Annual Report 2010 - Hannover Re

Annual Report 2010 - Hannover Re

Annual Report 2010 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

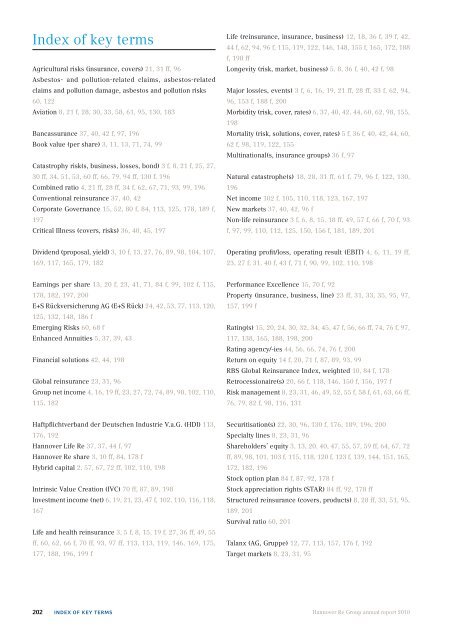

Index of key terms<br />

Agricultural risks (insurance, covers) 21, 31 ff, 96<br />

Asbestos- and pollution-related claims, asbestos-related<br />

claims and pollution damage, asbestos and pollution risks<br />

60, 122<br />

Aviation 8, 21 f, 28, 30, 33, 58, 61, 95, 130, 183<br />

Bancassurance 37, 40, 42 f, 97, 196<br />

Book value (per share) 3, 11, 13, 71, 74, 99<br />

Catastrophy risk(s, business, losses, bond) 3 f, 8, 21 f, 25, 27,<br />

30 ff, 34, 51, 53, 60 ff, 66, 79, 94 ff, 130 f, 196<br />

Combined ratio 4, 21 ff, 28 ff, 34 f, 62, 67, 71, 93, 99, 196<br />

Conventional reinsurance 37, 40, 42<br />

Corporate Governance 15, 52, 80 f, 84, 113, 125, 178, 189 f,<br />

197<br />

Critical Illness (covers, risks) 36, 40, 45, 197<br />

Life (reinsurance, insurance, business) 12, 18, 36 f, 39 f, 42,<br />

44 f, 62, 94, 96 f, 115, 119, 122, 146, 148, 155 f, 165, 172, 188<br />

f, 198 ff<br />

Longevity (risk, market, business) 5, 8, 36 f, 40, 42 f, 98<br />

Major loss(es, events) 3 f, 6, 16, 19, 21 ff, 28 ff, 33 f, 62, 94,<br />

96, 153 f, 188 f, 200<br />

Morbidity (risk, cover, rates) 6, 37, 40, 42, 44, 60, 62, 98, 155,<br />

198<br />

Mortality (risk, solutions, cover, rates) 5 f, 36 f, 40, 42, 44, 60,<br />

62 f, 98, 119, 122, 155<br />

Multinational(s, insurance groups) 36 f, 97<br />

Natural catastrophe(s) 18, 28, 31 ff, 61 f, 79, 96 f, 122, 130,<br />

196<br />

Net income 102 f, 105, 110, 118, 123, 167, 197<br />

New markets 37, 40, 42, 96 f<br />

Non-life reinsurance 3 f, 6, 8, 15, 18 ff, 49, 57 f, 66 f, 70 f, 93<br />

f, 97, 99, 110, 112, 125, 150, 156 f, 181, 189, 201<br />

Dividend (proposal, yield) 3, 10 f, 13, 27, 76, 89, 98, 104, 107,<br />

169, 117, 165, 179, 182<br />

Operating profit/loss, operating result (EBIT) 4, 6, 11, 19 ff,<br />

23, 27 f, 31, 40 f, 43 f, 71 f, 90, 99, 102, 110, 198<br />

Earnings per share 13, 20 f, 23, 41, 71, 84 f, 99, 102 f, 115,<br />

178, 182, 197, 200<br />

E+S Rückversicherung AG (E+S Rück) 24, 42, 53, 77, 113, 120,<br />

125, 132, 148, 186 f<br />

Emerging Risks 60, 68 f<br />

Enhanced Annuities 5, 37, 39, 43<br />

Financial solutions 42, 44, 198<br />

Global reinsurance 23, 31, 96<br />

Group net income 4, 16, 19 ff, 23, 27, 72, 74, 89, 98, 102, 110,<br />

115, 182<br />

Performance Excellence 15, 70 f, 92<br />

Property (insurance, business, line) 23 ff, 31, 33, 35, 95, 97,<br />

157, 199 f<br />

Rating(s) 15, 20, 24, 30, 32, 34, 45, 47 f, 56, 66 ff, 74, 76 f, 97,<br />

117, 138, 165, 188, 198, 200<br />

Rating agency/-ies 44, 56, 66, 74, 76 f, 200<br />

<strong>Re</strong>turn on equity 14 f, 20, 71 f, 87, 89, 93, 99<br />

RBS Global <strong>Re</strong>insurance Index, weighted 10, 84 f, 178<br />

<strong>Re</strong>trocessionaire(s) 20, 66 f, 118, 146, 150 f, 156, 197 f<br />

Risk management 8, 23, 31, 46, 49, 52, 55 f, 58 f, 61, 63, 66 ff,<br />

76, 79, 82 f, 98, 116, 131<br />

Haftpflichtverband der Deutschen Industrie V.a.G. (HDI) 113,<br />

176, 192<br />

<strong>Hannover</strong> Life <strong>Re</strong> 37, 37, 44 f, 97<br />

<strong>Hannover</strong> <strong>Re</strong> share 3, 10 ff, 84, 178 f<br />

Hybrid capital 2, 57, 67, 72 ff, 102, 110, 198<br />

Intrinsic Value Creation (IVC) 70 ff, 87, 89, 198<br />

Investment income (net) 6, 19, 21, 23, 47 f, 102, 110, 116, 118,<br />

167<br />

Life and health reinsurance 3, 5 f, 8, 15, 19 f, 27, 36 ff, 49, 55<br />

ff, 60, 62, 66 f, 70 ff, 93, 97 ff, 113, 113, 119, 146, 169, 175,<br />

177, 188, 196, 199 f<br />

Securitisation(s) 22, 30, 96, 130 f, 176, 189, 196, 200<br />

Specialty lines 8, 23, 31, 96<br />

Shareholders’ equity 3, 13, 20, 40, 47, 55, 57, 59 ff, 64, 67, 72<br />

ff, 89, 98, 101, 103 f, 115, 118, 120 f, 123 f, 139, 144, 151, 165,<br />

172, 182, 196<br />

Stock option plan 84 f, 87, 92, 178 f<br />

Stock appreciation rights (STAR) 84 ff, 92, 178 ff<br />

Structured reinsurance (covers, products) 8, 28 ff, 33, 51, 95,<br />

189, 201<br />

Survival ratio 60, 201<br />

Talanx (AG, Gruppe) 12, 77, 113, 157, 176 f, 192<br />

Target markets 8, 23, 31, 95<br />

202 INDEX OF KEY TERMS<br />

<strong>Hannover</strong> <strong>Re</strong> Group annual report <strong>2010</strong>