Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

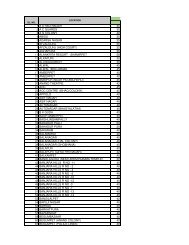

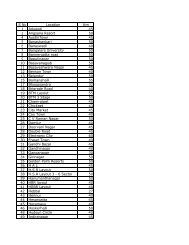

12. Trade and other receivables<br />

Trade receivables - net of provision<br />

Prepayments<br />

Related parties (Note 23)<br />

Deposits and other receivables<br />

Movements in the provision for impairment of trade receivables are as follows:<br />

Balance brought forward<br />

Acquisition<br />

Charge for the year<br />

Unused amounts reversed<br />

Amounts written off as uncollectible<br />

Currency translation differences<br />

Balance carried forward<br />

The other classes of trade and other receivables do not contain impaired assets.<br />

Ageing of receivables that are past due but not impaired is as follows:<br />

Below 3 months<br />

3-6 months<br />

Above 6 months<br />

13. Capital<br />

Capital represents the permanent capital of Dnata.<br />

127<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

399,731<br />

48,202<br />

51,572<br />

90,039<br />

589,544<br />

393,733<br />

32,237<br />

47,837<br />

112,939<br />

586,746<br />

The impairment charge on trade receivables recognised in the consolidated in<strong>com</strong>e statement during the year mainly relates to<br />

<strong>com</strong>mercial, travel agency and airline customers who are in unexpected difficult economic situations and are unable to meet their<br />

obligations. This charge is included in operating costs. Amounts charged to the provision account are written off when there is no<br />

expectation of further recovery.<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000<br />

AED'000<br />

19,022<br />

13,131<br />

-<br />

443<br />

15,912<br />

25,864<br />

(13,444)<br />

(19,643)<br />

(393)<br />

(877)<br />

(138) 104<br />

20,959<br />

19,022<br />

The maximum exposure to credit risk of current trade and other receivables at the reporting date is the carrying value of each class of<br />

receivable mentioned above.<br />

<strong>2009</strong><br />

<strong>2008</strong><br />

AED'000 AED'000<br />

171,298<br />

42,535<br />

58,137<br />

271,970<br />

190,234<br />

28,448<br />

36,602<br />

255,284