Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

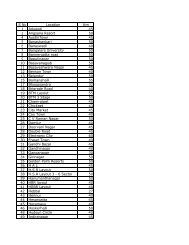

36. Capital risk management<br />

<strong>Emirates</strong> objective when managing capital is to safeguard its ability to continue as a going concern in order to provide returns for its<br />

Owner and to maintain an optimal capital structure to reduce the cost of capital.<br />

<strong>Emirates</strong> monitors the return on Owner's equity which is defined as the profit for the year expressed as a percentage of average<br />

Owner's equity. <strong>Emirates</strong> seeks to provide a better return to the Owner by borrowing and taking aircraft on operating leases to meet<br />

its growth plans. In <strong>2009</strong>, <strong>Emirates</strong> achieved a return on Owner's equity funds of 5.9% (<strong>2008</strong>: 33.8%) in <strong>com</strong>parison to an effective<br />

interest rate of 3.5% (<strong>2008</strong>: 5.2%) on borrowings.<br />

<strong>Emirates</strong> also monitors capital on the basis of a gearing ratio which is calculated as the ratio of non-current liabilities and lease<br />

liabilities, net of cash to Owner's equity. In <strong>2009</strong> this ratio was 48.6% (<strong>2008</strong>: 0.6%) and if operating leases are included, the same<br />

ratio was 138.5% (<strong>2008</strong>: 82.0%).<br />

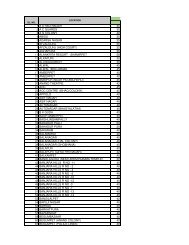

37. Business <strong>com</strong>binations<br />

On 23 March <strong>2009</strong>, <strong>Emirates</strong> acquired 100% of the business of Hudsons Coffee through its wholly owned subsidiary <strong>Emirates</strong><br />

Leisure Retail Holding L.L.C. The principal activities of Hudsons Coffee Pty Ltd is retail sales of food and beverage products in<br />

Australia. Revenue and profit from the date of acquisition to 31 March <strong>2009</strong> is not material.<br />

Cash and cash equivalents<br />

Property, plant and equipment (Note 10)<br />

Intangible assets (Note 11)<br />

Other current assets<br />

Employee end of service benefits provision (Note 24)<br />

Current liabilities<br />

Fair value of assets acquired<br />

Goodwill (Note 11)<br />

Total purchase consideration<br />

Less: Cash and cash equivalents acquired<br />

Cash outflow on acquisition<br />

38. Comparatives<br />

Recognised<br />

on<br />

acquisition<br />

<br />

445<br />

15,867<br />

35,703<br />

1,485<br />

(4,389)<br />

49,006<br />

2,856<br />

51,862<br />

(445)<br />

51,417<br />

The following <strong>com</strong>parative figures have been reclassified to conform with the current year's presentation so that they appropriately<br />

reflect the nature of the transactions:<br />

111<br />

Acquiree's<br />

carrying<br />

amount<br />

<br />

445<br />

14,676<br />

-<br />

1,171<br />

(105) (105)<br />

(4,389)<br />

11,798<br />

<br />

of derivative financial instruments that do not qualify for hedge accounting (Note 7).