Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Strategy and self-image<br />

Strategic principles<br />

4. Investments<br />

• Priority attached to investments aimed at<br />

achieving an optimally diversified portfolio<br />

5. Growth<br />

• Organic growth before acquisitions<br />

• Acquisitions only when they offer more<br />

than volume growth<br />

6. Invested assets<br />

• Generation of an optimal profit contribution<br />

in the light of risk/return considerations<br />

• Ongoing dynamic financial analysis for the<br />

purposes of optimal asset/liability management<br />

7. Organisation and infrastructure<br />

• An effective and efficient organisation<br />

oriented towards our business processes<br />

• Investment priority for information management<br />

as an increasingly significant competitive<br />

factor<br />

• Accounting systems that satisfy internal<br />

and external reporting requirements and<br />

support our business processes<br />

8. Human resources policy<br />

• Attractive jobs for ambitious, performanceminded<br />

employees who identify with our<br />

corporate objectives<br />

• Constant improvement of qualifications and<br />

motivation<br />

• Fostering of entrepreneurial thinking by<br />

delegating tasks, authorities and responsibility<br />

wherever possible<br />

Strategic fields of action<br />

10. Performance Excellence<br />

• Constant improvements in leadership, the<br />

definition and communication of business<br />

policy, the quality of employees and in the<br />

management of resources and processes<br />

• Attainment of optimal performance levels<br />

as regards both satisfaction among staff<br />

and clients and the business results<br />

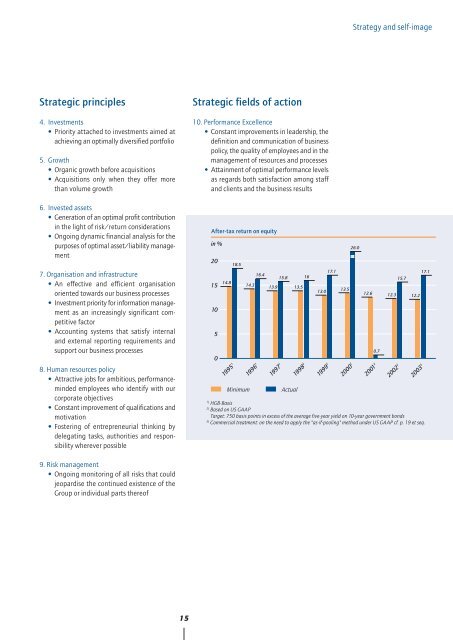

After-tax return on equity<br />

in %<br />

20<br />

15<br />

10<br />

5<br />

0<br />

14.8<br />

18.5<br />

1995 1 1996 1 1997 1 1998 2 1999 2 2000 2 2001 2 2002 2 <strong>2003</strong> 3<br />

Minimum<br />

14.3<br />

16.4<br />

15.8<br />

13.9<br />

Actual<br />

13.5<br />

16<br />

1)<br />

HGB-Basis<br />

2)<br />

Based on US GAAP<br />

Target: 750 basis points in excess of the average five-year yield on 10-year government bonds<br />

3)<br />

Commercial treatment: on the need to apply the "as-if-pooling" method under US GAAP cf. p. 19 et seq.<br />

13.0<br />

17.1<br />

13.5<br />

26.0<br />

12.6<br />

0.7<br />

12.3<br />

15.7<br />

12.2<br />

17.1<br />

9. Risk management<br />

• Ongoing monitoring of all risks that could<br />

jeopardise the continued existence of the<br />

Group or individual parts thereof<br />

15