Annual Report 2010 - Hannover Re

Annual Report 2010 - Hannover Re

Annual Report 2010 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

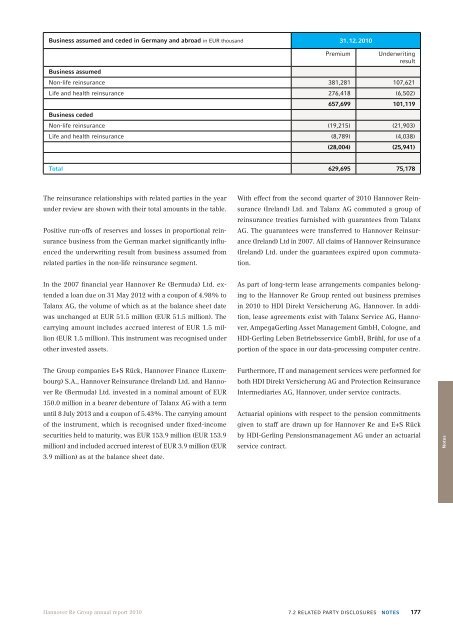

Business assumed and ceded in Germany and abroad in EUR thousand 31. 12. <strong>2010</strong><br />

Premium Underwriting<br />

result<br />

Business assumed<br />

Non-life reinsurance 381,281 107,621<br />

Life and health reinsurance 276,418 (6,502)<br />

657,699 101,119<br />

Business ceded<br />

Non-life reinsurance (19,215) (21,903)<br />

Life and health reinsurance (8,789) (4,038)<br />

(28,004) (25,941)<br />

Total 629,695 75,178<br />

The reinsurance relationships with related parties in the year<br />

under review are shown with their total amounts in the table.<br />

Positive run-offs of reserves and losses in proportional reinsurance<br />

business from the German market significantly influenced<br />

the underwriting result from business assumed from<br />

related parties in the non-life reinsurance segment.<br />

With effect from the second quarter of <strong>2010</strong> <strong>Hannover</strong> <strong>Re</strong>insurance<br />

(Ireland) Ltd. and Talanx AG commuted a group of<br />

reinsurance treaties furnished with guarantees from Talanx<br />

AG. The guarantees were transferred to <strong>Hannover</strong> <strong>Re</strong>insurance<br />

(Ireland) Ltd in 2007. All claims of <strong>Hannover</strong> <strong>Re</strong>insurance<br />

(Ireland) Ltd. under the guarantees expired upon commutation.<br />

In the 2007 financial year <strong>Hannover</strong> <strong>Re</strong> (Bermuda) Ltd. extended<br />

a loan due on 31 May 2012 with a coupon of 4.98% to<br />

Talanx AG, the volume of which as at the balance sheet date<br />

was unchanged at EUR 51.5 million (EUR 51.5 million). The<br />

carrying amount includes accrued interest of EUR 1.5 million<br />

(EUR 1.5 million). This instrument was recognised under<br />

other invested assets.<br />

As part of long-term lease arrangements companies belonging<br />

to the <strong>Hannover</strong> <strong>Re</strong> Group rented out business premises<br />

in <strong>2010</strong> to HDI Direkt Versicherung AG, <strong>Hannover</strong>. In addition,<br />

lease agreements exist with Talanx Service AG, <strong>Hannover</strong>,<br />

AmpegaGerling Asset Management GmbH, Cologne, and<br />

HDI-Gerling Leben Betriebsservice GmbH, Brühl, for use of a<br />

portion of the space in our data-processing computer centre.<br />

The Group companies E+S Rück, <strong>Hannover</strong> Finance (Luxembourg)<br />

S.A., <strong>Hannover</strong> <strong>Re</strong>insurance (Ireland) Ltd. and <strong>Hannover</strong><br />

<strong>Re</strong> (Bermuda) Ltd. invested in a nominal amount of EUR<br />

150.0 million in a bearer debenture of Talanx AG with a term<br />

until 8 July 2013 and a coupon of 5.43%. The carrying amount<br />

of the instrument, which is recognised under fixed-income<br />

securities held to maturity, was EUR 153.9 million (EUR 153.9<br />

million) and included accrued interest of EUR 3.9 million (EUR<br />

3.9 million) as at the balance sheet date.<br />

Furthermore, IT and management services were performed for<br />

both HDI Direkt Versicherung AG and Protection <strong>Re</strong>insurance<br />

Intermediaries AG, <strong>Hannover</strong>, under service contracts.<br />

Actuarial opinions with respect to the pension commitments<br />

given to staff are drawn up for <strong>Hannover</strong> <strong>Re</strong> and E+S Rück<br />

by HDI-Gerling Pensionsmanagement AG under an actuarial<br />

service contract.<br />

Notes<br />

<strong>Hannover</strong> <strong>Re</strong> Group annual report <strong>2010</strong><br />

7.2 <strong>Re</strong>lated party disclosures Notes<br />

177