How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

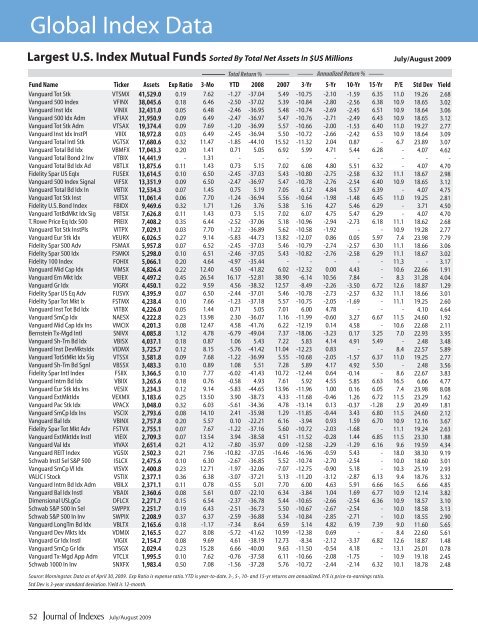

Global Index Data<br />

Largest U.S. Index Mutual Funds Sorted By Total Net Assets In $US Millions July/August 2009<br />

Fund Name Ticker Assets Exp Ratio 3-Mo YTD<br />

Vanguard Tot Stk<br />

Vanguard 500 Index<br />

Vanguard Inst Idx<br />

Vanguard 500 Idx Adm<br />

Vanguard Tot Stk Adm<br />

Vanguard Inst Idx InstPl<br />

Vanguard Total Intl Stk<br />

Vanguard Total Bd Idx<br />

Vanguard Total Bond 2 Inv<br />

Vanguard Total Bd Idx Ad<br />

Fidelity Spar US EqIx<br />

Vanguard 500 Index Signal<br />

Vanguard Total Bd Idx In<br />

Vanguard Tot Stk Inst<br />

Fidelity U.S. Bond Index<br />

Vanguard TotBdMkt Idx Sig<br />

T. Rowe Price Eq Idx 500<br />

Vanguard Tot Stk InstPls<br />

Vanguard Eur Stk Idx<br />

Fidelity Spar 500 Adv<br />

Fidelity Spar 500 Idx<br />

Fidelity 100 Index<br />

Vanguard Mid Cap Idx<br />

Vanguard Em Mkt Idx<br />

Vanguard Gr Idx<br />

Fidelity Spar US Eq Adv<br />

Fidelity Spar Tot Mkt Ix<br />

Vanguard Inst Tot Bd Idx<br />

Vanguard SmCp Idx<br />

Vanguard Mid Cap Idx Ins<br />

Bernstein Tx-Mgd Intl<br />

Vanguard Sh-Tm Bd Idx<br />

Vanguard Inst DevMktsIdx<br />

Vanguard TotStMkt Idx Sig<br />

Vanguard Sh-Tm Bd Sgnl<br />

Fidelity Spar Intl Index<br />

Vanguard Intm Bd Idx<br />

Vanguard Eur Stk Idx Ins<br />

Vanguard ExtMktIdx<br />

Vanguard Pac Stk Idx<br />

Vanguard SmCp Idx Ins<br />

Vanguard Bal Idx<br />

Fidelity Spar Tot Mkt Adv<br />

Vanguard ExtMktIdx Instl<br />

Vanguard Val Idx<br />

Vanguard REIT Index<br />

Schwab Instl Sel S&P 500<br />

Vanguard SmCp Vl Idx<br />

VALIC I S<strong>to</strong>ck<br />

Vanguard Intm Bd Idx Adm<br />

Vanguard Bal Idx Instl<br />

Dimensional USLgCo<br />

Schwab S&P 500 In Sel<br />

Schwab S&P 500 In Inv<br />

Vanguard LongTm Bd Idx<br />

Vanguard Dev Mkts Idx<br />

Vanguard Gr Idx Instl<br />

Vanguard SmCp Gr Idx<br />

Vanguard Tx-Mgd App Adm<br />

Schwab 1000 In Inv<br />

VTSMX<br />

VFINX<br />

VINIX<br />

VFIAX<br />

VTSAX<br />

VIIIX<br />

VGTSX<br />

VBMFX<br />

VTBIX<br />

VBTLX<br />

FUSEX<br />

VIFSX<br />

VBTIX<br />

VITSX<br />

FBIDX<br />

VBTSX<br />

PREIX<br />

VITPX<br />

VEURX<br />

FSMAX<br />

FSMKX<br />

FOHIX<br />

VIMSX<br />

VEIEX<br />

VIGRX<br />

FUSVX<br />

FSTMX<br />

VITBX<br />

NAESX<br />

VMCIX<br />

SNIVX<br />

VBISX<br />

VIDMX<br />

VTSSX<br />

VBSSX<br />

FSIIX<br />

VBIIX<br />

VESIX<br />

VEXMX<br />

VPACX<br />

VSCIX<br />

VBINX<br />

FSTVX<br />

VIEIX<br />

VIVAX<br />

VGSIX<br />

ISLCX<br />

VISVX<br />

VSTIX<br />

VBILX<br />

VBAIX<br />

DFLCX<br />

SWPPX<br />

SWPIX<br />

VBLTX<br />

VDMIX<br />

VIGIX<br />

VISGX<br />

VTCLX<br />

SNXFX<br />

41,529.0<br />

38,045.6<br />

