How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

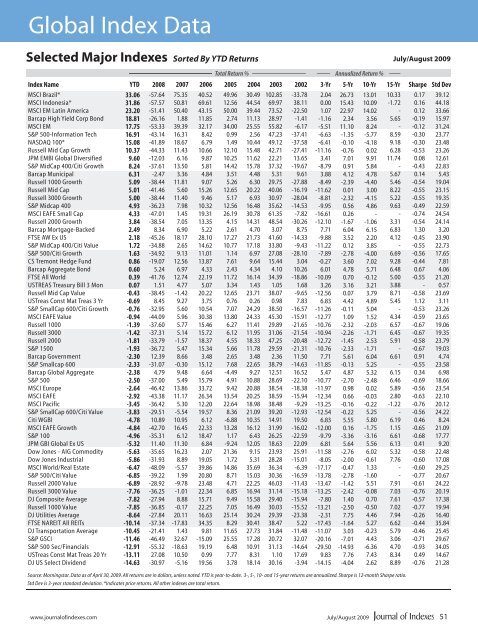

Global Index Data<br />

Selected Major Indexes Sorted By YTD Returns July/August 2009<br />

Total Return % Annualized Return %<br />

Index Name YTD 2008 2007 2006 2005 2004 2003 2002 3-Yr 5-Yr 10-Yr 15-Yr<br />

MSCI Brazil*<br />

MSCI Indonesia*<br />

MSCI EM Latin America<br />

Barcap High Yield Corp Bond<br />

MSCI EM<br />

S&P 500-Information Tech<br />

NASDAQ 100*<br />

Russell Mid Cap Growth<br />

JPM EMBI Global Diversified<br />

S&P MidCap 400/Citi Growth<br />

Barcap Municipal<br />

Russell 1000 Growth<br />

Russell Mid Cap<br />

Russell 3000 Growth<br />

S&P Midcap 400<br />

MSCI EAFE Small Cap<br />

Russell 2000 Growth<br />

Barcap Mortgage-Backed<br />

FTSE AW Ex US<br />

S&P MidCap 400/Citi Value<br />

S&P 500/Citi Growth<br />

CS Tremont Hedge Fund<br />

Barcap Aggregate Bond<br />

FTSE All World<br />

USTREAS Treasury Bill 3 Mon<br />

Russell Mid Cap Value<br />

USTreas Const Mat Treas 3 Yr<br />

S&P SmallCap 600/Citi Growth<br />

MSCI EAFE Value<br />

Russell 1000<br />

Russell 3000<br />

Russell 2000<br />

S&P 1500<br />

Barcap Government<br />

S&P Smallcap 600<br />

Barcap Global Aggregate<br />

S&P 500<br />

MSCI Europe<br />

MSCI EAFE<br />

MSCI Pacific<br />

S&P SmallCap 600/Citi Value<br />

Citi WGBI<br />

MSCI EAFE Growth<br />

S&P 100<br />

JPM GBI Global Ex US<br />

Dow Jones - AIG Commodity<br />

Dow Jones Industrial<br />

MSCI World/Real Estate<br />

S&P 500/Citi Value<br />

Russell 2000 Value<br />

Russell 3000 Value<br />

DJ Composite Average<br />

Russell 1000 Value<br />

DJ Utilities Average<br />

FTSE NAREIT All REITs<br />

DJ Transportation Average<br />

S&P GSCI<br />

S&P 500 Sec/Financials<br />

USTreas Const Mat Treas 20 Yr<br />

DJ US Select Dividend<br />

33.06<br />

31.86<br />

23.20<br />

18.81<br />

17.75<br />

16.91<br />

15.08<br />

10.37<br />

9.60<br />

8.24<br />

6.31<br />

5.09<br />

5.01<br />

5.00<br />

4.93<br />

4.33<br />

3.84<br />

2.49<br />

2.18<br />

1.72<br />

1.63<br />

0.86<br />

0.60<br />

0.39<br />

0.07<br />

-0.43<br />

-0.69<br />

-0.76<br />

-0.94<br />

-1.39<br />

-1.42<br />

-1.81<br />

-1.93<br />

-2.30<br />

-2.33<br />

-2.38<br />

-2.50<br />

-2.64<br />

-2.92<br />

-3.45<br />

-3.83<br />

-4.78<br />

-4.84<br />

-4.96<br />

-5.32<br />

-5.63<br />

-5.86<br />

-6.47<br />

-6.85<br />

-6.89<br />

-7.76<br />

-7.82<br />

-7.85<br />

-8.64<br />

-10.14<br />

-10.45<br />

-11.46<br />

