Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Emirates</strong><br />

096<br />

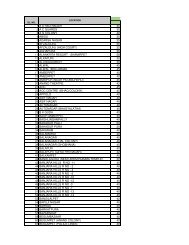

20. Borrowings and lease liabilities<br />

Non-current<br />

Bonds (Note 21) 6,650,525<br />

Term loans (Note 22) 409,162<br />

Lease liabilities (Note 23)<br />

8,080,188<br />

15,139,875<br />

Current<br />

Term loans (Note 22) 121,746<br />

Lease liabilities (Note 23) 1,248,306<br />

Bank overdrafts (Note 30) 1,576<br />

1,371,628<br />

16,511,503<br />

Borrowings and lease liabilities are denominated in the following currencies:<br />

UAE Dirhams<br />

2,157,518<br />

US Dollars 13,232,246<br />

Singapore Dollars 965,800<br />

Others 155,939<br />

The effective interest rate per annum on lease liabilities and term loans was 3.38% (<strong>2008</strong>: 5.13%) and on bonds was 3.69% (<strong>2008</strong>:<br />

5.30%).<br />

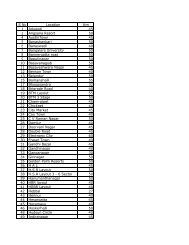

21. Bonds<br />

Bonds are denominated in the following currencies:<br />

UAE Dirhams 1,836,500<br />

Singapore Dollars<br />

967,120<br />

US Dollars<br />

3,856,650<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

6,745,067<br />

520,909<br />

5,034,634<br />

12,300,610<br />

393,296<br />

1,022,979<br />

-<br />

1,416,275<br />

13,716,885<br />

2,234,603<br />

10,240,657<br />

1,063,151<br />

178,474<br />

<strong>2009</strong><br />

<strong>2008</strong><br />

AED'000 AED'000<br />

1,836,500<br />

1,065,064<br />

3,856,650<br />

6,660,270 6,758,214<br />

Less: Transaction costs (9,745) (13,147)<br />

Bonds are repayable as follows:<br />

6,650,525 6,745,067<br />

Between 2 and 5 years<br />

6,288,350 4,514,251<br />

After 5 years<br />

362,175 2,230,816<br />

Contractual repricing dates are set at six month intervals except for bonds denominated in Singapore Dollars amounting to AED<br />

483.6 million (<strong>2008</strong>: AED 532.5 million) which carry a fixed interest rate over their term.<br />

USD bonds, carried at AED 2,020.2 million (<strong>2008</strong>: AED 2,020.2 million), represent the proceeds raised from an Islamic 'sukuk'<br />

(bond) issue to finance the construction of certain buildings.<br />

The fair value of bonds amount to AED 6,325.4 million (<strong>2008</strong>: AED 6,728.4 million). The fair value of the Singapore Dollar bonds is<br />

AED 700.8 million (<strong>2008</strong>: AED 1,035.2 million), which is based on listed prices. The fair value of the other bonds is determined by<br />

discounting projected cash flows using the interest rate yield curve for the remaining term to maturities and currencies adjusted for<br />

credit spread.