32,431.0<br />

21,950.9<br />

19,374.4<br />

18,972.8<br />

17,680.6<br />

17,043.3<br />

14,441.9<br />

13,875.6<br />

13,614.5<br />

13,351.9<br />

12,534.3<br />

11,061.4<br />

9,469.6<br />

7,626.8<br />

7,408.2<br />

7,029.1<br />

6,026.5<br />

5,957.8<br />

5,298.0<br />

5,066.1<br />

4,826.4<br />

4,497.2<br />

4,450.1<br />

4,395.9<br />

4,238.4<br />

4,226.0<br />

4,222.8<br />

4,201.3<br />

4,085.8<br />

4,037.1<br />

3,725.7<br />

3,581.8<br />

3,483.3<br />

3,366.5<br />

3,265.6<br />

3,234.3<br />

3,183.6<br />

3,048.0<br />

2,793.6<br />

2,757.8<br />

2,755.1<br />

2,709.3<br />

2,651.4<br />

2,502.3<br />

2,475.6<br />

2,400.8<br />

2,377.1<br />

2,371.1<br />

2,360.6<br />

2,271.7<br />

2,251.7<br />

2,208.9<br />

2,165.6<br />

2,165.5<br />

2,154.7<br />

2,029.4<br />

1,995.5<br />

1,983.4<br />

0.19<br />

0.18<br />

0.05<br />

0.09<br />

0.09<br />

0.03<br />

0.32<br />

0.20<br />

-<br />

0.11<br />

0.10<br />

0.09<br />

0.07<br />

0.06<br />

0.32<br />

0.11<br />

0.35<br />

0.03<br />

0.27<br />

0.07<br />

0.10<br />

0.20<br />

0.22<br />

0.45<br />

0.22<br />

0.07<br />

0.10<br />

0.05<br />

0.23<br />

0.08<br />

1.12<br />

0.18<br />

0.12<br />

0.09<br />

0.10<br />

0.10<br />

0.18<br />

0.12<br />

0.25<br />

0.32<br />

0.08<br />

0.20<br />

0.07<br />

0.07<br />

0.21<br />

0.21<br />

0.10<br />

0.23<br />

0.36<br />

0.11<br />

0.08<br />

0.15<br />

0.19<br />

0.37<br />

0.18<br />

0.27<br />

0.08<br />

0.23<br />

0.10<br />

0.50<br />

7.62<br />

6.46<br />

6.48<br />

6.49<br />

7.69<br />

6.49<br />

11.47<br />

1.41<br />

1.31<br />

1.43<br />

6.50<br />

6.50<br />

1.45<br />

7.70<br />

1.71<br />

1.43<br />

6.44<br />

7.70<br />

9.14<br />

6.52<br />

6.51<br />

4.64<br />

12.40<br />

26.54<br />

9.59<br />

6.50<br />

7.66<br />

1.44<br />

13.98<br />

12.47<br />

4.78<br />

0.87<br />

8.15<br />

7.68<br />

0.89<br />

7.77<br />

0.76<br />

9.14<br />

13.50<br />

6.03<br />

14.10<br />

5.57<br />

7.67<br />

13.54<br />

4.12<br />

7.96<br />

6.30<br />

12.71<br />

6.38<br />

0.78<br />

5.61<br />

6.54<br />

6.43<br />

6.37<br />

-1.17<br />

8.08<br />

9.69<br />

15.28<br />

7.62<br />

7.08<br />

-1.27<br />

-2.50<br />

-2.46<br />

-2.47<br />

-1.20<br />

-2.45<br />

-1.85<br />

0.71<br />

-<br />

0.73<br />

-2.45<br />

-2.47<br />

0.75<br />

-1.24<br />

1.26<br />

0.73<br />

-2.52<br />

-1.22<br />

-5.83<br />

-2.45<br />

-2.46<br />

-4.97<br />

4.50<br />

16.17<br />

4.56<br />

-2.44<br />

-1.23<br />

0.71<br />

2.30<br />

4.58<br />

-6.79<br />

1.06<br />

-5.76<br />

-1.22<br />

1.08<br />

-6.02<br />

-0.58<br />

-5.83<br />

3.90<br />

-5.61<br />

2.41<br />

0.10<br />

-1.22<br />

