Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management report<br />

property and casualty reinsurance<br />

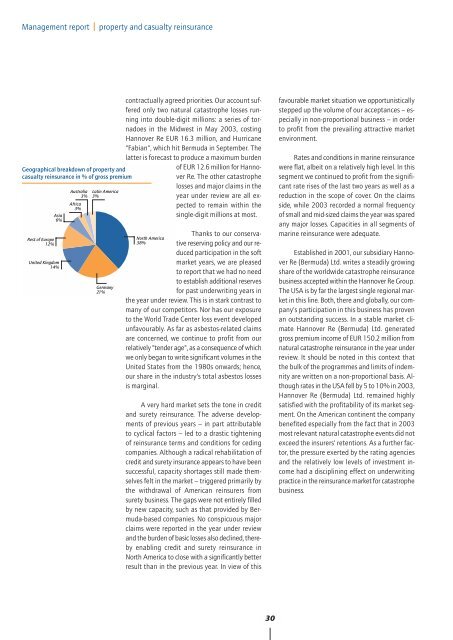

Geographical breakdown of property and<br />

casualty reinsurance in % of gross premium<br />

<strong>Re</strong>st of Europe<br />

12%<br />

Asia<br />

6%<br />

United Kingdom<br />

14%<br />

Australia<br />

3%<br />

Africa<br />

3%<br />

Latin America<br />

3%<br />

Germany<br />

21%<br />

contractually agreed priorities. Our account suffered<br />

only two natural catastrophe losses running<br />

into double-digit millions: a series of tornadoes<br />

in the Midwest in May <strong>2003</strong>, costing<br />

<strong>Hannover</strong> <strong>Re</strong> EUR 16.3 million, and Hurricane<br />

"Fabian", which hit Bermuda in September. The<br />

latter is forecast to produce a maximum burden<br />

North America<br />

38%<br />

of EUR 12.6 million for <strong>Hannover</strong><br />

<strong>Re</strong>. The other catastrophe<br />

losses and major claims in the<br />

year under review are all expected<br />

to remain within the<br />

single-digit millions at most.<br />

Thanks to our conservative<br />

reserving policy and our reduced<br />

participation in the soft<br />

market years, we are pleased<br />

to report that we had no need<br />

to establish additional reserves<br />

for past underwriting years in<br />

the year under review. This is in stark contrast to<br />

many of our competitors. Nor has our exposure<br />

to the World Trade Center loss event developed<br />

unfavourably. As far as asbestos-related claims<br />

are concerned, we continue to profit from our<br />

relatively "tender age", as a consequence of which<br />

we only began to write significant volumes in the<br />

United States from the 1980s onwards; hence,<br />

our share in the industry's total asbestos losses<br />

is marginal.<br />

A very hard market sets the tone in credit<br />

and surety reinsurance. The adverse developments<br />

of previous years – in part attributable<br />

to cyclical factors – led to a drastic tightening<br />

of reinsurance terms and conditions for ceding<br />

companies. Although a radical rehabilitation of<br />

credit and surety insurance appears to have been<br />

successful, capacity shortages still made themselves<br />

felt in the market – triggered primarily by<br />

the withdrawal of American reinsurers from<br />

surety business. The gaps were not entirely filled<br />

by new capacity, such as that provided by Bermuda-based<br />

companies. No conspicuous major<br />

claims were reported in the year under review<br />

and the burden of basic losses also declined, thereby<br />

enabling credit and surety reinsurance in<br />

North America to close with a significantly better<br />

result than in the previous year. In view of this<br />

favourable market situation we opportunistically<br />

stepped up the volume of our acceptances – especially<br />

in non-proportional business – in order<br />

to profit from the prevailing attractive market<br />

environment.<br />

Rates and conditions in marine reinsurance<br />

were flat, albeit on a relatively high level. In this<br />

segment we continued to profit from the significant<br />

rate rises of the last two years as well as a<br />

reduction in the scope of cover. On the claims<br />

side, while <strong>2003</strong> recorded a normal frequency<br />

of small and mid-sized claims the year was spared<br />

any major losses. Capacities in all segments of<br />

marine reinsurance were adequate.<br />

Established in 2001, our subsidiary <strong>Hannover</strong><br />

<strong>Re</strong> (Bermuda) Ltd. writes a steadily growing<br />

share of the worldwide catastrophe reinsurance<br />

business accepted within the <strong>Hannover</strong> <strong>Re</strong> Group.<br />

The USA is by far the largest single regional market<br />

in this line. Both, there and globally, our company's<br />

participation in this business has proven<br />

an outstanding success. In a stable market climate<br />

<strong>Hannover</strong> <strong>Re</strong> (Bermuda) Ltd. generated<br />

gross premium income of EUR 150.2 million from<br />

natural catastrophe reinsurance in the year under<br />

review. It should be noted in this context that<br />

the bulk of the programmes and limits of indemnity<br />

are written on a non-proportional basis. Although<br />

rates in the USA fell by 5 to 10% in <strong>2003</strong>,<br />

<strong>Hannover</strong> <strong>Re</strong> (Bermuda) Ltd. remained highly<br />

satisfied with the profitability of its market segment.<br />

On the American continent the company<br />

benefited especially from the fact that in <strong>2003</strong><br />

most relevant natural catastrophe events did not<br />

exceed the insurers' retentions. As a further factor,<br />

the pressure exerted by the rating agencies<br />

and the relatively low levels of investment income<br />

had a disciplining effect on underwriting<br />

practice in the reinsurance market for catastrophe<br />

business.<br />

30