How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

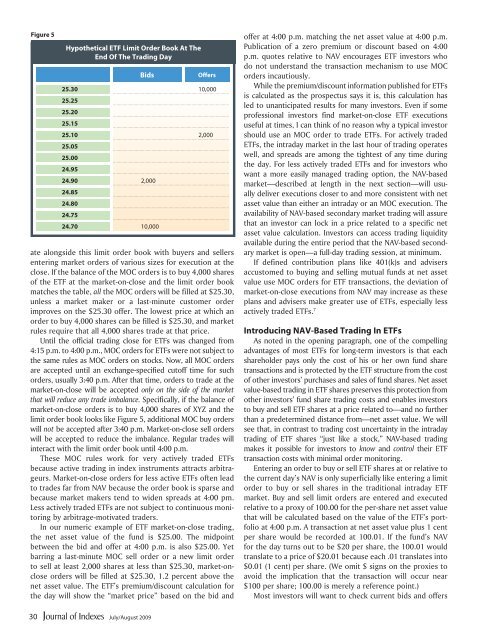

Figure 5<br />

Hypothetical ETF Limit Order Book At The<br />

End Of The Trading Day<br />

Bids<br />

Offers<br />

25.30 10,000<br />

25.25<br />

25.20<br />

25.15<br />

25.10 2,000<br />

25.05<br />

25.00<br />

24.95<br />

24.90 2,000<br />

24.85<br />

24.80<br />

24.75<br />

24.70 10,000<br />

ate alongside this limit order book with buyers <strong>and</strong> sellers<br />

entering market orders of various sizes for execution at the<br />

close. If the balance of the MOC orders is <strong>to</strong> buy 4,000 shares<br />

of the ETF at the market-on-close <strong>and</strong> the limit order book<br />

matches the table, all the MOC orders will be filled at $25.30,<br />

unless a market maker or a last-minute cus<strong>to</strong>mer order<br />

improves on the $25.30 offer. The lowest price at which an<br />

order <strong>to</strong> buy 4,000 shares can be filled is $25.30, <strong>and</strong> market<br />

rules require that all 4,000 shares trade at that price.<br />

Until the official trading close for ETFs was changed from<br />

4:15 p.m. <strong>to</strong> 4:00 p.m., MOC orders for ETFs were not subject <strong>to</strong><br />

the same rules as MOC orders on s<strong>to</strong>cks. Now, all MOC orders<br />

are accepted until an exchange-specified cu<strong>to</strong>ff time for such<br />

orders, usually 3:40 p.m. After that time, orders <strong>to</strong> trade at the<br />

market-on-close will be accepted only on the side of the market<br />

that will reduce any trade imbalance. Specifically, if the balance of<br />

market-on-close orders is <strong>to</strong> buy 4,000 shares of XYZ <strong>and</strong> the<br />

limit order book looks like Figure 5, additional MOC buy orders<br />

will not be accepted after 3:40 p.m. Market-on-close sell orders<br />

will be accepted <strong>to</strong> reduce the imbalance. Regular trades will<br />

interact with the limit order book until 4:00 p.m.<br />

These MOC rules work for very actively traded ETFs<br />

because active trading in index instruments attracts arbitrageurs.<br />

Market-on-close orders for less active ETFs often lead<br />

<strong>to</strong> trades far from NAV because the order book is sparse <strong>and</strong><br />

because market makers tend <strong>to</strong> widen spreads at 4:00 pm.<br />

Less actively traded ETFs are not subject <strong>to</strong> continuous moni<strong>to</strong>ring<br />

by arbitrage-motivated traders.<br />

In our numeric example of ETF market-on-close trading,<br />

the net asset value of the fund is $25.00. The midpoint<br />

between the bid <strong>and</strong> offer at 4:00 p.m. is also $25.00. Yet<br />

barring a last-minute MOC sell order or a new limit order<br />

<strong>to</strong> sell at least 2,000 shares at less than $25.30, market-onclose<br />

orders will be filled at $25.30, 1.2 percent above the<br />

net asset value. The ETF’s premium/discount calculation for<br />

the day will show the “market price” based on the bid <strong>and</strong><br />

offer at 4:00 p.m. matching the net asset value at 4:00 p.m.<br />

Publication of a zero premium or discount based on 4:00<br />

p.m. quotes relative <strong>to</strong> NAV encourages ETF inves<strong>to</strong>rs who<br />

