Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SEGMENTAL REPORT<br />

as at 31 December <strong>2003</strong><br />

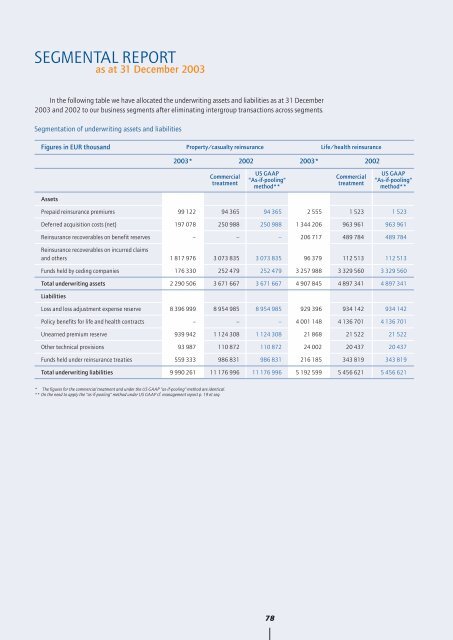

In the following table we have allocated the underwriting assets and liabilities as at 31 December<br />

<strong>2003</strong> and 2002 to our business segments after eliminating intergroup transactions across segments.<br />

Segmentation of underwriting assets and liabilities<br />

Figures in EUR thousand<br />

Property/casualty reinsurance<br />

Life/health reinsurance<br />

<strong>2003</strong>* 2002<br />

<strong>2003</strong>* 2002<br />

Commercial<br />

treatment<br />

US GAAP<br />

"As-if-pooling"<br />

method**<br />

Commercial<br />

treatment<br />

US GAAP<br />

"As-if-pooling"<br />

method**<br />

Assets<br />

Prepaid reinsurance premiums 99 122 94 365 94 365 2 555 1 523 1 523<br />

Deferred acquisition costs (net) 197 078 250 988 250 988 1 344 206 963 961 963 961<br />

<strong>Re</strong>insurance recoverables on benefit reserves – – – 206 717 489 784 489 784<br />

<strong>Re</strong>insurance recoverables on incurred claims<br />

and others 1 817 976 3 073 835 3 073 835 96 379 112 513 112 513<br />

Funds held by ceding companies 176 330 252 479 252 479 3 257 988 3 329 560 3 329 560<br />

Total underwriting assets 2 290 506 3 671 667 3 671 667 4 907 845 4 897 341 4 897 341<br />

Liabilities<br />

Loss and loss adjustment expense reserve 8 396 999 8 954 985 8 954 985 929 396 934 142 934 142<br />

Policy benefits for life and health contracts – – – 4 001 148 4 136 701 4 136 701<br />

Unearned premium reserve 939 942 1 124 308 1 124 308 21 868 21 522 21 522<br />

Other technical provisions 93 987 110 872 110 872 24 002 20 437 20 437<br />

Funds held under reinsurance treaties 559 333 986 831 986 831 216 185 343 819 343 819<br />

Total underwriting liabilities 9 990 261 11 176 996 11 176 996 5 192 599 5 456 621 5 456 621<br />

* The figures for the commercial treatment and under the US GAAP "as-if-pooling" method are identical.<br />

** On the need to apply the "as-if-pooling" method under US GAAP cf. management report p. 19 et seq.<br />

78