-12.91<br />

-13.11<br />

-14.63<br />

-57.64<br />

-57.57<br />

-51.41<br />

-26.16<br />

-53.33<br />

-43.14<br />

-41.89<br />

-44.33<br />

-12.03<br />

-37.61<br />

-2.47<br />

-38.44<br />

-41.46<br />

-38.44<br />

-36.23<br />

-47.01<br />

-38.54<br />

8.34<br />

-45.26<br />

-34.88<br />

-34.92<br />

-19.07<br />

5.24<br />

-41.76<br />

1.51<br />

-38.45<br />

8.45<br />

-32.95<br />

-44.09<br />

-37.60<br />

-37.31<br />

-33.79<br />

-36.72<br />

12.39<br />

-31.07<br />

4.79<br />

-37.00<br />

-46.42<br />

-43.38<br />

-36.42<br />

-29.51<br />

10.89<br />

-42.70<br />

-35.31<br />

11.40<br />

-35.65<br />

-31.93<br />

-48.09<br />

-39.22<br />

-28.92<br />

-36.25<br />

-27.94<br />

-36.85<br />

-27.84<br />

-37.34<br />

-21.41<br />

-46.49<br />

-55.32<br />

27.08<br />

-30.97<br />

75.35<br />

50.81<br />

50.40<br />

1.88<br />

39.39<br />

16.31<br />

18.67<br />

11.43<br />

6.16<br />

13.50<br />

3.36<br />

11.81<br />

5.60<br />

11.40<br />

7.98<br />

1.45<br />

7.05<br />

6.90<br />

18.17<br />

2.65<br />

9.13<br />

12.56<br />

6.97<br />

12.74<br />

4.77<br />

-1.42<br />

9.27<br />

5.60<br />

5.96<br />

5.77<br />

5.14<br />

-1.57<br />

5.47<br />

8.66<br />

-0.30<br />

9.48<br />

5.49<br />

13.86<br />

11.17<br />

5.30<br />

-5.54<br />

10.95<br />

16.45<br />

6.12<br />

11.30<br />

16.23<br />

8.89<br />

-5.57<br />

1.99<br />

-9.78<br />

-1.01<br />

8.88<br />

-0.17<br />

20.11<br />

-17.83<br />

1.43<br />

32.67<br />

-18.63<br />

10.50<br />

-5.16<br />

40.52<br />

69.61<br />

43.15<br />

11.85<br />

32.17<br />

8.42<br />

6.79<br />

10.66<br />

9.87<br />

5.81<br />

4.84<br />

9.07<br />

15.26<br />

9.46<br />

10.32<br />

19.31<br />

13.35<br />

5.22<br />

28.10<br />

14.62<br />

11.01<br />

13.87<br />

4.33<br />

22.19<br />

5.07<br />

20.22<br />

3.75<br />

10.54<br />

30.38<br />

15.46<br />

15.72<br />

18.37<br />

15.34<br />

3.48<br />

15.12<br />

6.64<br />

15.79<br />

33.72<br />

26.34<br />

12.20<br />

19.57<br />

6.12<br />

22.33<br />

18.47<br />

6.84<br />

2.07<br />

19.05<br />

39.86<br />

20.80<br />

23.48<br />

22.34<br />

15.71<br />

22.25<br />

16.63<br />

34.35<br />

9.81<br />

-15.09<br />

19.19<br />

0.99<br />

19.56<br />

49.96<br />

12.56<br />

50.00<br />

2.74<br />

34.00<br />

0.99<br />

1.49<br />

12.10<br />

10.25<br />

14.42<br />

3.51<br />

5.26<br />

12.65<br />

5.17<br />

12.56<br />

26.19<br />

4.15<br />

2.61<br />

