General Government - Town of Meredith

General Government - Town of Meredith

General Government - Town of Meredith

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

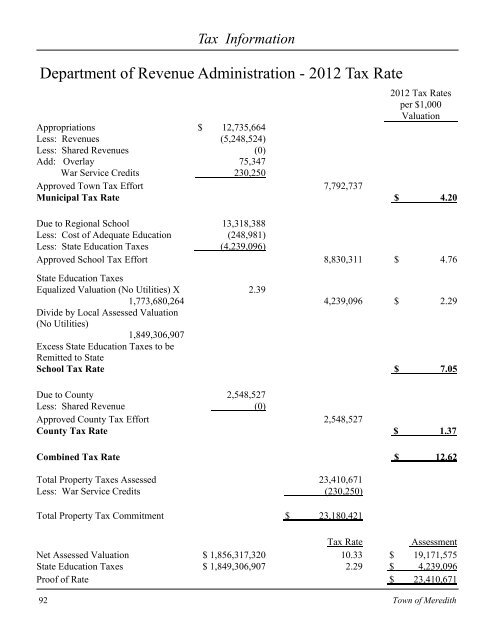

Tax Information<br />

Department <strong>of</strong> Revenue Administration - 2012 Tax Rate<br />

2012 Tax Rates<br />

per $1,000<br />

Valuation<br />

Appropriations $ 12,735,664<br />

Less: Revenues (5,248,524)<br />

Less: Shared Revenues (0)<br />

Add: Overlay 75,347<br />

War Service Credits 230,250<br />

Approved <strong>Town</strong> Tax Effort 7,792,737<br />

Municipal Tax Rate $ 4.20<br />

Due to Regional School 13,318,388<br />

Less: Cost <strong>of</strong> Adequate Education (248,981)<br />

Less: State Education Taxes (4,239,096)<br />

Approved School Tax Effort 8,830,311 $ 4.76<br />

State Education Taxes<br />

Equalized Valuation (No Utilities) X 2.39<br />

1,773,680,264 4,239,096 $ 2.29<br />

Divide by Local Assessed Valuation<br />

(No Utilities)<br />

1,849,306,907<br />

Excess State Education Taxes to be<br />

Remitted to State<br />

School Tax Rate $ 7.05<br />

Due to County 2,548,527<br />

Less: Shared Revenue (0)<br />

Approved County Tax Effort 2,548,527<br />

County Tax Rate $ 1.37<br />

Combined Tax Rate $ 12.62<br />

Total Property Taxes Assessed 23,410,671<br />

Less: War Service Credits (230,250)<br />

Total Property Tax Commitment $ 23,180,421<br />

Tax Rate<br />

Assessment<br />

Net Assessed Valuation $ 1,856,317,320 10.33 $ 19,171,575<br />

State Education Taxes $ 1,849,306,907 2.29 $ 4,239,096<br />

Pro<strong>of</strong> <strong>of</strong> Rate $ 23,410,671<br />

92<br />

<strong>Town</strong> <strong>of</strong> <strong>Meredith</strong>