The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Convenience. In terms <strong>of</strong> why shoppers buy groceries onl<strong>in</strong>e, <strong>the</strong> ability to have groceries delivered to one’s<br />

door is <strong>the</strong> most frequently cited reason: 44% <strong>of</strong> onl<strong>in</strong>e grocery shoppers do so because <strong>of</strong> <strong>the</strong> convenience <strong>of</strong><br />

hav<strong>in</strong>g <strong>the</strong> groceries delivered to <strong>the</strong>ir doors, while better than one-third say onl<strong>in</strong>e grocery shopp<strong>in</strong>g saves<br />

<strong>the</strong>m time. Males (51%) and lower-<strong>in</strong>come households, “Have Nots” (54%), are significantly more likely to cite<br />

home delivery as <strong>the</strong> reason for onl<strong>in</strong>e purchas<strong>in</strong>g. Dedicated onl<strong>in</strong>e grocery shoppers also are particularly<br />

keen on <strong>the</strong> convenience factor <strong>of</strong> onl<strong>in</strong>e grocery shopp<strong>in</strong>g, with 51% cit<strong>in</strong>g <strong>the</strong> ability to have groceries<br />

delivered to <strong>the</strong>ir door as a reason for buy<strong>in</strong>g onl<strong>in</strong>e, compared with only 43% <strong>of</strong> casual onl<strong>in</strong>e grocery<br />

shoppers.<br />

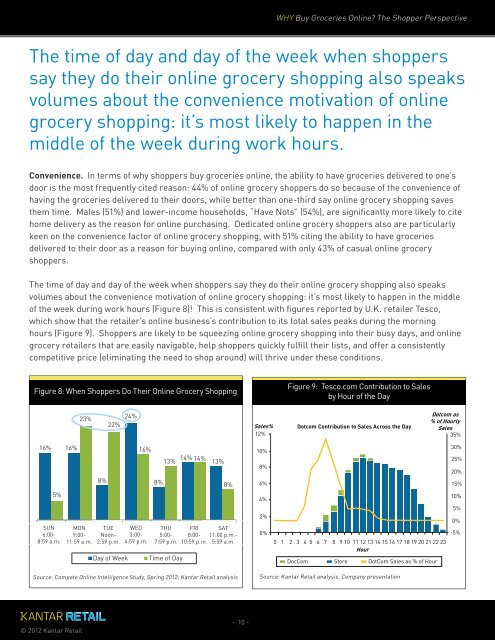

<strong>The</strong> time <strong>of</strong> day and day <strong>of</strong> <strong>the</strong> week when shoppers say <strong>the</strong>y do <strong>the</strong>ir onl<strong>in</strong>e grocery shopp<strong>in</strong>g also speaks<br />

volumes about <strong>the</strong> convenience motivation <strong>of</strong> onl<strong>in</strong>e grocery shopp<strong>in</strong>g: it’s most likely to happen <strong>in</strong> <strong>the</strong> middle<br />

<strong>of</strong> <strong>the</strong> week dur<strong>in</strong>g work hours (Figure 8)! This is consistent with figures reported by U.K. retailer Tesco,<br />

which show that <strong>the</strong> retailer’s onl<strong>in</strong>e bus<strong>in</strong>ess’s contribution to its total sales peaks dur<strong>in</strong>g <strong>the</strong> morn<strong>in</strong>g<br />

hours (Figure 9). Shoppers are likely to be squeez<strong>in</strong>g onl<strong>in</strong>e grocery shopp<strong>in</strong>g <strong>in</strong>to <strong>the</strong>ir busy days, and onl<strong>in</strong>e<br />

grocery retailers that are easily navigable, help shoppers quickly fulfill <strong>the</strong>ir lists, and <strong>of</strong>fer a consistently<br />

competitive price (elim<strong>in</strong>at<strong>in</strong>g <strong>the</strong> need to shop around) will thrive under <strong>the</strong>se conditions.<br />

Figure 8: When Shoppers Do <strong>The</strong>ir <strong>Onl<strong>in</strong>e</strong> <strong>Grocery</strong> <strong>Shopp<strong>in</strong>g</strong><br />

16% 16%<br />

5%<br />

SUN<br />

6:00-<br />

8:59 a.m.<br />

Source: Compete <strong>Onl<strong>in</strong>e</strong> Intelligence Study, Spr<strong>in</strong>g 2012; <strong>Kantar</strong> <strong>Retail</strong> analysis Source: <strong>Kantar</strong> <strong>Retail</strong> analysis, Company presentation<br />

© 2012 <strong>Kantar</strong> <strong>Retail</strong><br />

23%<br />

MON<br />

9:00-<br />

11:59 a.m.<br />

8%<br />

22%<br />

TUE<br />

Noon-<br />

2:59 p.m.<br />

24%<br />

16%<br />

WED<br />

3:00-<br />

4:59 p.m.<br />

8%<br />

Day <strong>of</strong> Week Time <strong>of</strong> Day<br />

14%<br />

13%<br />

14%<br />

THU<br />

5:00-<br />

7:59 p.m.<br />

13%<br />

8%<br />

FRI SAT<br />

8:00- 11:00 p.m.-<br />

10:59 p.m. 5:59 a.m.<br />

- 10 -<br />

WHY Buy Groceries <strong>Onl<strong>in</strong>e</strong>? <strong>The</strong> Shopper Perspective<br />

<strong>The</strong> time <strong>of</strong> day and day <strong>of</strong> <strong>the</strong> week when shoppers<br />

say <strong>the</strong>y do <strong>the</strong>ir onl<strong>in</strong>e grocery shopp<strong>in</strong>g also speaks<br />

volumes about <strong>the</strong> convenience motivation <strong>of</strong> onl<strong>in</strong>e<br />

grocery shopp<strong>in</strong>g: it’s most likely to happen <strong>in</strong> <strong>the</strong><br />

middle <strong>of</strong> <strong>the</strong> week dur<strong>in</strong>g work hours.<br />

Figure 9: Tesco.com Contribution to Sales<br />

by Hour <strong>of</strong> <strong>the</strong> Day<br />

Dotcom as<br />

% <strong>of</strong> Hourly<br />

Sales% Dotcom Contribution to Sales Across <strong>the</strong> Day Sales<br />

12%<br />

35%<br />

10%<br />

30%<br />

25%<br />

8%<br />

20%<br />

6%<br />

15%<br />

4%<br />

10%<br />

5%<br />

2%<br />

0%<br />

0%<br />

-5%<br />

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23<br />

Hour<br />

DocCom Store DotCom Sales as % <strong>of</strong> Hour