The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3. Prepare for a World Where Habits and First-Mover Advantage Matter<br />

As shoppers f<strong>in</strong>d <strong>the</strong> optimal balance between onl<strong>in</strong>e and <strong>in</strong>-store grocery shopp<strong>in</strong>g, patterns will evolve and<br />

retailers and suppliers must adjust <strong>the</strong>ir strategies and tactics to rema<strong>in</strong> relevant. Critical among <strong>the</strong>se skills<br />

is understand<strong>in</strong>g list formation <strong>in</strong> order to <strong>in</strong>fluence shopper behavior both onl<strong>in</strong>e and <strong>in</strong>-store.<br />

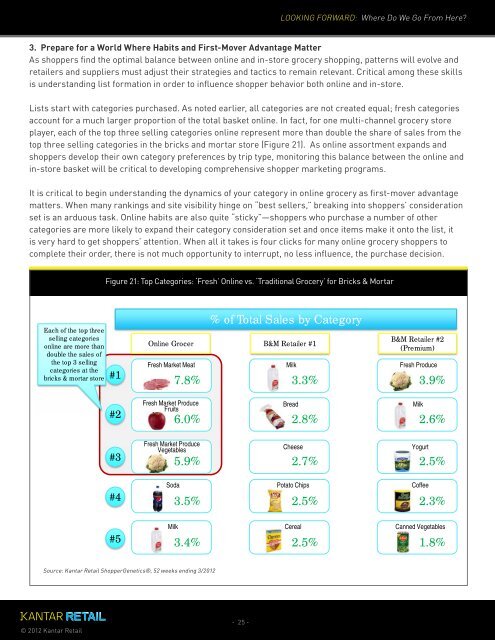

Lists start with categories purchased. As noted earlier, all categories are not created equal; fresh categories<br />

account for a much larger proportion <strong>of</strong> <strong>the</strong> total basket onl<strong>in</strong>e. In fact, for one multi-channel grocery store<br />

player, each <strong>of</strong> <strong>the</strong> top three sell<strong>in</strong>g categories onl<strong>in</strong>e represent more than double <strong>the</strong> share <strong>of</strong> sales from <strong>the</strong><br />

top three sell<strong>in</strong>g categories <strong>in</strong> <strong>the</strong> bricks and mortar store (Figure 21). As onl<strong>in</strong>e assortment expands and<br />

shoppers develop <strong>the</strong>ir own category preferences by trip type, monitor<strong>in</strong>g this balance between <strong>the</strong> onl<strong>in</strong>e and<br />

<strong>in</strong>-store basket will be critical to develop<strong>in</strong>g comprehensive shopper market<strong>in</strong>g programs.<br />

It is critical to beg<strong>in</strong> understand<strong>in</strong>g <strong>the</strong> dynamics <strong>of</strong> your category <strong>in</strong> onl<strong>in</strong>e grocery as first-mover advantage<br />

matters. When many rank<strong>in</strong>gs and site visibility h<strong>in</strong>ge on “best sellers,” break<strong>in</strong>g <strong>in</strong>to shoppers’ consideration<br />

set is an arduous task. <strong>Onl<strong>in</strong>e</strong> habits are also quite “sticky”—shoppers who purchase a number <strong>of</strong> o<strong>the</strong>r<br />

categories are more likely to expand <strong>the</strong>ir category consideration set and once items make it onto <strong>the</strong> list, it<br />

is very hard to get shoppers’ attention. When all it takes is four clicks for many onl<strong>in</strong>e grocery shoppers to<br />

complete <strong>the</strong>ir order, <strong>the</strong>re is not much opportunity to <strong>in</strong>terrupt, no less <strong>in</strong>fluence, <strong>the</strong> purchase decision.<br />

Each <strong>of</strong> <strong>the</strong> top three<br />

sell<strong>in</strong>g categories<br />

onl<strong>in</strong>e are more than<br />

double <strong>the</strong> sales <strong>of</strong><br />

<strong>the</strong> top 3 sell<strong>in</strong>g<br />

categories at <strong>the</strong><br />

bricks & mortar store<br />

© 2012 <strong>Kantar</strong> <strong>Retail</strong><br />

Figure 21: Top Categories: ‘Fresh’ <strong>Onl<strong>in</strong>e</strong> vs. ‘Traditional <strong>Grocery</strong>’ for Bricks & Mortar<br />

#1<br />

#2<br />

#3<br />

#4<br />

#5<br />

Source: <strong>Kantar</strong> <strong>Retail</strong> ShopperGenetics®, 52 weeks end<strong>in</strong>g 3/2012<br />

<strong>Onl<strong>in</strong>e</strong> Grocer B&M <strong>Retail</strong>er #1<br />

Fresh Market Meat<br />

Fresh Market Produce<br />

Fruits<br />

Fresh Market Produce<br />

Vegetables<br />

- 25 -<br />

LOOKING FORWARD: Where Do We Go From Here?<br />

% <strong>of</strong> Total Sales by Category<br />

Milk<br />

B&M <strong>Retail</strong>er #2<br />

(Premium)<br />

7.8% 3.3% 3.9%<br />

Bread<br />

Fresh Produce<br />

6.0% 2.8% 2.6%<br />

5.9% 2.7% 2.5%<br />

Soda Potato Chips C<strong>of</strong>fee<br />

3.5% 2.5% 2.3%<br />

Milk Cereal Canned Vegetables<br />

3.4% 2.5% 1.8%<br />

Milk<br />

Cheese Yogurt