The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

The Future of Online Grocery Shopping in the United ... - Kantar Retail

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

© 2012 <strong>Kantar</strong> <strong>Retail</strong><br />

<strong>Kantar</strong> <strong>Retail</strong> Po<strong>in</strong>t <strong>of</strong> View<br />

LOOKING FORWARD: Where Do We<br />

Go From Here?<br />

<strong>The</strong> message from shoppers is clear and proves <strong>Kantar</strong> <strong>Retail</strong>’s core hypo<strong>the</strong>sis: <strong>The</strong> future <strong>of</strong> onl<strong>in</strong>e grocery<br />

shopp<strong>in</strong>g <strong>in</strong> <strong>the</strong> <strong>United</strong> States is a matter <strong>of</strong> when … not if. Shoppers with access to a full assortment, and homedelivery<br />

options understand <strong>the</strong> value proposition. O<strong>the</strong>rs have come to understand <strong>the</strong> value <strong>of</strong> purchas<strong>in</strong>g<br />

frequently purchased shelf-stable items onl<strong>in</strong>e. <strong>The</strong> only questions surround<strong>in</strong>g <strong>the</strong> evolution <strong>of</strong> onl<strong>in</strong>e grocery<br />

shopp<strong>in</strong>g is how quickly it will develop and how onl<strong>in</strong>e grocery shopp<strong>in</strong>g, once more widely available, will fit <strong>in</strong>to<br />

shoppers’ grocery shopp<strong>in</strong>g rout<strong>in</strong>es as <strong>the</strong>y optimize retailers and channels to fulfill <strong>the</strong>ir grocery shopp<strong>in</strong>g<br />

needs. As this plays out <strong>in</strong> <strong>the</strong> marketplace, key plann<strong>in</strong>g premises for suppliers and retailers <strong>in</strong>clude:<br />

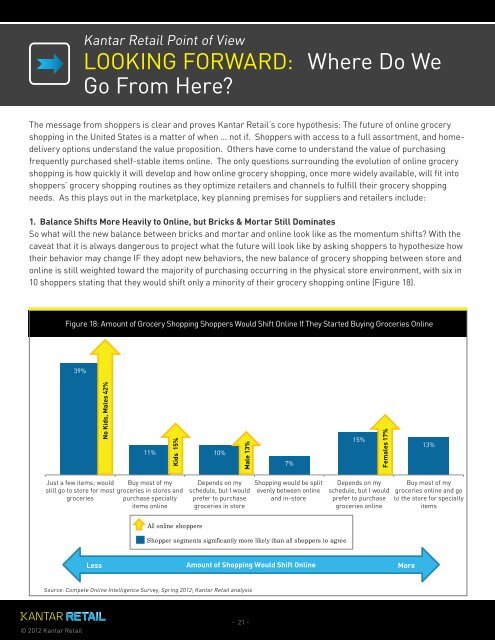

1. Balance Shifts More Heavily to <strong>Onl<strong>in</strong>e</strong>, but Bricks & Mortar Still Dom<strong>in</strong>ates<br />

So what will <strong>the</strong> new balance between bricks and mortar and onl<strong>in</strong>e look like as <strong>the</strong> momentum shifts? With <strong>the</strong><br />

caveat that it is always dangerous to project what <strong>the</strong> future will look like by ask<strong>in</strong>g shoppers to hypo<strong>the</strong>size how<br />

<strong>the</strong>ir behavior may change IF <strong>the</strong>y adopt new behaviors, <strong>the</strong> new balance <strong>of</strong> grocery shopp<strong>in</strong>g between store and<br />

onl<strong>in</strong>e is still weighted toward <strong>the</strong> majority <strong>of</strong> purchas<strong>in</strong>g occurr<strong>in</strong>g <strong>in</strong> <strong>the</strong> physical store environment, with six <strong>in</strong><br />

10 shoppers stat<strong>in</strong>g that <strong>the</strong>y would shift only a m<strong>in</strong>ority <strong>of</strong> <strong>the</strong>ir grocery shopp<strong>in</strong>g onl<strong>in</strong>e (Figure 18).<br />

Figure 18: Amount <strong>of</strong> <strong>Grocery</strong> <strong>Shopp<strong>in</strong>g</strong> Shoppers Would Shift <strong>Onl<strong>in</strong>e</strong> If <strong>The</strong>y Started Buy<strong>in</strong>g Groceries <strong>Onl<strong>in</strong>e</strong><br />

39%<br />

No Kids, Males 42%<br />

11% 10%<br />

Source: Compete <strong>Onl<strong>in</strong>e</strong> Intelligence Survey, Spr<strong>in</strong>g 2012; <strong>Kantar</strong> <strong>Retail</strong> analysis<br />

Kids 15%<br />

Just a few items; would Buy most <strong>of</strong> my<br />

still go to store for most groceries <strong>in</strong> stores and<br />

groceries purchase specialty<br />

items onl<strong>in</strong>e<br />

All onl<strong>in</strong>e shoppers<br />

Male 13%<br />

Depends on my<br />

schedule, but I would<br />

prefer to purchase<br />

groceries <strong>in</strong> store<br />

- 21 -<br />

7%<br />

<strong>Shopp<strong>in</strong>g</strong> would be split<br />

evenly between onl<strong>in</strong>e<br />

and <strong>in</strong>-store<br />

Shopper segments significantly more likely than all shoppers to agree<br />

15%<br />

Females 17%<br />

Depends on my<br />

schedule, but I would<br />

prefer to purchase<br />

groceries onl<strong>in</strong>e<br />

Amount <strong>of</strong> <strong>Shopp<strong>in</strong>g</strong> Would Shift <strong>Onl<strong>in</strong>e</strong><br />

Less More<br />

13%<br />

Buy most <strong>of</strong> my<br />

groceries onl<strong>in</strong>e and go<br />

to <strong>the</strong> store for specialty<br />

items