How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

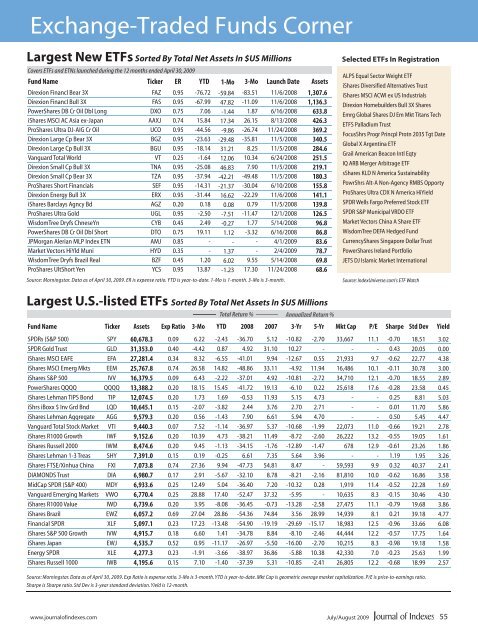

Exchange-Traded Funds Corner<br />

Largest New ETFs Sorted By Total Net Assets In $US Millions<br />

Covers ETFs <strong>and</strong> ETNs launched during the 12 months ended April 30, 2009<br />

Fund Name<br />

Direxion Financl Bear 3X<br />

Direxion Financl Bull 3X<br />

PowerShares DB Cr Oil Dbl Long<br />

iShares MSCI AC Asia ex-Japan<br />

ProShares Ultra DJ-AIG Cr Oil<br />

Direxion Large Cp Bear 3X<br />

Direxion Large Cp Bull 3X<br />

Vanguard Total World<br />

Direxion Small Cp Bull 3X<br />

Direxion Small Cp Bear 3X<br />

ProShares Short Financials<br />

Direxion Energy Bull 3X<br />

iShares Barclays Agncy Bd<br />

ProShares Ultra Gold<br />

WisdomTree Dryfs ChneseYn<br />

PowerShares DB Cr Oil Dbl Short<br />

JPMorgan Alerian MLP Index ETN<br />

Market Vec<strong>to</strong>rs HiYld Muni<br />

WisdomTree Dryfs Brazil Real<br />

ProShares UltShort Yen<br />

Ticker<br />

FAZ<br />

FAS<br />

DXO<br />

AAXJ<br />

UCO<br />

BGZ<br />

BGU<br />

VT<br />

TNA<br />

TZA<br />

SEF<br />

ERX<br />

AGZ<br />

UGL<br />

CYB<br />

DTO<br />

AMJ<br />

HYD<br />

BZF<br />

YCS<br />

ER<br />

0.95<br />

0.95<br />

0.75<br />

0.74<br />

0.95<br />

0.95<br />

0.95<br />

0.25<br />

0.95<br />

0.95<br />

0.95<br />

0.95<br />

0.20<br />

0.95<br />

0.45<br />

0.75<br />

0.85<br />

0.35<br />

0.45<br />

0.95<br />

YTD<br />

-76.72<br />

-67.99<br />

7.06<br />

15.84<br />

-44.56<br />

-23.63<br />

-18.14<br />

-1.64<br />

-25.08<br />

-37.94<br />

-14.31<br />

-31.44<br />

0.18<br />

-2.50<br />

2.49<br />

19.11<br />

-<br />

-<br />

1.20<br />

13.87<br />

1-Mo<br />

-59.84<br />

47.82<br />

-1.44<br />

17.34<br />

-9.86<br />

-29.48<br />

31.21<br />

12.06<br />

46.83<br />

-42.21<br />

-21.37<br />

16.62<br />

0.08<br />

-7.51<br />

-0.27<br />

1.12<br />

-<br />

1.37<br />

6.02<br />

-1.23<br />

3-Mo<br />

-83.51<br />

-11.09<br />

1.87<br />

26.15<br />

-26.74<br />

-35.81<br />

8.25<br />

10.34<br />

7.90<br />

-49.48<br />

-30.04<br />

-22.29<br />

0.79<br />

-11.47<br />

1.77<br />

-3.32<br />

-<br />

-<br />

9.55<br />

17.30<br />

Launch Date<br />

11/6/2008<br />

11/6/2008<br />

6/16/2008<br />

8/13/2008<br />

11/24/2008<br />

11/5/2008<br />

11/5/2008<br />

6/24/2008<br />

11/5/2008<br />

11/5/2008<br />

6/10/2008<br />

11/6/2008<br />

11/5/2008<br />

12/1/2008<br />

5/14/2008<br />

6/16/2008<br />

4/1/2009<br />

2/4/2009<br />

5/14/2008<br />

11/24/2008<br />

Source: Morningstar. Data as of April 30, 2009. ER is expense ratio. YTD is year-<strong>to</strong>-date. 1-Mo is 1-month. 3-Mo is 3-month.<br />

