Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Annual Report 2008-2009 - Emirates.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Emirates</strong><br />

098<br />

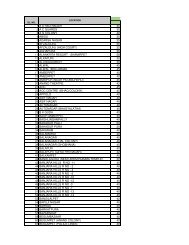

23. Lease liabilities (continued)<br />

The fair value of lease liabilities amounts to AED 6,977.9 million (<strong>2008</strong>: AED 6,061.4 million). The fair value is determined by<br />

discounting projected cash flows using the interest rate yield curve for the remaining term to maturities and currencies adjusted for<br />

credit spread.<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

Operating leases<br />

Future minimum lease payments are as follows:<br />

Aircraft fleet 28,107,555 25,880,651<br />

Other 2,748,955 2,504,453<br />

Within one year<br />

3,885,544<br />

Between 2 and 5 years<br />

14,273,279<br />

After 5 years 12,697,687<br />

<strong>Emirates</strong> is entitled to extend certain aircraft leases for a further period of one to four years at the end of the initial lease period.<br />

Further, <strong>Emirates</strong> is entitled to purchase eighteen of ninety four (<strong>2008</strong>: eighteen of eighty five) aircraft under these leases.<br />

Employee end of service benefits<br />

Frequent flyer programme<br />

Employee end of service benefits<br />

30,856,510<br />

30,856,510<br />

28,385,104<br />

3,486,778<br />

13,059,833<br />

11,838,493<br />

28,385,104<br />

In the event of the aircraft leases being terminated prior to their expiry, penalties are payable. Had these leases been cancelled at 31<br />

March <strong>2009</strong>, the penalties would have been AED 489.2 million (<strong>2008</strong>: AED 478.0 million).<br />

In addition, <strong>Emirates</strong> has eight Boeing aircraft contracted on operating leases for delivery between April <strong>2009</strong> and March 2014.<br />

24. Provisions<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

366,943<br />

179,902<br />

546,845<br />

445,612<br />

124,731<br />

570,343<br />

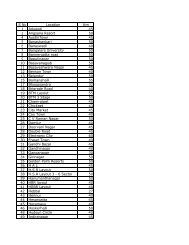

In accordance with the provisions of IAS 19, management has carried out an exercise to assess the present value of its defined<br />

benefit obligations at 31 March <strong>2009</strong>, in respect of employees' end of service benefits payable under relevant local regulations and<br />

contractual arrangements. The assessment assumed expected salary increases averaging 5.0% (<strong>2008</strong>: 5.0%) and a discount rate<br />

of 6.5% (<strong>2008</strong>: 6.0%) per annum. The present values of the defined benefit obligations at 31 March <strong>2009</strong> were <strong>com</strong>puted using the<br />

actuarial assumptions set out above.<br />

The liabilities recognised in the balance sheet are:<br />

<strong>2009</strong> <strong>2008</strong><br />

AED'000 AED'000<br />

Present value of funded defined benefit obligations 635,394<br />

691,394<br />

Less: Fair value of plan assets<br />

(603,222) (672,899)<br />

32,172<br />

18,495<br />

Present value of unfunded defined benefit obligations 334,771<br />

427,117<br />

366,943<br />

445,612