3.94<br />

-7.80<br />

-10.82<br />

-2.67<br />

-1.97<br />

-3.07<br />

-0.55<br />

0.07<br />

-2.37<br />

-2.51<br />

-2.59<br />

-7.34<br />

-5.72<br />

4.61<br />

6.66<br />

-0.76<br />

-1.56<br />

Total Return % Annualized Return %<br />

2008 2007 3-Yr<br />

-37.04<br />

-37.02<br />

-36.95<br />

-36.97<br />

-36.99<br />

-36.94<br />

-44.10<br />

5.05<br />

-<br />

5.15<br />

-37.03<br />

-36.97<br />

5.19<br />

-36.94<br />

3.76<br />

5.15<br />

-37.06<br />

-36.89<br />

-44.73<br />

-37.03<br />

-37.05<br />

-35.44<br />

-41.82<br />

-52.81<br />

-38.32<br />

-37.01<br />

-37.18<br />

5.05<br />

-36.07<br />

-41.76<br />

-49.04<br />

5.43<br />

-41.42<br />

-36.99<br />

5.51<br />

-41.43<br />

4.93<br />

-44.65<br />

-38.73<br />

-34.36<br />

-35.98<br />

-22.21<br />

-37.16<br />

-38.58<br />

-35.97<br />

-37.05<br />

-36.85<br />

-32.06<br />

-37.21<br />

5.01<br />

-22.10<br />

-36.78<br />

-36.73<br />

-36.88<br />

8.64<br />

-41.62<br />

-38.19<br />

-40.00<br />

-37.58<br />

-37.28<br />

5.49<br />

5.39<br />

5.48<br />

5.47<br />

5.57<br />

5.50<br />

15.52<br />

6.92<br />

-<br />

7.02<br />

5.43<br />

5.47<br />

7.05<br />

5.56<br />

5.38<br />

7.02<br />

5.18<br />

5.62<br />

13.82<br />

5.46<br />

5.43<br />

-<br />

6.02<br />

38.90<br />

12.57<br />

5.46<br />

5.57<br />

7.01<br />

1.16<br />

6.22<br />

7.37<br />

7.22<br />

11.04<br />

5.55<br />

7.28<br />

10.72<br />

7.61<br />

13.96<br />

4.33<br />

4.78<br />

1.29<br />

6.16<br />

5.60<br />

4.51<br />

0.09<br />

-16.46<br />

5.52<br />

-7.07<br />

5.13<br />

7.70<br />

6.34<br />

5.44<br />

5.50<br />

5.34<br />

6.59<br />

10.99<br />

12.73<br />

9.63<br />

6.11<br />

5.76<br />

-10.75<br />

-10.84<br />

-10.74<br />

-10.76<br />

-10.66<br />

-10.72<br />

-11.32<br />

5.99<br />

-<br />

6.08<br />

-10.80<br />

-10.78<br />

6.12<br />

-10.64<br />

5.16<br />

6.07<br />

-10.96<br />

-10.58<br />

-12.07<br />

-10.79<br />

-10.82<br />

-<br />

-12.32<br />

-6.14<br />

-8.49<br />

-10.78<br />

-10.75<br />

6.00<br />

-11.99<br />

-12.19<br />

-18.06<br />

5.83<br />

-12.23<br />

-10.68<br />

5.89<br />

-12.44<br />

5.92<br />

-11.96<br />

-11.68<br />

-13.14<br />

-11.85<br />

-3.94<br />

-10.72<br />

-11.52<br />

-12.58<br />

-16.96<br />

-10.74<br />

-12.75<br />

-11.20<br />

6.00<br />

-3.84<br />

-10.65<br />

-10.67<br />

-10.84<br />

5.14<br />

-12.38<br />

-8.34<br />

-11.50<br />

-10.66<br />

-10.72<br />

Source: Morningstar. Data as of April 30, 2009. Exp Ratio is expense ratio. YTD is year-<strong>to</strong>-date. 3-, 5-, 10- <strong>and</strong> 15-yr returns are annualized. P/E is price-<strong>to</strong>-earnings ratio.<br />