17.27<br />

10.77<br />

1.14<br />

7.61<br />

2.43<br />

11.72<br />

3.34<br />

12.65<br />

0.76<br />

7.07<br />

13.80<br />

6.27<br />

6.12<br />

4.55<br />

5.66<br />

2.65<br />

7.68<br />

-4.49<br />

4.91<br />

9.42<br />

13.54<br />

22.64<br />

8.36<br />

-6.88<br />

13.28<br />

1.17<br />

-9.24<br />

21.36<br />

1.72<br />

14.86<br />

8.71<br />

4.71<br />

6.85<br />

9.49<br />

7.05<br />

25.14<br />

8.29<br />

11.65<br />

25.55<br />

6.48<br />

7.77<br />

3.78<br />

30.49<br />

44.54<br />

39.44<br />

11.13<br />

25.55<br />

2.56<br />

10.44<br />

15.48<br />

11.62<br />

15.78<br />

4.48<br />

6.30<br />

20.22<br />

6.93<br />

16.48<br />

30.78<br />

14.31<br />

4.70<br />

21.73<br />

17.18<br />

6.97<br />

9.64<br />

4.34<br />

16.14<br />

1.43<br />

23.71<br />

0.26<br />

24.29<br />

24.33<br />

11.41<br />

11.95<br />

18.33<br />

11.78<br />

3.48<br />

22.65<br />

9.27<br />

10.88<br />

20.88<br />

20.25<br />

18.98<br />

21.09<br />

10.35<br />

16.12<br />

6.43<br />

12.05<br />

9.15<br />

5.31<br />

35.69<br />

15.03<br />

22.25<br />

16.94<br />

15.58<br />

16.49<br />

30.24<br />

30.41<br />

27.73<br />

17.28<br />

10.91<br />

8.31<br />

18.14<br />

102.85<br />

69.97<br />

73.52<br />

28.97<br />

55.82<br />

47.23<br />

49.12<br />

42.71<br />

22.21<br />

37.32<br />

5.31<br />

29.75<br />

40.06<br />

30.97<br />

35.62<br />

61.35<br />

48.54<br />

3.07<br />

41.60<br />

33.80<br />

27.08<br />

15.44<br />

4.10<br />

34.39<br />

1.05<br />

38.07<br />

0.98<br />

38.50<br />

45.30<br />

29.89<br />

31.06<br />

47.25<br />

29.59<br />

2.36<br />

38.79<br />

12.51<br />

28.69<br />

38.54<br />

38.59<br />

38.48<br />

39.20<br />

14.91<br />

31.99<br />

26.25<br />

18.63<br />

23.93<br />

28.28<br />

36.34<br />

30.36<br />

46.03<br />

31.14<br />

29.40<br />

30.03<br />

29.39<br />

38.47<br />

31.84<br />

20.72<br />

31.13<br />

1.10<br />

30.16<br />

-33.78<br />

38.11<br />

-22.50<br />

-1.41<br />

-6.17<br />

-37.41<br />

-37.58<br />

-27.41<br />

13.65<br />

-19.67<br />

9.61<br />

-27.88<br />

-16.19<br />

-28.04<br />

-14.53<br />

-7.82<br />

-30.26<br />

8.75<br />

-14.33<br />

-9.43<br />

-28.10<br />

3.04<br />

10.26<br />

-18.86<br />

1.68<br />

-9.65<br />

7.83<br />

-16.57<br />

-15.91<br />

-21.65<br />

-21.54<br />

-20.48<br />

-21.31<br />

11.50<br />

-14.63<br />

16.52<br />

-22.10<br />

-18.38<br />

-15.94<br />

-9.29<br />

-12.93<br />