Assets<br />

1,307.6<br />

1,136.3<br />

633.8<br />

426.3<br />

369.2<br />

340.5<br />

284.6<br />

251.5<br />

219.1<br />

180.3<br />

155.8<br />

141.1<br />

139.8<br />

126.5<br />

96.8<br />

86.8<br />

83.6<br />

78.7<br />

69.8<br />

68.6<br />

Selected ETFs In Registration<br />

ALPS Equal Sec<strong>to</strong>r Weight ETF<br />

iShares Diversified Alternatives Trust<br />

iShares MSCI ACWI ex US Industrials<br />

Direxion Homebuilders Bull 3X Shares<br />

Emrg Global Shares DJ Em Mkt Titans Tech<br />

ETFS Palladium Trust<br />

FocusShrs Progr Princpl Protn 2035 Tgt Date<br />

Global X Argentina ETF<br />

Grail American Beacon Intl Eqty<br />

IQ ARB Merger Arbitrage ETF<br />

sShares KLD N America Sustainability<br />

PowrShrs Alt-A Non-Agency RMBS Opporty<br />

ProShares Ultra CDX N America HiYield<br />

SPDR Wells Fargo Preferred S<strong>to</strong>ck ETF<br />

SPDR S&P Municipal VRDO ETF<br />

Market Vec<strong>to</strong>rs China A Share ETF<br />

WisdomTree DEFA Hedged Fund<br />

CurrencyShares Singapore Dollar Trust<br />

PowerShares Irel<strong>and</strong> Portfolio<br />

JETS DJ Islamic Market International<br />

Source: IndexUniverse.com's ETF Watch<br />

Largest U.S.-listed ETFs Sorted By Total Net Assets In $US Millions<br />

Total Return % Annualized Return %<br />

Fund Name Ticker Assets Exp Ratio 3-Mo YTD<br />

2008 2007<br />

3-Yr 5-Yr Mkt Cap P/E<br />

Sharpe Std Dev Yield<br />

SPDRs (S&P 500)<br />

SPDR Gold Trust<br />

iShares MSCI EAFE<br />

iShares MSCI Emerg Mkts<br />

iShares S&P 500<br />

PowerShares QQQQ<br />

iShares Lehman TIPS Bond<br />

iShrs iBoxx $ Inv Grd Bnd<br />

iShares Lehman Aggregate<br />

Vanguard Total S<strong>to</strong>ck Market<br />

iShares R1000 Growth<br />

iShares Russell 2000<br />

iShares Lehman 1-3 Treas<br />

iShares FTSE/Xinhua China<br />

DIAMONDS Trust<br />

MidCap SPDR (S&P 400)<br />

Vanguard Emerging Markets<br />

iShares R1000 Value<br />

iShares Brazil<br />

Financial SPDR<br />

iShares S&P 500 Growth<br />

iShares Japan<br />

Energy SPDR<br />

iShares Russell 1000<br />

SPY<br />

GLD<br />

EFA<br />

EEM<br />

IVV<br />

QQQQ<br />

TIP<br />

LQD<br />

AGG<br />

VTI<br />

IWF<br />

IWM<br />

SHY<br />

FXI<br />

DIA<br />

MDY<br />

VWO<br />

IWD<br />

EWZ<br />

XLF<br />

IVW<br />

EWJ<br />

XLE<br />

IWB<br />

60,678.3<br />

31,353.0<br />

27,281.4<br />

25,767.8<br />

16,379.5<br />

13,388.2<br />

12,074.5<br />

10,645.1<br />

9,579.3<br />

9,440.3<br />

9,152.6<br />

8,474.6<br />

7,391.0<br />

7,073.8<br />

6,980.7<br />

6,933.6<br />

6,770.4<br />

6,739.6<br />

6,057.2<br />

5,097.1<br />

4,915.7<br />

4,535.7<br />

4,277.3<br />

4,195.6<br />

0.09<br />

0.40<br />

0.34<br />

0.74<br />

0.09<br />

0.20<br />

0.20<br />

0.15<br />

0.20<br />

0.07<br />

0.20<br />

0.20<br />

0.15<br />

0.74<br />

0.17<br />

0.25<br />

0.25<br />

0.20<br />

0.69<br />

0.23<br />

0.18<br />

0.52<br />

0.23<br />

0.15<br />

6.22<br />

-4.42<br />

8.32<br />

26.58<br />

6.43<br />

18.15<br />

1.73<br />

-2.07<br />

0.56<br />

7.52<br />

10.39<br />

9.45<br />

0.19<br />

27.36<br />

2.91<br />

12.49<br />

28.88<br />

3.95<br />

27.04<br />

17.23<br />

6.60<br />

0.95<br />

-1.91<br />

7.10<br />

-2.43<br />

0.87<br />

