General Government - Town of Meredith

General Government - Town of Meredith

General Government - Town of Meredith

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

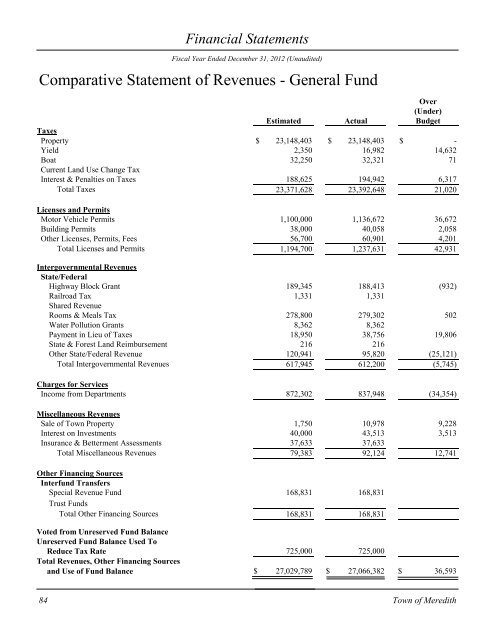

Financial Statements<br />

Fiscal Year Ended December 31, 2012 (Unaudited)<br />

Comparative Statement <strong>of</strong> Revenues - <strong>General</strong> Fund<br />

Over<br />

(Under)<br />

Estimated Actual Budget<br />

Taxes<br />

Property $ 23,148,403 $ 23,148,403 $ -<br />

Yield 2,350 16,982 14,632<br />

Boat 32,250 32,321 71<br />

Current Land Use Change Tax<br />

Interest & Penalties on Taxes 188,625 194,942 6,317<br />

Total Taxes 23,371,628 23,392,648 21,020<br />

Licenses and Permits<br />

Motor Vehicle Permits 1,100,000 1,136,672 36,672<br />

Building Permits 38,000 40,058 2,058<br />

Other Licenses, Permits, Fees 56,700 60,901 4,201<br />

Total Licenses and Permits 1,194,700 1,237,631 42,931<br />

Intergovernmental Revenues<br />

State/Federal<br />

Highway Block Grant 189,345 188,413 (932)<br />

Railroad Tax 1,331 1,331<br />

Shared Revenue<br />

Rooms & Meals Tax 278,800 279,302 502<br />

Water Pollution Grants 8,362 8,362<br />

Payment in Lieu <strong>of</strong> Taxes 18,950 38,756 19,806<br />

State & Forest Land Reimbursement 216 216<br />

Other State/Federal Revenue 120,941 95,820 (25,121)<br />

Total Intergovernmental Revenues 617,945 612,200 (5,745)<br />

Charges for Services<br />

Income from Departments 872,302 837,948 (34,354)<br />

Miscellaneous Revenues<br />

Sale <strong>of</strong> <strong>Town</strong> Property 1,750 10,978 9,228<br />

Interest on Investments 40,000 43,513 3,513<br />

Insurance & Betterment Assessments 37,633 37,633<br />

Total Miscellaneous Revenues 79,383 92,124 12,741<br />

Other Financing Sources<br />

Interfund Transfers<br />

Special Revenue Fund 168,831 168,831<br />

Trust Funds<br />

Total Other Financing Sources 168,831 168,831<br />

Voted from Unreserved Fund Balance<br />

Unreserved Fund Balance Used To<br />

Reduce Tax Rate 725,000 725,000<br />

Total Revenues, Other Financing Sources<br />

and Use <strong>of</strong> Fund Balance $ 27,029,789 $ 27,066,382 $ 36,593<br />

84<br />

<strong>Town</strong> <strong>of</strong> <strong>Meredith</strong>