do not underst<strong>and</strong> the transaction mechanism <strong>to</strong> use MOC<br />

orders incautiously.<br />

While the premium/discount information published for ETFs<br />

is calculated as the prospectus says it is, this calculation has<br />

led <strong>to</strong> unanticipated results for many inves<strong>to</strong>rs. Even if some<br />

professional inves<strong>to</strong>rs find market-on-close ETF executions<br />

useful at times, I can think of no reason why a typical inves<strong>to</strong>r<br />

should use an MOC order <strong>to</strong> trade ETFs. For actively traded<br />

ETFs, the intraday market in the last hour of trading operates<br />

well, <strong>and</strong> spreads are among the tightest of any time during<br />

the day. For less actively traded ETFs <strong>and</strong> for inves<strong>to</strong>rs who<br />

want a more easily managed trading option, the NAV-based<br />

market—described at length in the next section—will usually<br />

deliver executions closer <strong>to</strong> <strong>and</strong> more consistent with net<br />

asset value than either an intraday or an MOC execution. The<br />

availability of NAV-based secondary market trading will assure<br />

that an inves<strong>to</strong>r can lock in a price related <strong>to</strong> a specific net<br />

asset value calculation. Inves<strong>to</strong>rs can access trading liquidity<br />

available during the entire period that the NAV-based secondary<br />

market is open—a full-day trading session, at minimum.<br />

If defined contribution plans like 401(k)s <strong>and</strong> advisers<br />

accus<strong>to</strong>med <strong>to</strong> buying <strong>and</strong> selling mutual funds at net asset<br />

value use MOC orders for ETF transactions, the deviation of<br />

market-on-close executions from NAV may increase as these<br />

plans <strong>and</strong> advisers make greater use of ETFs, especially less<br />

actively traded ETFs. 7<br />

Introducing NAV-Based Trading In ETFs<br />

As noted in the opening paragraph, one of the compelling<br />

advantages of most ETFs for long-term inves<strong>to</strong>rs is that each<br />

shareholder pays only the cost of his or her own fund share<br />

transactions <strong>and</strong> is protected by the ETF structure from the cost<br />

of other inves<strong>to</strong>rs’ purchases <strong>and</strong> sales of fund shares. Net asset<br />

value-based trading in ETF shares preserves this protection from<br />

other inves<strong>to</strong>rs’ fund share trading costs <strong>and</strong> enables inves<strong>to</strong>rs<br />

<strong>to</strong> buy <strong>and</strong> sell ETF shares at a price related <strong>to</strong>—<strong>and</strong> no further<br />

than a predetermined distance from—net asset value. We will<br />

see that, in contrast <strong>to</strong> trading cost uncertainty in the intraday<br />

trading of ETF shares “just like a s<strong>to</strong>ck,” NAV-based trading<br />

makes it possible for inves<strong>to</strong>rs <strong>to</strong> know <strong>and</strong> control their ETF<br />

transaction costs with minimal order moni<strong>to</strong>ring.<br />

Entering an order <strong>to</strong> buy or sell ETF shares at or relative <strong>to</strong><br />

the current day’s NAV is only superficially like entering a limit<br />

order <strong>to</strong> buy or sell shares in the traditional intraday ETF<br />

market. Buy <strong>and</strong> sell limit orders are entered <strong>and</strong> executed<br />

relative <strong>to</strong> a proxy of 100.00 for the per-share net asset value<br />

that will be calculated based on the value of the ETF’s portfolio<br />

at 4:00 p.m. A transaction at net asset value plus 1 cent<br />

per share would be recorded at 100.01. If the fund’s NAV<br />

for the day turns out <strong>to</strong> be $20 per share, the 100.01 would<br />

translate <strong>to</strong> a price of $20.01 because each .01 translates in<strong>to</strong><br />

$0.01 (1 cent) per share. (We omit $ signs on the proxies <strong>to</strong><br />

avoid the implication that the transaction will occur near<br />

$100 per share; 100.00 is merely a reference point.)<br />

Most inves<strong>to</strong>rs will want <strong>to</strong> check current bids <strong>and</strong> offers<br />

30<br />

July/August 2009