How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Talking Indexes<br />

Managing The Risks In Ourselves<br />

We simply attempt <strong>to</strong> be fearful when others are<br />

greedy <strong>and</strong> <strong>to</strong> be greedy only when others are<br />

fearful.<br />

—Warren Buffett<br />

By <strong>David</strong> Blitzer<br />

The financial markets turmoil of the last year has<br />

taught, or retaught, all of us a lot about risk <strong>and</strong><br />

risk management. In the halcyon days before<br />

2008, risk management was an occasional activity that<br />

we believed we knew something about. Today we are<br />

serious about it. Further, in the short space of about a<br />

year, we may have learned a little—now we know that<br />

the normal distribution is often abnormal, that “impossible”<br />

events happen <strong>and</strong> that all those uncorrelated<br />

asset classes can sink <strong>to</strong>gether—at exactly the moment<br />

you most need the correlation benefit. Our respect for<br />

market turmoil is much greater <strong>and</strong> our underst<strong>and</strong>ing<br />

of markets, maybe, has increased.<br />

<strong>How</strong>ever, for inves<strong>to</strong>rs, the market <strong>and</strong> its gyrations<br />

are only half the problem—we’re the other half. Or, in the<br />

words of Pogo, 1 “We have met the enemy <strong>and</strong> he is us.”<br />

As shocking <strong>and</strong> dismaying as the housing boom-bust<br />

<strong>and</strong> financial crisis are, they are not unprecedented.<br />

Housing is following the same boom-bust pattern<br />

that markets have experienced for centuries. The oldest<br />

commonly cited cycle is the Dutch tulip bulbs in<br />

1637, as chronicled by Charles MacKay. 2 A more recent<br />

analysis is provided by Charles Kindleberger in “Mania,<br />

Panics, <strong>and</strong> Crashes.” 3 Kindleberger recounts a number<br />

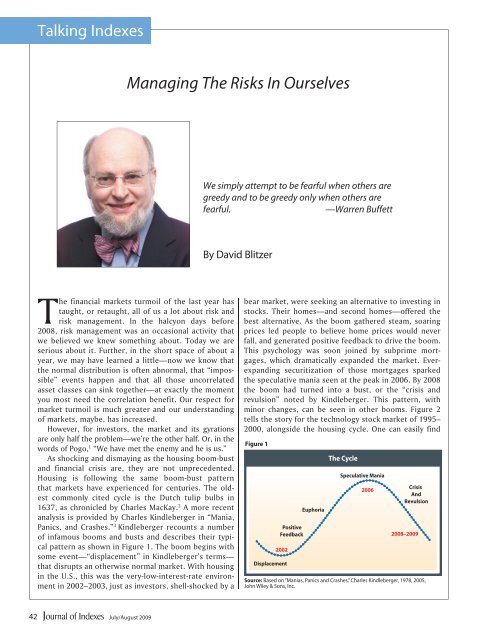

of infamous booms <strong>and</strong> busts <strong>and</strong> describes their typical<br />

pattern as shown in Figure 1. The boom begins with<br />

some event—“displacement” in Kindleberger’s terms—<br />

that disrupts an otherwise normal market. With housing<br />

in the U.S., this was the very-low-interest-rate environment<br />

in 2002–2003, just as inves<strong>to</strong>rs, shell-shocked by a<br />

bear market, were seeking an alternative <strong>to</strong> investing in<br />

s<strong>to</strong>cks. Their homes—<strong>and</strong> second homes—offered the<br />

best alternative. As the boom gathered steam, soaring<br />

prices led people <strong>to</strong> believe home prices would never<br />

fall, <strong>and</strong> generated positive feedback <strong>to</strong> drive the boom.<br />

This psychology was soon joined by subprime mortgages,<br />

which dramatically exp<strong>and</strong>ed the market. Everexp<strong>and</strong>ing<br />

securitization of those mortgages sparked<br />

the speculative mania seen at the peak in 2006. By 2008<br />

the boom had turned in<strong>to</strong> a bust, or the “crisis <strong>and</strong><br />

revulsion” noted by Kindleberger. This pattern, with<br />

minor changes, can be seen in other booms. Figure 2<br />

tells the s<strong>to</strong>ry for the technology s<strong>to</strong>ck market of 1995–<br />

2000, alongside the housing cycle. One can easily find<br />

Figure 1<br />

2002<br />

Displacement<br />

Positive<br />

Feedback<br />

Euphoria<br />

The Cycle<br />

Speculative Mania<br />

2006<br />

Crisis<br />

And<br />

Revulsion<br />

2008–2009<br />

Source: Based on “Manias, Panics <strong>and</strong> Crashes,” Charles Kindleberger, 1978, 2005,<br />

John Wiley & Sons, Inc.<br />

42<br />

July/August 2009