How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

inves<strong>to</strong>r has decided <strong>to</strong> benchmark 85 percent of their portfolio<br />

<strong>to</strong> the large-cap subasset class, 15 percent <strong>to</strong> small-caps <strong>and</strong><br />

no exposure <strong>to</strong> micro-caps. The actual market coverage of the<br />

policy benchmark is listed as of Jan. 1, 2009. The result of these<br />

decisions (i.e., underweighting large-cap, overweighting smallcap<br />

<strong>and</strong> underweighting micro-caps) is approximately 9 basis<br />

points in benchmark misfit. Those 9 basis points represent a<br />

performance mismatch that can be directly attributed <strong>to</strong> the<br />

allocation decisions exclusive of manager performance.<br />

Compounding The Problem<br />

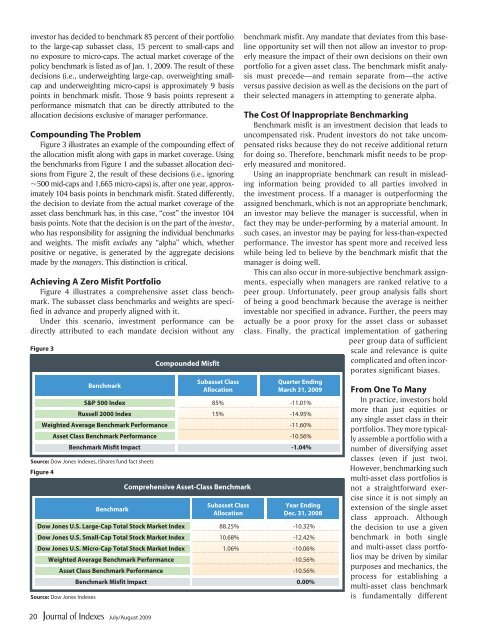

Figure 3 illustrates an example of the compounding effect of<br />

the allocation misfit along with gaps in market coverage. Using<br />

the benchmarks from Figure 1 <strong>and</strong> the subasset allocation decisions<br />

from Figure 2, the result of these decisions (i.e., ignoring<br />

~500 mid-caps <strong>and</strong> 1,665 micro-caps) is, after one year, approximately<br />

104 basis points in benchmark misfit. Stated differently,<br />

the decision <strong>to</strong> deviate from the actual market coverage of the<br />

asset class benchmark has, in this case, “cost” the inves<strong>to</strong>r 104<br />

basis points. Note that the decision is on the part of the inves<strong>to</strong>r,<br />

who has responsibility for assigning the individual benchmarks<br />

<strong>and</strong> weights. The misfit excludes any “alpha” which, whether<br />

positive or negative, is generated by the aggregate decisions<br />

made by the managers. This distinction is critical.<br />

Achieving A Zero Misfit Portfolio<br />

Figure 4 illustrates a comprehensive asset class benchmark.<br />

The subasset class benchmarks <strong>and</strong> weights are specified<br />

in advance <strong>and</strong> properly aligned with it.<br />

Under this scenario, investment performance can be<br />

directly attributed <strong>to</strong> each m<strong>and</strong>ate decision without any<br />

Figure 3<br />

Source: Dow Jones Indexes, iShares fund fact sheets<br />

Figure 4<br />

Source: Dow Jones Indexes<br />

Benchmark<br />

Benchmark<br />

Compounded Misfit<br />

Subasset Class<br />

Allocation<br />

Comprehensive Asset-Class Benchmark<br />

Subasset Class<br />

Allocation<br />

benchmark misfit. Any m<strong>and</strong>ate that deviates from this baseline<br />

opportunity set will then not allow an inves<strong>to</strong>r <strong>to</strong> properly<br />

measure the impact of their own decisions on their own<br />

portfolio for a given asset class. The benchmark misfit analysis<br />

must precede—<strong>and</strong> remain separate from—the active<br />

versus passive decision as well as the decisions on the part of<br />

their selected managers in attempting <strong>to</strong> generate alpha.<br />

The Cost Of Inappropriate Benchmarking<br />

Benchmark misfit is an investment decision that leads <strong>to</strong><br />

uncompensated risk. Prudent inves<strong>to</strong>rs do not take uncompensated<br />

risks because they do not receive additional return<br />

for doing so. Therefore, benchmark misfit needs <strong>to</strong> be properly<br />

measured <strong>and</strong> moni<strong>to</strong>red.<br />

Using an inappropriate benchmark can result in misleading<br />

information being provided <strong>to</strong> all parties involved in<br />

the investment process. If a manager is outperforming the<br />

assigned benchmark, which is not an appropriate benchmark,<br />

an inves<strong>to</strong>r may believe the manager is successful, when in<br />

fact they may be under-performing by a material amount. In<br />

such cases, an inves<strong>to</strong>r may be paying for less-than-expected<br />

performance. The inves<strong>to</strong>r has spent more <strong>and</strong> received less<br />

while being led <strong>to</strong> believe by the benchmark misfit that the<br />

manager is doing well.<br />

This can also occur in more-subjective benchmark assignments,<br />

especially when managers are ranked relative <strong>to</strong> a<br />

peer group. Unfortunately, peer group analysis falls short<br />

of being a good benchmark because the average is neither<br />

investable nor specified in advance. Further, the peers may<br />

actually be a poor proxy for the asset class or subasset<br />

class. Finally, the practical implementation of gathering<br />

peer group data of sufficient<br />

scale <strong>and</strong> relevance is quite<br />

complicated <strong>and</strong> often incorporates<br />

significant biases.<br />

Quarter Ending<br />

March 31, 2009<br />

S&P 500 Index 85% -11.01%<br />

Russell 2000 Index 15% -14.95%<br />

Weighted Average Benchmark Performance -11.60%<br />

Asset Class Benchmark Performance -10.56%<br />

Benchmark Misfit Impact -1.04%<br />

Year Ending<br />

Dec. 31, 2008<br />

Dow Jones U.S. Large-Cap Total S<strong>to</strong>ck Market Index 88.25% -10.32%<br />

Dow Jones U.S. Small-Cap Total S<strong>to</strong>ck Market Index 10.68% -12.42%<br />

Dow Jones U.S. Micro-Cap Total S<strong>to</strong>ck Market Index 1.06% -10.06%<br />

Weighted Average Benchmark Performance -10.56%<br />

Asset Class Benchmark Performance -10.56%<br />

Benchmark Misfit Impact 0.00%<br />

From One To Many<br />

In practice, inves<strong>to</strong>rs hold<br />

more than just equities or<br />

any single asset class in their<br />

portfolios. They more typically<br />

assemble a portfolio with a<br />

number of diversifying asset<br />

classes (even if just two).<br />

<strong>How</strong>ever, benchmarking such<br />

multi-asset class portfolios is<br />

not a straightforward exercise<br />

since it is not simply an<br />

extension of the single asset<br />

class approach. Although<br />

the decision <strong>to</strong> use a given<br />

benchmark in both single<br />

<strong>and</strong> multi-asset class portfolios<br />

may be driven by similar<br />

purposes <strong>and</strong> mechanics, the<br />

process for establishing a<br />

multi-asset class benchmark<br />

is fundamentally different<br />

20<br />

July/August 2009