19.50<br />

-16.02<br />

-22.59<br />

22.09<br />

25.91<br />

-15.01<br />

-6.39<br />

-16.59<br />

-11.43<br />

-15.18<br />

-15.94<br />

-15.52<br />

-23.38<br />

5.22<br />

-11.48<br />

32.07<br />

-14.64<br />

17.69<br />

-3.94<br />

2.04<br />

0.00<br />

1.07<br />

-1.16<br />

-5.51<br />

-6.63<br />

-6.41<br />

-11.16<br />

3.41<br />

-8.79<br />

3.88<br />

-8.49<br />

-11.62<br />

-8.81<br />

-9.95<br />

-16.61<br />

-12.10<br />

7.71<br />

-9.88<br />

-11.22<br />

-7.89<br />

-0.27<br />

6.01<br />

-10.09<br />

3.26<br />

-12.56<br />

6.83<br />

-11.26<br />

-12.77<br />

-10.76<br />

-10.94<br />

-12.72<br />

-10.76<br />

7.71<br />

-11.85<br />

5.47<br />

-10.77<br />

-11.97<br />

-12.34<br />

-13.25<br />

-12.54<br />

6.83<br />

-12.00<br />

-9.79<br />

6.81<br />

-11.58<br />

-8.05<br />

-17.17<br />

-13.78<br />

-13.47<br />

-13.25<br />

-7.80<br />

-13.21<br />

-2.31<br />

-17.43<br />

-11.07<br />

-20.16<br />

-29.50<br />

9.83<br />

-14.15<br />

26.73<br />

15.43<br />

22.97<br />

2.34<br />

11.10<br />

-1.35<br />

-0.10<br />

-0.76<br />

7.01<br />

0.91<br />

4.12<br />

-2.39<br />

0.01<br />

-2.32<br />

0.56<br />

0.26<br />

-1.67<br />

6.04<br />

3.52<br />

0.12<br />

-2.78<br />

3.60<br />

4.78<br />

0.70<br />

3.16<br />

0.07<br />

4.42<br />

-0.11<br />

1.09<br />

-2.32<br />

-2.26<br />

-1.45<br />

-2.33<br />

5.61<br />

-0.13<br />

4.87<br />

-2.70<br />

0.98<br />

0.66<br />

-0.16<br />

-0.22<br />

5.55<br />

0.16<br />

-3.36<br />

5.64<br />

-2.76<br />

-2.00<br />

-0.47<br />

-2.78<br />

-1.42<br />

-2.42<br />

1.40<br />

-2.50<br />

7.75<br />

-1.64<br />

3.03<br />

-7.01<br />

-14.93<br />

7.76<br />

-4.04<br />

13.01<br />

10.09<br />

14.02<br />

3.56<br />

8.24<br />

-5.77<br />

-4.18<br />

0.02<br />

9.91<br />

5.84<br />

4.78<br />

-4.40<br />

3.00<br />

-4.15<br />

4.86<br />

-<br />

-1.06<br />

6.15<br />

2.20<br />

3.85<br />

-4.00<br />

7.02<br />

5.71<br />

-0.12<br />

3.21<br />

3.79<br />

4.89<br />

5.04<br />

1.52<br />

-2.03<br />

-1.71<br />

2.53<br />

-1.71<br />

6.04<br />

5.25<br />

5.32<br />

-2.48<br />

0.02<br />

-0.03<br />

-0.22<br />

5.25<br />

5.80<br />

-1.75<br />

-3.16<br />

5.56<br />

6.02<br />

-0.61<br />

1.33<br />

-1.60<br />

5.51<br />

-0.08<br />

0.70<br />

-0.50<br />

4.46<br />

5.27<br />

-0.23<br />

4.43<br />

-6.36<br />

7.43<br />

2.62<br />

10.33<br />

-1.72<br />

-<br />

5.65<br />

-<br />

8.59<br />

