Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Dnata<br />

136<br />

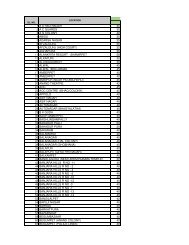

24. Financial risk management (continued)<br />

The following sensitivity analysis shows how profit and equity would change if the market risk variables had been different on the<br />

balance sheet date with all other variables held constant and has been <strong>com</strong>puted on the basis of assumptions and indices used and<br />

considered by other market participants.<br />

Interest cost<br />

- 100 basis points<br />

Singapore Dollars<br />

Swiss Francs<br />

+ 100 basis points<br />

Singapore Dollars<br />

Swiss Francs<br />

Interest in<strong>com</strong>e<br />

- 100 basis points<br />

+ 100 basis points<br />

Currency - Singapore Dollars<br />

+ 1%<br />

- 1%<br />

Currency - Swiss Francs<br />

+ 1%<br />

- 1%<br />

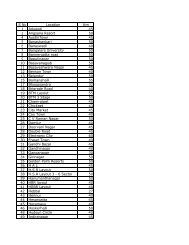

(ii) Credit risk<br />

AA- to AA+<br />

A- to A+<br />

Lower than A-<br />

Effect on<br />

profit<br />

<strong>2009</strong><br />

AED'000<br />

2,436<br />

2,919<br />

5,355<br />

Effect on<br />

equity<br />

2,436<br />

2,919<br />

5,355<br />

Effect on<br />

profit<br />

<strong>2008</strong><br />

AED'000<br />

2,698<br />

1,204<br />

3,902<br />

Effect on<br />

equity<br />

2,698<br />

1,204<br />

3,902<br />

(2,436) (2,436) (2,698) (2,698)<br />

(2,919) (2,919) (1,204) (1,204)<br />

(5,355) (5,355) (3,902) (3,902)<br />

-<br />

-<br />

(473) (1,054)<br />

473 1,054<br />

(2,031) -<br />

2,031<br />

-<br />

(2,660)<br />

2,660<br />

22,979<br />

1,325,926<br />

167<br />

-<br />

-<br />

(2,609)<br />

2,609<br />

Policies are in place to ensure that sales are made to customers with an appropriate credit history failing which an appropriate level of<br />

security is obtained, where necessary sales are made on cash terms. Credit limits are also imposed to cap exposure to a customer.<br />

The table below presents an analysis of short term bank deposits and cash and cash equivalents by rating agency designation at the<br />

balance sheet date based on Standard & Poor's ratings or its equivalent for the main banking relationships:<br />

(473)<br />

473<br />

-<br />

-<br />

(1,054)<br />

1,054<br />

(3,186)<br />

3,186<br />

Dnata is exposed to credit risk, which is the risk that the counterparty will cause a financial loss to Dnata by failing to discharge an<br />

obligation. Financial assets which potentially subject Dnata to credit risk consist principally of deposits with banks and trade<br />

receivables. Dnata uses external ratings such as Standard & Poor's, Moody's or their equivalent in order to measure and monitor its<br />

credit risk exposures to financial institutions. In the absence of independent ratings, credit quality is assessed based on<br />

counterparty's financial position, past experience and other factors.<br />

Dnata manages limits and controls concentration of risk wherever they are identified. Exposure to credit risk is managed through<br />

regular analysis of the ability of counterparties and potential counterparties to meet their obligations and by changing their limits where<br />

appropriate. Approximately 28% (<strong>2008</strong>: 33%) of cash and bank balances are held with financial institutions under <strong>com</strong>mon control.<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

48,214<br />

1,334,510<br />

-