Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The <strong>Emirates</strong> Group<br />

Financial position<br />

Group<br />

058<br />

At 31 March <strong>2009</strong>, the Group’s cash funds (including held-to-maturity cash investments of AED 200 million) were AED 8,718 million<br />

(USD 2,376 million). The Group invested surplus funds in a mix of high credit quality bank deposits and liquidity funds. The overall<br />

interest in<strong>com</strong>e earned yielded an effective rate of 4.8% (<strong>2008</strong>: 5.2%), reflecting market rates.<br />

Group shareholder’s funds at 31 March <strong>2009</strong> was AED 18,963 million (USD 5,167 million), up by 1% <strong>com</strong>pared to AED 18,867 million<br />

(USD 5,141 million) at 31 March <strong>2008</strong>.<br />

<strong>Emirates</strong><br />

At 31 March <strong>2009</strong>, <strong>Emirates</strong> cash position (including held-to-maturity cash investments of AED 200 million) was AED 7,368 million<br />

(USD 2,008 million) <strong>com</strong>pared to AED 12,619 million (USD 3,438 million) in 2007-08. Cash was recorded after funding capital outflows<br />

of AED 5,573 million (USD 1,518 million) <strong>com</strong>prising pre-delivery payments, spare engines, rotables, buildings and other capital items<br />

and also after paying dividends to the shareholder of AED 2,913 million (USD 794 million) during the year. <strong>Emirates</strong> cash balance<br />

more than adequately covers its traditional benchmark of maintaining cash balances for at least six months debt obligations and lease<br />

rentals.<br />

During the financial year, <strong>Emirates</strong> took delivery of 21 aircraft, 17 from Boeing and 4 from Airbus. Despite the challenging environment<br />

nearly USD 2.6 billion was raised during the financial year to finance these aircraft deliveries, using six different types of financing<br />

structures and 12 funding sources. This clearly establishes the firm support that <strong>Emirates</strong> has from global financial institutions.<br />

Airbus deliveries consisted of the first 4 twin deck A380 aircraft out of a total order book of 58 units. These were funded as finance<br />

leases and included one unit financed through the Dubai International Financial Centre (DIFC). Boeing aircraft <strong>com</strong>prised ten B777-<br />

300ER, six B777-200LR and one B777-200LR freighter. Six Boeing aircraft were funded using US Ex-Im Bank support, five as pure<br />

operating leases, three through sale and lease back transactions and two as Islamic leases syndicated by global financial institutions.<br />

The freighter aircraft was financed as a pure operating lease from Dubai Aviation Enterprises (DAE).<br />

<strong>Emirates</strong> cash profit from operations (or EBITDAR) for the year ended 31 March <strong>2009</strong> was 16.4% of operating revenue or AED 6,986<br />

million. EBITDAR for the year equated to more than 15 months of debt service and lease rentals, including periodic principal and<br />

interest payments on aircraft financing and bond issues.<br />

<strong>Emirates</strong> continued to target a balanced portfolio approach, whilst still taking advantage of market movements, of hedging around half of<br />

its interest rate and currency risk exposures, using prudent hedging solutions including interest swaps and options. <strong>Emirates</strong> borrowings<br />

and lease liabilities (net of cash) after including operating leases, at 31 March <strong>2009</strong>, <strong>com</strong>prised 61% on a fixed interest rate basis with<br />

the balance 39% on floating interest rates. A one percentage point increase in interest rates would increase the interest charges and the<br />

operating lease charges (net of interest in<strong>com</strong>e) during the next financial year by AED 109 million (2007-08: AED 57 million). At 31 March<br />

<strong>2009</strong>, <strong>Emirates</strong> borrowings and lease liabilities carried a weighted average interest rate of circa 3.52% (2007-08: 5.21%).<br />

<strong>Emirates</strong> proactively managed its currency exposure by using prudent hedging solutions including currency swaps, options and natural<br />

hedges through outflows denominated in Pound sterling, Euro, Japanese yen and Australian dollar. For the year ended 31 March <strong>2009</strong>,<br />

net annual Australian dollars receipts were fully hedged, while hedging coverage for Pound sterling, Euro, New Zealand dollar and<br />

Japanese yen were 56%, 29%, 76% and 38% respectively.<br />

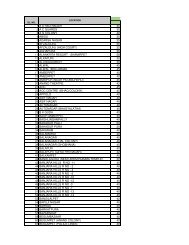

Shareholder’s funds (AED million)<br />

20000<br />

16000<br />

12000<br />

8000<br />

4000<br />

0<br />

Shareholder’s funds<br />

2004-05 2005-06 2006-07 2007-08 <strong>2008</strong>-09<br />

Shareholder’s funds (AED million) Net profit<br />

5250<br />

4500<br />

3750<br />

3000<br />

2250<br />

1500<br />

750<br />

0<br />

Net profit (AED million)<br />

<strong>Emirates</strong> shareholder’s funds at 31 March <strong>2009</strong> was AED<br />

16,410 million (USD 4,471 million), <strong>com</strong>pared to AED 16,687<br />

million (USD 4,547 million) in the previous year. For the financial<br />

year ending 31 March <strong>2009</strong>, <strong>Emirates</strong> long term borrowings<br />

and lease liabilities was AED 15,140 million (USD 4,125<br />

million). <strong>Emirates</strong> long term borrowings and lease liabilities<br />

(net of cash) / shareholders’ funds ratio was 49% (2007-08:<br />

1%). After including operating leases, the same ratio was<br />

138.5% (2007-08: 82.0%).<br />

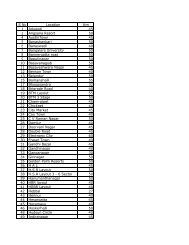

Dnata<br />

At 31 March <strong>2009</strong>, Dnata cash balance was AED 1,350 million<br />

(USD 368 million). This balance was recorded after funding<br />

capital outflows of AED 172 million during the year.<br />

Dnata shareholder’s funds at 31 March <strong>2009</strong> was AED 2,553<br />

million (USD 696 million), up by 17.1 % <strong>com</strong>pared to AED 2,180<br />

million (USD 594 million) in the previous year. Dnata long term<br />

debt was AED 412 million (USD 112 million) at 31 March <strong>2009</strong>,<br />

a net decrease of AED 116 million over 31 March <strong>2008</strong>.