Feasibility Study of a Digital Platform for the delivery of UK ... - BFI

Feasibility Study of a Digital Platform for the delivery of UK ... - BFI

Feasibility Study of a Digital Platform for the delivery of UK ... - BFI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>UK</strong> FILM COUNCIL<br />

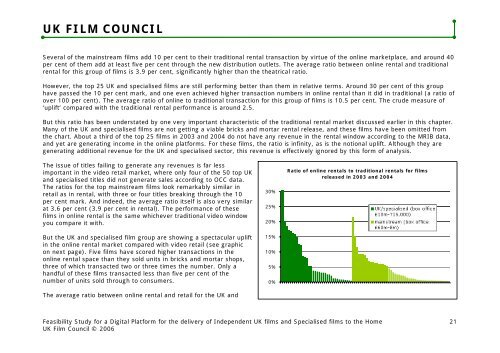

Several <strong>of</strong> <strong>the</strong> mainstream films add 10 per cent to <strong>the</strong>ir traditional rental transaction by virtue <strong>of</strong> <strong>the</strong> online marketplace, and around 40<br />

per cent <strong>of</strong> <strong>the</strong>m add at least five per cent through <strong>the</strong> new distribution outlets. The average ratio between online rental and traditional<br />

rental <strong>for</strong> this group <strong>of</strong> films is 3.9 per cent, significantly higher than <strong>the</strong> <strong>the</strong>atrical ratio.<br />

However, <strong>the</strong> top 25 <strong>UK</strong> and specialised films are still per<strong>for</strong>ming better than <strong>the</strong>m in relative terms. Around 30 per cent <strong>of</strong> this group<br />

have passed <strong>the</strong> 10 per cent mark, and one even achieved higher transaction numbers in online rental than it did in traditional (a ratio <strong>of</strong><br />

over 100 per cent). The average ratio <strong>of</strong> online to traditional transaction <strong>for</strong> this group <strong>of</strong> films is 10.5 per cent. The crude measure <strong>of</strong><br />

‘uplift’ compared with <strong>the</strong> traditional rental per<strong>for</strong>mance is around 2.5.<br />

But this ratio has been understated by one very important characteristic <strong>of</strong> <strong>the</strong> traditional rental market discussed earlier in this chapter.<br />

Many <strong>of</strong> <strong>the</strong> <strong>UK</strong> and specialised films are not getting a viable bricks and mortar rental release, and <strong>the</strong>se films have been omitted from<br />

<strong>the</strong> chart. About a third <strong>of</strong> <strong>the</strong> top 25 films in 2003 and 2004 do not have any revenue in <strong>the</strong> rental window according to <strong>the</strong> MRIB data,<br />

and yet are generating income in <strong>the</strong> online plat<strong>for</strong>ms. For <strong>the</strong>se films, <strong>the</strong> ratio is infinity, as is <strong>the</strong> notional uplift. Although <strong>the</strong>y are<br />

generating additional revenue <strong>for</strong> <strong>the</strong> <strong>UK</strong> and specialised sector, this revenue is effectively ignored by this <strong>for</strong>m <strong>of</strong> analysis.<br />

The issue <strong>of</strong> titles failing to generate any revenues is far less<br />

important in <strong>the</strong> video retail market, where only four <strong>of</strong> <strong>the</strong> 50 top <strong>UK</strong><br />

and specialised titles did not generate sales according to OCC data.<br />

The ratios <strong>for</strong> <strong>the</strong> top mainstream films look remarkably similar in<br />

retail as in rental, with three or four titles breaking through <strong>the</strong> 10<br />

per cent mark. And indeed, <strong>the</strong> average ratio itself is also very similar<br />

at 3.6 per cent (3.9 per cent in rental). The per<strong>for</strong>mance <strong>of</strong> <strong>the</strong>se<br />

films in online rental is <strong>the</strong> same whichever traditional video window<br />

you compare it with.<br />

But <strong>the</strong> <strong>UK</strong> and specialised film group are showing a spectacular uplift<br />

in <strong>the</strong> online rental market compared with video retail (see graphic<br />

on next page). Five films have scored higher transactions in <strong>the</strong><br />

online rental space than <strong>the</strong>y sold units in bricks and mortar shops,<br />

three <strong>of</strong> which transacted two or three times <strong>the</strong> number. Only a<br />

handful <strong>of</strong> <strong>the</strong>se films transacted less than five per cent <strong>of</strong> <strong>the</strong><br />

number <strong>of</strong> units sold through to consumers.<br />

The average ratio between online rental and retail <strong>for</strong> <strong>the</strong> <strong>UK</strong> and<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Ratio <strong>of</strong> online rentals to traditional rentals <strong>for</strong> films<br />

released in 2003 and 2004<br />

<strong>Feasibility</strong> <strong>Study</strong> <strong>for</strong> a <strong>Digital</strong> <strong>Plat<strong>for</strong>m</strong> <strong>for</strong> <strong>the</strong> <strong>delivery</strong> <strong>of</strong> Independent <strong>UK</strong> films and Specialised films to <strong>the</strong> Home<br />

<strong>UK</strong> Film Council © 2006<br />

21