Std Dev is 3-year st<strong>and</strong>ard deviation. Yield is 12-month.<br />

5-Yr 10-Yr 15-Yr P/E Std Dev Yield<br />

-2.10<br />

-2.80<br />

-2.69<br />

-2.71<br />

-2.00<br />

-2.66<br />

2.04<br />

4.71<br />

-<br />

4.80<br />

-2.75<br />

-2.76<br />

4.84<br />

-1.98<br />

4.27<br />

4.75<br />

-2.94<br />

-1.92<br />

0.86<br />

-2.74<br />

-2.76<br />

-<br />

0.00<br />

10.56<br />

-2.26<br />

-2.73<br />

-2.05<br />

4.78<br />

-0.60<br />

0.14<br />

-3.23<br />

4.14<br />

0.83<br />

-2.05<br />

4.17<br />

0.64<br />

4.55<br />

1.00<br />

-0.46<br />

0.13<br />

-0.44<br />

0.93<br />

-2.03<br />

-0.28<br />

-2.29<br />

-0.59<br />

-2.70<br />

-0.90<br />

-3.12<br />

4.63<br />

1.04<br />

-2.66<br />

-2.67<br />

-2.85<br />

4.82<br />

0.69<br />

-2.12<br />

-0.54<br />

-2.08<br />

-2.44<br />

-1.59<br />

-2.56<br />

-2.45<br />

-2.49<br />

-1.53<br />

-2.42<br />

0.87<br />

5.44<br />

-<br />

5.51<br />

-2.58<br />

-2.54<br />

5.57<br />

-1.48<br />

5.46<br />

5.47<br />

-2.73<br />

-<br />

0.05<br />

-2.57<br />

-2.58<br />

-<br />

4.43<br />

7.84<br />

-3.50<br />

-2.57<br />

-1.69<br />

-<br />

3.27<br />

4.58<br />

0.17<br />

4.91<br />

-<br />

-1.57<br />

4.92<br />

-0.14<br />

5.85<br />

0.16<br />

1.26<br />

-0.37<br />

3.43<br />

1.59<br />

-1.68<br />

1.44<br />

-1.29<br />

5.43<br />

-2.54<br />

5.18<br />

-2.87<br />

5.91<br />

1.69<br />

-2.54<br />

-2.54<br />

-2.71<br />

6.19<br />

-<br />

-3.37<br />

4.18<br />

-1.75<br />

-2.14<br />

6.35<br />

6.38<br />

6.51<br />

6.43<br />

6.40<br />

6.53<br />

-<br />

6.28<br />

-<br />

6.32<br />

6.32<br />

6.40<br />

6.39<br />

6.45<br />

6.29<br />

6.29<br />

6.18<br />

-<br />

5.97<br />

6.30<br />

6.29<br />

-<br />

-<br />

-<br />

6.72<br />

6.32<br />

-<br />

-<br />

6.67<br />

-<br />

3.25<br />

5.49<br />

-<br />

6.37<br />

5.50<br />

-<br />

6.63<br />

6.05<br />

6.72<br />

-1.28<br />

6.80<br />

6.70<br />

-<br />

6.85<br />

6.16<br />

-<br />

-<br />

-<br />

6.13<br />

6.66<br />

6.77<br />

6.36<br />

-<br />

-<br />

7.39<br />

-<br />

