How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>to</strong> write the book “Portable Alpha Theory <strong>and</strong> Practice: What<br />

Inves<strong>to</strong>rs Really Need <strong>to</strong> Know,” turning in our first draft <strong>to</strong><br />

the publisher well before August 2007. Our colleague Chris<br />

Dialynas put it best in the epilogue:<br />

“Ironically, what began in the early 1980’s as a simple<br />

finance arbitrage Pimco portable alpha strategy has<br />

evolved in some cases <strong>to</strong> highly leveraged, unregulated<br />

portable alpha hedge fund strategies. Both are referred<br />

<strong>to</strong> as the alpha source in a portable alpha context,<br />

but they are vastly different in terms of the potential<br />

downside risk.”<br />

Alpha And Beta: It’s the Combination<br />

That Matters, As Does The Execution<br />

This is not <strong>to</strong> say that all portable alpha strategies that<br />

involve the use of hedge funds as the alpha strategy are bad<br />

or highly risky. There are surely any number of successful,<br />

prudent approaches that involve hedge funds. Regardless of<br />

the approach, though, as a starting point, proper quantification<br />

of investment <strong>and</strong> operational risk in portable alpha programs<br />

is a necessary ingredient <strong>to</strong> well-informed investment,<br />

benchmarking, risk budgeting <strong>and</strong> asset allocation efforts.<br />

Risk management <strong>and</strong> measurement is a crucial component<br />

of a successful portable alpha strategy.<br />

While portable alpha may seem <strong>to</strong> be an elegant <strong>and</strong><br />

low-risk way <strong>to</strong> earn excess returns in addition <strong>to</strong> the return<br />

from the reference market index, there really is no such thing<br />

as a free lunch in the financial markets. The fundamental<br />

laws of investing apply <strong>to</strong> portable alpha just as they do <strong>to</strong><br />

any other type of investment. It is almost always necessary<br />

<strong>to</strong> take some type of risk in order <strong>to</strong> generate return over<br />

money market rates. While portable alpha strategies may<br />

seem simple in theory, they cannot outperform the reference<br />

index 100 percent of the time. The primary risks of portable<br />

alpha strategies in this regard can include: (1) the potential<br />

for under-performance in the collateral (alpha) portfolio, (2)<br />

a spike in the financing costs for futures/swaps, (3) margin<br />

calls on the derivatives in a falling market, which force the<br />

liquidation of the most liquid (<strong>and</strong> highest-quality) parts of<br />

the portfolio, or (4) operational errors.<br />

Inves<strong>to</strong>rs should carefully evaluate both the risk of<br />

the derivatives-based index exposure <strong>and</strong> the alpha strategy<br />

when attempting <strong>to</strong> underst<strong>and</strong> the overall risk of the<br />

strategy. Focusing first on the alpha side of the equation,<br />

inves<strong>to</strong>rs should underst<strong>and</strong> the liquidity of the portfolio.<br />

Futures margin is typically settled on a next-day basis, <strong>and</strong><br />

swap collateral requirements may be settled as frequently<br />

as daily in stressed market environments. Consequently,<br />

underst<strong>and</strong>ing portfolio liquidity is critically important.<br />

Similarly, underst<strong>and</strong>ing the alpha portfolio’s expected<br />

behavior during periods of market stress may provide<br />

insight in<strong>to</strong> how the portfolio as a whole behaves in down<br />

markets. Well-informed analysis will focus on the sources of<br />

return in the alpha portfolio <strong>and</strong> the risk fac<strong>to</strong>r exposures<br />

that drive those returns. Further analysis should focus on<br />

the likely correlation of those risk fac<strong>to</strong>rs across different<br />

market environments <strong>and</strong> <strong>to</strong> what extent the risks are identifiable,<br />

