Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

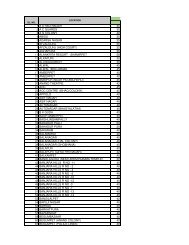

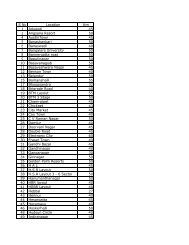

14. Other investments (continued)<br />

(b) Held-to-maturity financial assets<br />

093<br />

Deposits with financial institutions:<br />

Current 200,000<br />

Non-current<br />

-<br />

The maturity dates fall into the following periods:<br />

Within one year<br />

Between 1 and 2 years<br />

15. Loans and other receivables<br />

200,000<br />

1,039,195 1,227,508<br />

The amounts are receivable as follows:<br />

Between 2 and 5 years<br />

986,469 1,013,228<br />

After 5 years 52,726<br />

214,280<br />

1,039,195<br />

Loans and other receivables are denominated in the following currencies:<br />

UAE Dirhams<br />

5,350<br />

US Dollars<br />

994,111<br />

Others 39,734<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

200,000<br />

-<br />

215,796<br />

200,000<br />

415,796<br />

215,796<br />

200,000<br />

The held-to-maturity financial assets are denominated either in UAE Dirhams, the functional currency or in US Dollars to which the<br />

UAE Dirham is pegged.<br />

The effective interest rate earned was 3.43% (<strong>2008</strong>: 5.68%) per annum.<br />

The carrying amounts of investments approximate their fair value. Fair value is determined by discounting projected cash flows<br />

using the interest rate yield curve applicable to the different maturities and currencies.<br />

The maximum exposure to credit risk at the reporting date is the carrying value of the held-to-maturity financial assets.<br />

Related parties (Note 34) 878,039<br />

Other receivables<br />

161,156<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

1,025,301<br />

202,207<br />

1,227,508<br />

6,490<br />

1,221,018<br />

-<br />

The fair value of loans and receivables amounts to AED 1,043.2 million (<strong>2008</strong>: AED 1,227.5 million). Fair value is determined by<br />

discounting projected cash flows using the interest rate yield curve for the remaining term to maturity and currencies based on<br />

credit spread applicable at the balance sheet date.<br />

The maximum exposure to credit risk at the reporting date is the carrying value of the loans and other receivables. At the balance<br />

sheet date, loans and other receivables were neither past due nor impaired.