6.82<br />

-<br />

-<br />

6.32<br />

11.0<br />

10.9<br />

10.9<br />

10.9<br />

11.0<br />

10.9<br />

6.7<br />

-<br />

-<br />

-<br />

11.1<br />

10.9<br />

-<br />

11.0<br />

-<br />

-<br />

11.1<br />

10.9<br />

7.4<br />

11.1<br />

11.1<br />

11.3<br />

10.6<br />

8.3<br />

12.6<br />

11.1<br />

11.1<br />

-<br />

11.5<br />

10.6<br />

7.0<br />

-<br />

8.4<br />

11.0<br />

-<br />

8.6<br />

16.5<br />

7.4<br />

11.5<br />

2.9<br />

11.5<br />

10.9<br />

11.1<br />

11.5<br />

9.6<br />

18.0<br />

10.0<br />

10.3<br />

9.4<br />

16.5<br />

10.9<br />

10.9<br />

10.0<br />

10.0<br />

9.0<br />

8.4<br />

12.6<br />

13.1<br />

10.9<br />

10.1<br />

19.26<br />

18.65<br />

18.64<br />

18.65<br />

19.27<br />

18.64<br />

23.89<br />

4.07<br />

-<br />

4.07<br />

18.67<br />

18.65<br />

4.07<br />

19.25<br />

3.71<br />

4.07<br />

18.62<br />

19.28<br />

23.98<br />

18.66<br />

18.67<br />

-<br />

22.66<br />

31.28<br />

18.87<br />

18.66<br />

19.25<br />

4.10<br />

24.60<br />

22.68<br />

22.93<br />

2.48<br />

22.57<br />

19.25<br />

2.48<br />

22.67<br />

6.66<br />

23.98<br />

23.29<br />

20.49<br />

24.60<br />

12.16<br />

19.24<br />

23.30<br />

19.59<br />

38.30<br />

18.60<br />

25.19<br />

18.76<br />

6.66<br />

12.14<br />

18.57<br />

18.58<br />

18.55<br />

11.60<br />

22.60<br />

18.87<br />

25.01<br />

19.18<br />

18.78<br />

2.68<br />

3.02<br />

3.06<br />

3.12<br />

2.77<br />

3.09<br />

3.07<br />

4.62<br />

-<br />

4.70<br />

2.98<br />

3.12<br />

4.75<br />

2.81<br />

4.50<br />

4.70<br />

2.68<br />

2.77<br />

7.79<br />

3.06<br />

3.02<br />

3.17<br />

1.91<br />

4.04<br />

1.29<br />

3.01<br />

2.60<br />

4.64<br />

1.92<br />

2.11<br />

3.95<br />

3.48<br />

5.89<br />

2.77<br />

3.56<br />

3.83<br />

4.77<br />

8.08<br />

1.62<br />

1.81<br />

2.12<br />

3.67<br />

2.63<br />

1.88<br />

4.34<br />

9.19<br />

3.01<br />

2.93<br />

3.32<br />

4.85<br />

3.82<br />

3.10<br />

3.13<br />

2.90<br />

5.65<br />

5.61<br />

1.48<br />

0.78<br />

2.45<br />

2.48<br />

52<br />

July/August 2009