Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The <strong>Hannover</strong> <strong>Re</strong> share<br />

Last but not least, our Investor <strong>Re</strong>lations<br />

webpages offer you regular updates on all our IR<br />

activities, and interested readers can consult our<br />

new "IR Online Magazine" for the latest monthly<br />

insights into developments at <strong>Hannover</strong> <strong>Re</strong>, in the<br />

reinsurance industry and on the capital markets.<br />

In June <strong>2003</strong> <strong>Hannover</strong> <strong>Re</strong> decided to implement<br />

a combined capital increase for cash<br />

and a contribution in kind in order to strengthen<br />

its capital resources. This measure increased our<br />

equity base by EUR 530 million and enlarged our<br />

underwriting capacity. Consequently, in the year<br />

under review we were able to fully participate<br />

in the hard, profitable reinsurance markets and<br />

raise our level of retained premiums in this profitable<br />

business.<br />

Following our capital increase in June <strong>2003</strong><br />

the number of <strong>Hannover</strong> <strong>Re</strong> shareholders grew<br />

from more than 25,000 to around 28,000. The<br />

placement of a 20.6% shareholding with institutional<br />

investors through our parent company<br />

Talanx AG in February 2004 boosted <strong>Hannover</strong><br />

<strong>Re</strong>'s free float by a further 24.8 million shares<br />

to its current level of 48.8% of the capital stock.<br />

The proportion of the free float attributable to<br />

institutional investors (corporate entities) increased<br />

substantially to 84%. The number of<br />

<strong>Hannover</strong> <strong>Re</strong> shareholders as at 27 February<br />

2004 stood at 32,529. Both measures had an<br />

extremely favourable effect on the liquidity of our<br />

share. The average value of the shares traded<br />

doubled after the capital increase to roughly<br />

EUR 5 million and then tripled after the reduction<br />

in the share held by Talanx to more than EUR<br />

15 million per day.<br />

In September <strong>Hannover</strong> <strong>Re</strong> was awarded<br />

the title "<strong>Re</strong>insurance Company of the Year<br />

<strong>2003</strong>" by the highly reputed UK trade journal<br />

"<strong>Re</strong>actions". The selection was made by the<br />

magazine's readership, namely the employees<br />

of insurance and reinsurance companies around<br />

the world, insurance and reinsurance brokers as<br />

well as financial analysts, rating agencies and<br />

other service providers. Among the reasons for<br />

awarding <strong>Hannover</strong> <strong>Re</strong> with the prize, "<strong>Re</strong>actions"<br />

cited the consistently high return on equity gen-<br />

erated by the company, the relative price stability<br />

of its share and its expert capital management –<br />

not least in view of the capital increase implemented<br />

in June of the year under review.<br />

As an additional measure, the issue of further<br />

subordinated hybrid capital (a blend of equity<br />

and debt capital) in February of the current financial<br />

year enabled <strong>Hannover</strong><br />

<strong>Re</strong> to optimise its capital base.<br />

With this transaction we made<br />

the most of the attractive interest<br />

rate environment and repurchased<br />

the outstanding US<br />

dollar bond at a very low exchange<br />

rate.<br />

<strong>Hannover</strong> <strong>Re</strong> has responded<br />

to the growing importance<br />

of the German Corporate Governance<br />

Code by providing a<br />

detailed Corporate Governance<br />

section on its Investor <strong>Re</strong>lations<br />

Internet pages. All information<br />

required pursuant to § 161 of the German Stock<br />

Corporation Act is published there. In addition,<br />

in the current financial year we are already fully<br />

implementing the financial reporting deadlines<br />

recommended by the Corporate Governance<br />

Code: the consolidated annual<br />

financial statements will be published<br />

within 90 days of the end<br />

of the financial year and the interim<br />

reports within 45 days of<br />

the end of the reporting period.<br />

The German Corporate<br />

Governance Code also provides<br />

for variable remuneration of<br />

management based on corporate<br />

performance. We live up to<br />

this standard with our virtual<br />

stock option plan for the Group's managerial<br />

staff worldwide, a scheme which we launched as<br />

long ago as 2000.<br />

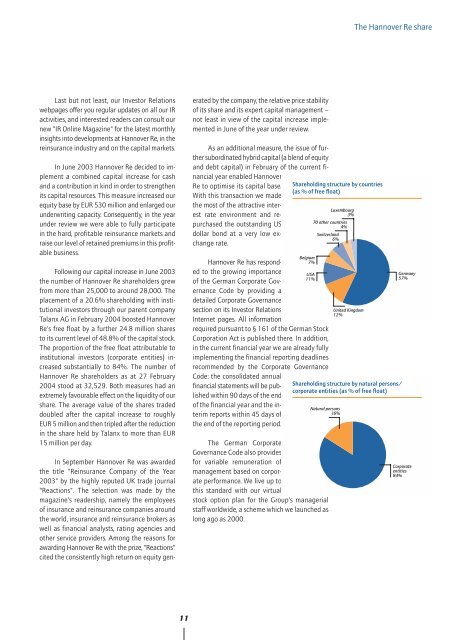

Shareholding structure by countries<br />

(as % of free float)<br />

Luxembourg<br />

3%<br />

70 other countries<br />

4%<br />

Switzerland<br />

6%<br />

Belgium<br />

7%<br />

USA<br />

11%<br />

United Kingdom<br />

12%<br />

Shareholding structure by natural persons/<br />

corporate entities (as % of free float)<br />

Natural persons<br />

16%<br />

Germany<br />

57%<br />

Corporate<br />

entities<br />

84%<br />

11