24%<br />

I worry that my food will spoil/get<br />

damaged <strong>in</strong> <strong>the</strong> mail<br />

24% 25% 24% 25% 26% 22% 23% 25%<br />

Delivery w<strong>in</strong>dows are too wide 16% 12% 14% 17% 15% 15% 15% 15%<br />

Availability No grocery stores <strong>in</strong> my area accept<br />

onl<strong>in</strong>e grocery orders<br />

14% 17% 14% 17% 17% 14% 14% 17%<br />

My preferred grocery retailer does not<br />

accept onl<strong>in</strong>e grocery orders<br />

13% 14% 12% 14% 13% 13% 13% 13%<br />

Products are not available <strong>in</strong> <strong>the</strong><br />

quantity I would prefer to purchase<br />

6% 5% 6% 5% 6% 6% 6% 6%<br />

I have tried shopp<strong>in</strong>g onl<strong>in</strong>e, but can’t<br />

f<strong>in</strong>d all <strong>the</strong> products that I <strong>of</strong>ten<br />

purchase <strong>in</strong> <strong>the</strong> store<br />

4% 4% 5% 3% 3% 5% 4% 4%<br />

Plann<strong>in</strong>g I would have to plan too far <strong>in</strong> advance 19% 17% 17% 20% 19% 18% 18% 19%<br />

I like <strong>the</strong> idea <strong>of</strong> hav<strong>in</strong>g someone else<br />

shop for me, but it’s too time consum<strong>in</strong>g<br />

to change shopp<strong>in</strong>g habits<br />

3% 7% 7% 2% 4% 6% 6% 4%<br />

- 19 -