Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report<br />

business development<br />

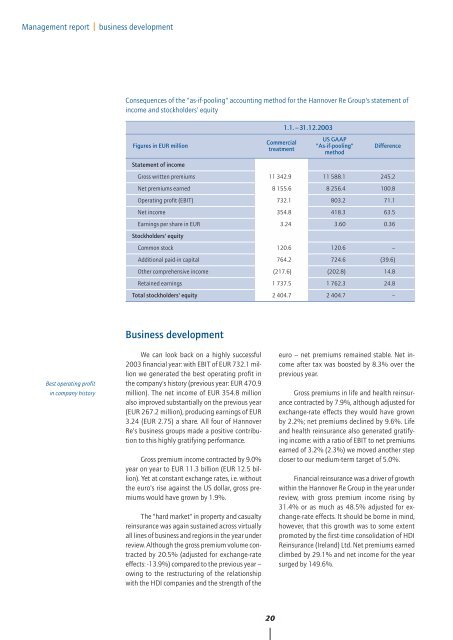

Consequences of the "as-if-pooling" accounting method for the <strong>Hannover</strong> <strong>Re</strong> Group's statement of<br />

income and stockholders' equity<br />

1.1.–31.12.<strong>2003</strong><br />

Figures in EUR million<br />

Commercial<br />

treatment<br />

US GAAP<br />

"As-if-pooling"<br />

method<br />

Difference<br />

Statement of income<br />

Gross written premiums 11 342.9 11 588.1 245.2<br />

Net premiums earned 8 155.6 8 256.4 100.8<br />

Operating profit (EBIT) 732.1 803.2 71.1<br />

Net income 354.8 418.3 63.5<br />

Earnings per share in EUR 3.24 3.60 0.36<br />

Stockholders' equity<br />

Common stock 120.6 120.6 –<br />

Additional paid-in capital 764.2 724.6 (39.6)<br />

Other comprehensive income (217.6) (202.8) 14.8<br />

<strong>Re</strong>tained earnings 1 737.5 1 762.3 24.8<br />

Total stockholders' equity 2 404.7 2 404.7 –<br />

Business development<br />

Best operating profit<br />

in company history<br />

We can look back on a highly successful<br />

<strong>2003</strong> financial year: with EBIT of EUR 732.1 million<br />

we generated the best operating profit in<br />

the company's history (previous year: EUR 470.9<br />

million). The net income of EUR 354.8 million<br />

also improved substantially on the previous year<br />

(EUR 267.2 million), producing earnings of EUR<br />

3.24 (EUR 2.75) a share. All four of <strong>Hannover</strong><br />

<strong>Re</strong>'s business groups made a positive contribution<br />

to this highly gratifying performance.<br />

Gross premium income contracted by 9.0%<br />

year on year to EUR 11.3 billion (EUR 12.5 billion).<br />

Yet at constant exchange rates, i.e. without<br />

the euro's rise against the US dollar, gross premiums<br />

would have grown by 1.9%.<br />

The "hard market" in property and casualty<br />

reinsurance was again sustained across virtually<br />

all lines of business and regions in the year under<br />

review. Although the gross premium volume contracted<br />

by 20.5% (adjusted for exchange-rate<br />

effects: -13.9%) compared to the previous year –<br />

owing to the restructuring of the relationship<br />

with the HDI companies and the strength of the<br />

euro – net premiums remained stable. Net income<br />

after tax was boosted by 8.3% over the<br />

previous year.<br />

Gross premiums in life and health reinsurance<br />

contracted by 7.9%, although adjusted for<br />

exchange-rate effects they would have grown<br />

by 2.2%; net premiums declined by 9.6%. Life<br />

and health reinsurance also generated gratifying<br />

income: with a ratio of EBIT to net premiums<br />

earned of 3.2% (2.3%) we moved another step<br />

closer to our medium-term target of 5.0%.<br />

Financial reinsurance was a driver of growth<br />

within the <strong>Hannover</strong> <strong>Re</strong> Group in the year under<br />

review, with gross premium income rising by<br />

31.4% or as much as 48.5% adjusted for exchange-rate<br />

effects. It should be borne in mind,<br />

however, that this growth was to some extent<br />

promoted by the first-time consolidation of HDI<br />

<strong>Re</strong>insurance (Ireland) Ltd. Net premiums earned<br />

climbed by 29.1% and net income for the year<br />

surged by 149.6%.<br />

20