Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE ISSUER<br />

The Issuer, <strong>Titan</strong> <strong>Europe</strong> <strong>2007</strong>-1 (<strong>NHP</strong>) <strong>Limited</strong>, was incorporated in Ireland on 28 March <strong>2007</strong><br />

(registration number 437005) as a private company limited by shares under the Companies Acts 1963 to 2006 of<br />

Ireland as a special purpose vehicle for the purpose of issuing the Notes. The registered office of the Issuer is<br />

located at First Floor, 7 <strong>Exchange</strong> Place, International Financial Services Centre, Dublin 1, Ireland (telephone<br />

number: +353 1 612 5555). The Issuer has no subsidiaries.<br />

Principal Activities<br />

The principal objects of the Issuer are set out in clause 3 of its memorandum of association and are, inter<br />

alia, to purchase, take transfer of, invest in and acquire loans and any security given or provided by any person<br />

in connection with such loans, to hold and manage and deal with, sell or alienate such loans and related security,<br />

to borrow, raise and secure the payment of money by the creation and issue of bonds, debentures, notes or other<br />

securities and to charge or grant security over the Issuer’s property or assets to secure its obligations.<br />

Since the date of its incorporation, the Issuer has not commenced operations and no accounts have been<br />

made up as at the date of this Offering Circular. The only activities in which the Issuer has engaged are those<br />

incidental to its incorporation and registration as a private limited company under the Companies Acts 1963 to<br />

2005 of Ireland, the authorisation of the issue of the Notes, the matters referred to or contemplated in this<br />

Offering Circular and the authorisation, execution, delivery and performance of the other documents referred to<br />

in this document to which it is a party and matters which are incidental or ancillary to the foregoing.<br />

The Issuer will covenant to observe certain restrictions on its activities which are detailed in Condition 4<br />

(Covenants), the Deed of Charge and Assignment and the Note Trust Deed. In addition, the Issuer will covenant<br />

in the Note Trust Deed to provide written confirmation to the Note Trustee, on an annual basis, that no Note<br />

Event of Default (or other matter which is required to be brought to the Note Trustee’s attention) has occurred in<br />

respect of the Notes.<br />

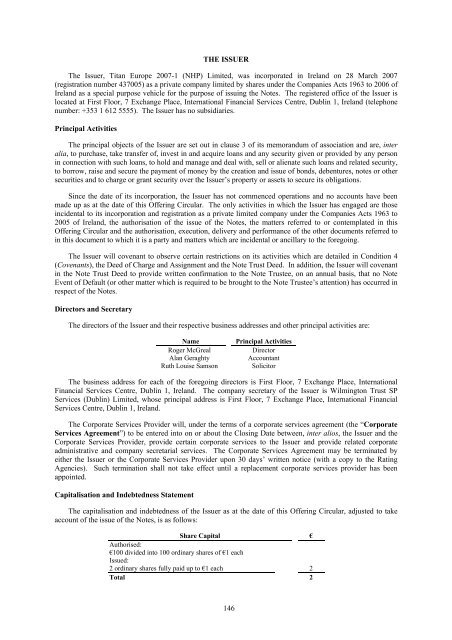

Directors and Secretary<br />

The directors of the Issuer and their respective business addresses and other principal activities are:<br />

Name<br />

Roger McGreal<br />

Alan Geraghty<br />

Ruth Louise Samson<br />

Principal Activities<br />

Director<br />

Accountant<br />

Solicitor<br />

The business address for each of the foregoing directors is First Floor, 7 <strong>Exchange</strong> Place, International<br />

Financial Services Centre, Dublin 1, Ireland. The company secretary of the Issuer is Wilmington Trust SP<br />

Services (Dublin) <strong>Limited</strong>, whose principal address is First Floor, 7 <strong>Exchange</strong> Place, International Financial<br />

Services Centre, Dublin 1, Ireland.<br />

The Corporate Services Provider will, under the terms of a corporate services agreement (the “Corporate<br />

Services Agreement”) to be entered into on or about the Closing Date between, inter alios, the Issuer and the<br />

Corporate Services Provider, provide certain corporate services to the Issuer and provide related corporate<br />

administrative and company secretarial services. The Corporate Services Agreement may be terminated by<br />

either the Issuer or the Corporate Services Provider upon 30 days’ written notice (with a copy to the Rating<br />

Agencies). Such termination shall not take effect until a replacement corporate services provider has been<br />

appointed.<br />

Capitalisation and Indebtedness Statement<br />

The capitalisation and indebtedness of the Issuer as at the date of this Offering Circular, adjusted to take<br />

account of the issue of the Notes, is as follows:<br />

Share Capital €<br />

Authorised:<br />

€100 divided into 100 ordinary shares of €1 each<br />

Issued:<br />

2 ordinary shares fully paid up to €1 each 2<br />

Total 2<br />

146