9.18<br />

6.28<br />

11.74<br />

-<br />

5.67<br />

5.46<br />

8.22<br />

5.22<br />

9.63<br />

-<br />

3.31<br />

6.83<br />

4.12<br />

-<br />

6.69<br />

9.28<br />

6.48<br />

5.00<br />

3.88<br />

8.71<br />

5.45<br />

-<br />

4.34<br />

6.57<br />

6.45<br />

5.91<br />

-<br />

6.61<br />

-<br />

6.15<br />

6.46<br />

5.89<br />

2.80<br />

-1.22<br />

-<br />

6.19<br />

1.15<br />

6.61<br />

6.13<br />

5.32<br />

7.76<br />

-<br />

-<br />

7.91<br />

7.03<br />

7.61<br />

7.02<br />

7.94<br />

6.62<br />

5.79<br />

3.06<br />

4.70<br />

8.34<br />

8.89<br />

Source: Morningstar. Data as of April 30, 2009. All returns are in dollars, unless noted. YTD is year-<strong>to</strong>-date. 3-, 5-, 10- <strong>and</strong> 15-year returns are annualized. Sharpe is 12-month Sharpe ratio.<br />

Std Dev is 3-year st<strong>and</strong>ard deviation. *Indicates price returns. All other indexes are <strong>to</strong>tal return.<br />

Sharpe<br />

0.17<br />

0.16<br />

0.12<br />

-0.19<br />

-0.12<br />

-0.30<br />

-0.30<br />

-0.53<br />

0.08<br />

-0.43<br />

0.14<br />

-0.54<br />

-0.55<br />

-0.55<br />

-0.49<br />

-0.74<br />

-0.54<br />

1.30<br />

-0.45<br />

-0.55<br />

-0.56<br />

-0.44<br />

0.67<br />

-0.55<br />

-<br />

-0.58<br />

1.12<br />

-0.53<br />

-0.59<br />

-0.67<br />

-0.67<br />

-0.58<br />

-0.67<br />

0.91<br />

-0.55<br />

0.34<br />

-0.69<br />

-0.56<br />

-0.63<br />

-0.76<br />

-0.56<br />

0.46<br />

-0.65<br />

-0.68<br />

0.41<br />

-0.58<br />

-0.60<br />

-0.60<br />

-0.77<br />

-0.61<br />

-0.76<br />

-0.57<br />

-0.77<br />

-0.26<br />

-0.44<br />

-0.46<br />

-0.71<br />

-0.93<br />

0.49<br />

-0.76<br />

Std Dev<br />

39.12<br />

44.18<br />

33.66<br />

15.97<br />

31.24<br />

23.77<br />

23.48<br />

23.26<br />

12.61<br />

22.83<br />

5.43<br />

19.04<br />

23.15<br />

19.35<br />

22.59<br />

24.54<br />

24.14<br />

3.20<br />

23.90<br />

22.73<br />

17.65<br />

7.81<br />

4.06<br />

21.20<br />

0.57<br />

23.69<br />

3.11<br />

23.26<br />

23.65<br />

19.06<br />

19.35<br />

23.79<br />

19.03<br />

4.74<br />

23.58<br />

6.98<br />

18.66<br />

23.54<br />

22.10<br />

20.12<br />

24.22<br />

8.24<br />

21.09<br />

17.77<br />

9.20<br />

22.48<br />

17.08<br />

29.25<br />

20.67<br />

24.22<br />

20.19<br />

17.38<br />

19.94<br />

16.40<br />

35.84<br />

25.45<br />

29.67<br />

34.05<br />

14.67<br />

21.28<br />

www.journalofindexes.com July/August 2009<br />

51