-6.55<br />

14.82<br />

-2.22<br />

15.45<br />

1.69<br />

-3.82<br />

-1.43<br />

-1.14<br />

4.73<br />

-1.13<br />

-0.25<br />

9.94<br />

-5.67<br />

5.04<br />

17.40<br />

-8.08<br />

28.86<br />

-13.48<br />

1.41<br />

-11.17<br />

-3.66<br />

-1.40<br />

-36.70<br />

4.92<br />

-41.01<br />

-48.86<br />

-37.01<br />

-41.72<br />

-0.53<br />

2.44<br />

7.90<br />

-36.97<br />

-38.21<br />

-34.15<br />

6.61<br />

-47.73<br />

-32.10<br />

-36.40<br />

-52.47<br />

-36.45<br />

-54.36<br />

-54.90<br />

-34.78<br />

-26.97<br />

-38.97<br />

-37.39<br />

5.12<br />

31.10<br />

9.94<br />

33.11<br />

4.92<br />

19.13<br />

11.93<br />

3.76<br />

6.61<br />

5.37<br />

11.49<br />

-1.76<br />

7.35<br />

54.81<br />

8.78<br />

7.20<br />

37.32<br />

-0.73<br />

74.84<br />

-19.19<br />

8.84<br />

-5.50<br />

36.86<br />

5.31<br />

-10.82<br />

10.27<br />

-12.67<br />

-4.92<br />

-10.81<br />

-6.10<br />

5.15<br />

2.70<br />

5.94<br />

-10.68<br />

-8.72<br />

-12.89<br />

5.64<br />

8.47<br />

-8.21<br />

-10.32<br />

-5.95<br />

-13.28<br />

3.56<br />

-29.69<br />

-8.10<br />

-16.00<br />

-5.88<br />

-10.85<br />

-2.70<br />

-<br />

0.55<br />

11.94<br />

-2.72<br />

0.22<br />

4.73<br />

2.71<br />

4.70<br />

-1.99<br />

-2.60<br />

-1.47<br />

3.96<br />

-<br />

-2.16<br />

0.28<br />

-<br />

-2.58<br />

28.99<br />

-15.17<br />

-2.46<br />

-2.70<br />

10.38<br />

-2.41<br />

33,667<br />

-<br />

21,933<br />

16,486<br />

34,710<br />

25,618<br />

-<br />

-<br />

-<br />

22,073<br />

26,222<br />

678<br />

-<br />

59,593<br />

81,810<br />

1,919<br />

10,635<br />

27,475<br />

14,939<br />

18,983<br />

44,444<br />

10,215<br />

42,330<br />

26,805<br />

11.1<br />

-<br />

9.7<br />

10.1<br />

12.1<br />

17.6<br />

-<br />

-<br />

-<br />

11.0<br />

13.2<br />

12.9<br />

-<br />

9.9<br />

10.0<br />

11.4<br />

8.3<br />

11.1<br />

8.1<br />

12.5<br />

12.2<br />

8.3<br />

7.0<br />

12.2<br />

-0.70<br />

0.43<br />

-0.62<br />

-0.11<br />

-0.70<br />

-0.28<br />

0.25<br />

0.01<br />

0.50<br />

-0.66<br />

-0.55<br />

-0.61<br />

1.19<br />

0.32<br />

-0.62<br />

-0.52<br />

-0.15<br />

-0.79<br />

0.21<br />

-0.96<br />

-0.57<br />

-0.98<br />

-0.23<br />

-0.68<br />

18.51<br />

20.05<br />

22.77<br />

30.78<br />

18.55<br />

23.58<br />

8.81<br />

11.70<br />

5.45<br />

19.21<br />

19.05<br />

23.26<br />

1.95<br />

40.37<br />

16.86<br />

22.28<br />

30.46<br />

19.68<br />

39.18<br />

33.66<br />

17.75<br />

19.18<br />

25.63<br />

18.99<br />

3.02<br />

0.00<br />

4.38<br />

3.00<br />

2.89<br />

0.45<br />

5.03<br />

5.86<br />

4.47<br />

2.78<br />

1.61<br />

1.86<br />

3.26<br />

2.41<br />

3.58<br />

1.69<br />

4.30<br />

3.86<br />

4.77<br />

6.08<br />

1.64<br />

1.58<br />

1.99<br />

2.57<br />

Source: Morningstar. Data as of April 30, 2009. Exp Ratio is expense ratio. 3-Mo is 3-month. YTD is year-<strong>to</strong>-date. Mkt Cap is geometric average market capitalization. P/E is price-<strong>to</strong>-earnings ratio.<br />

Sharpe is Sharpe ratio. Std Dev is 3-year st<strong>and</strong>ard deviation. Yield is 12-month.<br />

www.journalofindexes.com July/August 2009<br />

55