Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Emirates</strong><br />

100<br />

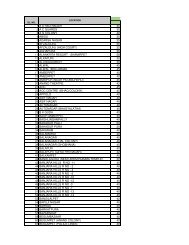

24. Provisions (continued)<br />

The movement in the defined benefit obligation is:<br />

Balance brought forward 124,731<br />

81,468<br />

Charge for the year<br />

133,800<br />

85,453<br />

Benefits utilised during the year<br />

(78,629) (42,190)<br />

Balance carried forward<br />

179,902<br />

124,731<br />

Balance carried forward<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

Balance brought forward<br />

427,117<br />

363,018<br />

Acquisition (Note 37)<br />

105<br />

-<br />

Release of excess provision (100,099) -<br />

Charge for the year<br />

69,738<br />

103,145<br />

Payments made during the year<br />

(62,090) (39,046)<br />

Balance carried forward<br />

334,771<br />

427,117<br />

Payments made during the year include the transfer of accumulated benefits to <strong>Emirates</strong>’ funded scheme.<br />

Frequent flyer programme<br />

Movements in the provision for frequent flyer programme are as follows:<br />

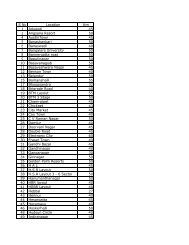

25. Deferred credits<br />

Balance brought forward<br />

Net additions during the year<br />

Transferred to property, plant and equipment<br />

Recognised during the year<br />

Balance carried forward<br />

Deferred credits will be recognised as follows:<br />

Within one year<br />

Over one year<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000<br />

AED'000<br />

764,760<br />

878,459<br />

57,541<br />

110,240<br />

-<br />

(65,514)<br />

(161,255) (158,425)<br />

661,046<br />

168,980<br />

492,066<br />

764,760<br />

164,696<br />

600,064<br />

Deferred credits transferred to property, plant and equipment are consequent to a change in classification of certain aircraft from<br />

operating lease to finance lease.<br />

26. Deferred in<strong>com</strong>e tax liability<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

Balance brought forward<br />

19,950<br />

50,642<br />

Credited to the consolidated in<strong>com</strong>e statement (7,267) (30,692)<br />

12,683<br />

19,950<br />

The deferred in<strong>com</strong>e tax liability is on account of accelerated tax depreciation.<br />

A deferred tax asset has not been recognised in respect of carried forward tax losses amounting to AED 391.3 million (<strong>2008</strong>: AED<br />

351.0 million).