measurable <strong>and</strong> can be diversified.<br />

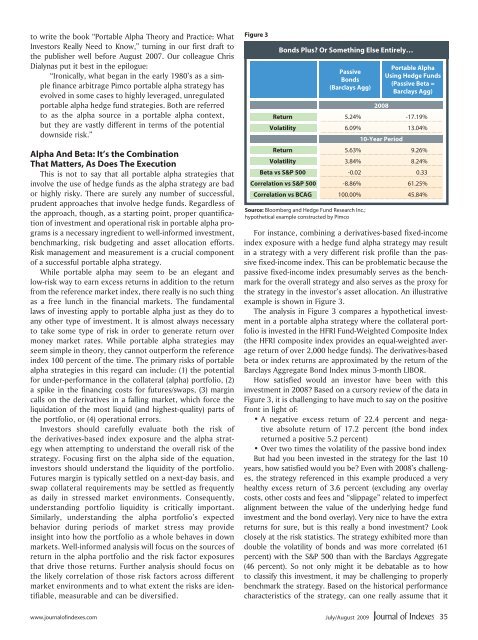

Figure 3<br />

Bonds Plus? Or Something Else Entirely…<br />

Passive<br />

Bonds<br />

(Barclays Agg)<br />

Source: Bloomberg <strong>and</strong> Hedge Fund Research Inc.;<br />

hypothetical example constructed by Pimco<br />

Portable Alpha<br />

Using Hedge Funds<br />

(Passive Beta =<br />

Barclays Agg)<br />

2008<br />

Return 5.24% -17.19%<br />

Volatility 6.09% 13.04%<br />

10-Year Period<br />

Return 5.63% 9.26%<br />

Volatility 3.84% 8.24%<br />

Beta vs S&P 500 -0.02 0.33<br />

Correlation vs S&P 500 -8.86% 61.25%<br />

Correlation vs BCAG 100.00% 45.84%<br />

For instance, combining a derivatives-based fixed-income<br />

index exposure with a hedge fund alpha strategy may result<br />

in a strategy with a very different risk profile than the passive<br />

fixed-income index. This can be problematic because the<br />

passive fixed-income index presumably serves as the benchmark<br />

for the overall strategy <strong>and</strong> also serves as the proxy for<br />

the strategy in the inves<strong>to</strong>r’s asset allocation. An illustrative<br />

example is shown in Figure 3.<br />

The analysis in Figure 3 compares a hypothetical investment<br />

in a portable alpha strategy where the collateral portfolio<br />

is invested in the HFRI Fund-Weighted Composite Index<br />

(the HFRI composite index provides an equal-weighted average<br />

return of over 2,000 hedge funds). The derivatives-based<br />

beta or index returns are approximated by the return of the<br />

Barclays Aggregate Bond Index minus 3-month LIBOR.<br />

<strong>How</strong> satisfied would an inves<strong>to</strong>r have been with this<br />

investment in 2008? Based on a cursory review of the data in<br />

Figure 3, it is challenging <strong>to</strong> have much <strong>to</strong> say on the positive<br />

front in light of:<br />

• A negative excess return of 22.4 percent <strong>and</strong> negative<br />

absolute return of 17.2 percent (the bond index<br />

returned a positive 5.2 percent)<br />

• Over two times the volatility of the passive bond index<br />

But had you been invested in the strategy for the last 10<br />

years, how satisfied would you be? Even with 2008’s challenges,<br />

the strategy referenced in this example produced a very<br />

healthy excess return of 3.6 percent (excluding any overlay<br />

costs, other costs <strong>and</strong> fees <strong>and</strong> “slippage” related <strong>to</strong> imperfect<br />

alignment between the value of the underlying hedge fund<br />

investment <strong>and</strong> the bond overlay). Very nice <strong>to</strong> have the extra<br />

returns for sure, but is this really a bond investment? Look<br />

closely at the risk statistics. The strategy exhibited more than<br />

double the volatility of bonds <strong>and</strong> was more correlated (61<br />

percent) with the S&P 500 than with the Barclays Aggregate<br />

(46 percent). So not only might it be debatable as <strong>to</strong> how<br />

<strong>to</strong> classify this investment, it may be challenging <strong>to</strong> properly<br />

benchmark the strategy. Based on the his<strong>to</strong>rical performance<br />

characteristics of the strategy, can one really assume that it<br />

www.journalofindexes.com July/August 2009<br />

35