Annual Report 2010 - Hannover Re

Annual Report 2010 - Hannover Re

Annual Report 2010 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

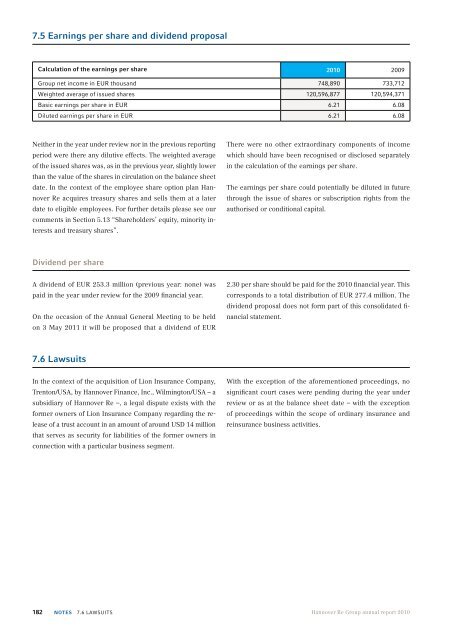

7.5 Earnings per share and dividend proposal<br />

Calculation of the earnings per share <strong>2010</strong> 2009<br />

Group net income in EUR thousand 748,890 733,712<br />

Weighted average of issued shares 120,596,877 120,594,371<br />

Basic earnings per share in EUR 6.21 6.08<br />

Diluted earnings per share in EUR 6.21 6.08<br />

Neither in the year under review nor in the previous reporting<br />

period were there any dilutive effects. The weighted average<br />

of the issued shares was, as in the previous year, slightly lower<br />

than the value of the shares in circulation on the balance sheet<br />

date. In the context of the employee share option plan <strong>Hannover</strong><br />

<strong>Re</strong> acquires treasury shares and sells them at a later<br />

date to eligible employees. For further details please see our<br />

comments in Section 5.13 “Shareholders’ equity, minority interests<br />

and treasury shares”.<br />

There were no other extraordinary components of income<br />

which should have been recognised or disclosed separately<br />

in the calculation of the earnings per share.<br />

The earnings per share could potentially be diluted in future<br />

through the issue of shares or subscription rights from the<br />

authorised or conditional capital.<br />

Dividend per share<br />

A dividend of EUR 253.3 million (previous year: none) was<br />

paid in the year under review for the 2009 financial year.<br />

On the occasion of the <strong>Annual</strong> General Meeting to be held<br />

on 3 May 2011 it will be proposed that a dividend of EUR<br />

2.30 per share should be paid for the <strong>2010</strong> financial year. This<br />

corresponds to a total distribution of EUR 277.4 million. The<br />

dividend proposal does not form part of this consolidated financial<br />

statement.<br />

7.6 Lawsuits<br />

In the context of the acquisition of Lion Insurance Company,<br />

Trenton/USA, by <strong>Hannover</strong> Finance, Inc., Wilmington/USA – a<br />

subsidiary of <strong>Hannover</strong> <strong>Re</strong> –, a legal dispute exists with the<br />

former owners of Lion Insurance Company regarding the release<br />

of a trust account in an amount of around USD 14 million<br />

that serves as security for liabilities of the former owners in<br />

connection with a particular business segment.<br />

With the exception of the aforementioned proceedings, no<br />

significant court cases were pending during the year under<br />

review or as at the balance sheet date – with the exception<br />

of proceedings within the scope of ordinary insurance and<br />

reinsurance business activities.<br />

182 Notes 7.6 Lawsuits<br />

<strong>Hannover</strong> <strong>Re</strong> Group annual report <strong>2010</strong>