How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Portable alpha approaches—which essentially involve<br />

seeking beta from one asset class <strong>and</strong> alpha from<br />

another—have fallen under a cloud, as have many other<br />

investment strategies, in the wake of the recent market turmoil.<br />

<strong>How</strong>ever, they can yield potentially powerful results<br />

for inves<strong>to</strong>rs both in terms of risk-adjusted excess return <strong>and</strong><br />

diversification benefits, which explains, at least in part, the<br />

heightened interest in portable alpha following the equity<br />

market sell-off in 2000–2002. Traditional s<strong>to</strong>ck <strong>and</strong> bond<br />

investment return expectations were relatively low, <strong>and</strong><br />

inves<strong>to</strong>rs were concerned about meeting return targets that<br />

were in many cases in the 7–10 percent range. As a result,<br />

inves<strong>to</strong>rs as a group were more open <strong>to</strong> new investment categories<br />

<strong>and</strong> approaches, including those that employ the use<br />

of derivatives <strong>and</strong> leverage, like portable alpha.<br />

At the time, portable alpha <strong>and</strong> related concepts were<br />

<strong>to</strong>uted as a new paradigm in investment management, <strong>and</strong><br />

even the holy grail of investing. The variety of different<br />

approaches <strong>to</strong> porting alpha <strong>and</strong> the number of providers of<br />

related products ballooned, as did the conferences dedicated<br />

<strong>to</strong> the <strong>to</strong>pic. Generally speaking, inves<strong>to</strong>rs seemed happy<br />

with the results. Of course, most of the newer approaches <strong>to</strong><br />

portable alpha were implemented in the low- <strong>and</strong> decliningvolatility<br />

environment that ended in 2007, with risk premiums<br />

initially rising <strong>to</strong> levels closer <strong>to</strong> his<strong>to</strong>rical averages<br />

before spiking <strong>to</strong> new highs this past fall.<br />

Unfortunately for some inves<strong>to</strong>rs, successful portable<br />

alpha implementation has proven <strong>to</strong> be much more complicated<br />

in practice than it may sound in theory. Portable-alpharelated<br />

losses experienced by some have been highlighted in<br />

the public domain, likely causing some inves<strong>to</strong>rs <strong>to</strong> question<br />

the merit of the entire concept.<br />

What does the future hold for portable alpha? The fundamental<br />

concepts that provide the basis for the viability<br />

<strong>and</strong> benefits of portable alpha for long-term inves<strong>to</strong>rs are<br />

very much alive <strong>and</strong> well. There have been important lessons<br />

learned, though. As a result, we are likely <strong>to</strong> see a bifurcation<br />

of the marketplace where portable alpha approaches that<br />

share certain important characteristics are likely <strong>to</strong> survive<br />

<strong>and</strong> even thrive, while others may disappear. In particular,<br />

we believe approaches that capitalize on the attractive risk<br />

premiums available in the high-quality, relatively liquid fixedincome<br />

arena merit serious consideration by inves<strong>to</strong>rs.<br />

Portable Alpha, Defined<br />

Not surprisingly given the wide variety of approaches<br />

employed, the definitions of the term “portable alpha” vary<br />

depending on who you ask. So far as we are aware, though, all<br />

strategies that fall under the portable alpha umbrella involve<br />

the use of derivatives (or a similar borrowing arrangement)<br />

<strong>to</strong> obtain the desired asset class or market index exposure,<br />

typically referred <strong>to</strong> as “beta,” thereby allowing risk-adjusted<br />

excess returns or “alpha” <strong>to</strong> be sourced from an entirely distinct<br />

asset class or active management strategy. Central <strong>to</strong><br />

the idea <strong>and</strong> also the potential value of portable alpha are the<br />

concepts of borrowing <strong>to</strong> achieve higher returns, <strong>and</strong> diversification<br />

as a means <strong>to</strong> increase the return per unit of risk. Sound<br />

familiar? These are also two of the key concepts that underlie<br />

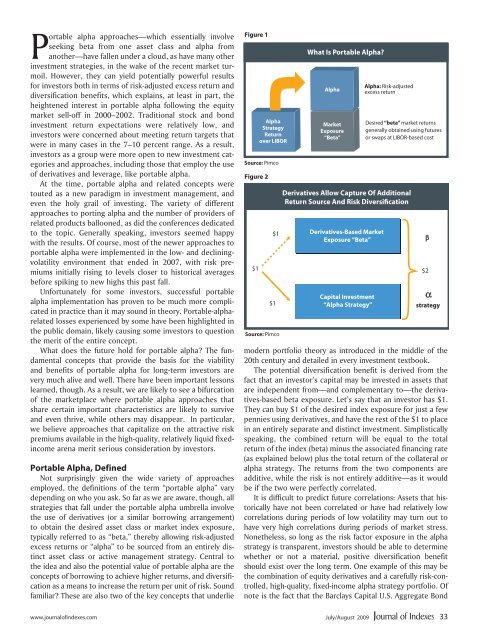

Figure 1<br />

Alpha<br />

Strategy<br />

Return<br />

over LIBOR<br />

Source: Pimco<br />

Figure 2<br />

$1<br />

$1<br />

$1<br />

Source: Pimco<br />

What Is Portable Alpha?<br />

Alpha<br />

Market<br />

Exposure<br />

“Beta”<br />

Derivatives-Based Market<br />

Exposure “Beta”<br />

Capital Investment<br />

C<br />

“Alpha Strategy”<br />

Alpha: Risk-adjusted<br />

excess return<br />

Desired “beta” market returns<br />

generally obtained using futures<br />

or swaps at LIBOR-based cost<br />

Derivatives Allow Capture Of Additional<br />

Return Source And Risk Diversification<br />

strategy<br />

modern portfolio theory as introduced in the middle of the<br />

20th century <strong>and</strong> detailed in every investment textbook.<br />

The potential diversification benefit is derived from the<br />

fact that an inves<strong>to</strong>r’s capital may be invested in assets that<br />

are independent from—<strong>and</strong> complementary <strong>to</strong>—the derivatives-based<br />

beta exposure. Let’s say that an inves<strong>to</strong>r has $1.<br />

They can buy $1 of the desired index exposure for just a few<br />

pennies using derivatives, <strong>and</strong> have the rest of the $1 <strong>to</strong> place<br />

in an entirely separate <strong>and</strong> distinct investment. Simplistically<br />

speaking, the combined return will be equal <strong>to</strong> the <strong>to</strong>tal<br />

return of the index (beta) minus the associated financing rate<br />

(as explained below) plus the <strong>to</strong>tal return of the collateral or<br />

alpha strategy. The returns from the two components are<br />

additive, while the risk is not entirely additive—as it would<br />

be if the two were perfectly correlated.<br />

It is difficult <strong>to</strong> predict future correlations: Assets that his<strong>to</strong>rically<br />

have not been correlated or have had relatively low<br />

correlations during periods of low volatility may turn out <strong>to</strong><br />

have very high correlations during periods of market stress.<br />

Nonetheless, so long as the risk fac<strong>to</strong>r exposure in the alpha<br />

strategy is transparent, inves<strong>to</strong>rs should be able <strong>to</strong> determine<br />

whether or not a material, positive diversification benefit<br />

should exist over the long term. One example of this may be<br />

the combination of equity derivatives <strong>and</strong> a carefully risk-controlled,<br />

high-quality, fixed-income alpha strategy portfolio. Of<br />

note is the fact that the Barclays Capital U.S. Aggregate Bond<br />

$2<br />

www.journalofindexes.com July/August 2009<br />

33