Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

notes on the individual items<br />

5.3 Contracts with no technical risk<br />

We have identified insurance contracts which do not satisfy the requirements of SFAS 113 "Accounting<br />

and <strong><strong>Re</strong>port</strong>ing for <strong>Re</strong>insurance of Short-Duration and Long-Duration Contracts". These involve<br />

reinsurance treaties under which the risk transfer between the ceding company and the reinsurer is of<br />

merely subordinate importance. With the exception of the contractually agreed fee payable by the ceding<br />

company, these contracts were eliminated in full from the technical account. The profit components were<br />

netted under other income/expenses. The payment flows resulting from these contracts were reported<br />

in the cash flow statement under financing activities. Technical amounts were shown as net changes<br />

in contract deposits, the fair values of which corresponded approximately to their book values.<br />

5.4 Goodwill; present value of future profits on acquired<br />

life reinsurance portfolios<br />

In accordance with SFAS 142 "Goodwill and Other Intangible Assets" scheduled amortisation is no<br />

longer taken on goodwill. Goodwill was tested for impairment in a two-step fair value process.<br />

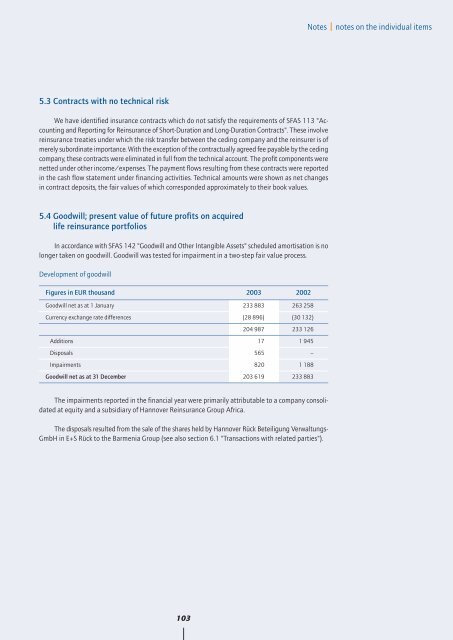

Development of goodwill<br />

Figures in EUR thousand<br />

<strong>2003</strong> 2002<br />

Goodwill net as at 1 January 233 883 263 258<br />

Currency exchange rate differences (28 896) (30 132)<br />

204 987 233 126<br />

Additions 17 1 945<br />

Disposals 565 –<br />

Impairments 820 1 188<br />

Goodwill net as at 31 December 203 619 233 883<br />

The impairments reported in the financial year were primarily attributable to a company consolidated<br />

at equity and a subsidiary of <strong>Hannover</strong> <strong>Re</strong>insurance Group Africa.<br />

The disposals resulted from the sale of the shares held by <strong>Hannover</strong> Rück Beteiligung Verwaltungs-<br />

GmbH in E+S Rück to the Barmenia Group (see also section 6.1 "Transactions with related parties").<br />

103