Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

or more Rule 144A Global Notes in respect of each class, in each<br />

case in registered form. The Notes of each class offered and sold<br />

outside the United States to non-U.S. persons in reliance on<br />

Regulation S will initially be represented by one or more<br />

Regulation S Global Notes in respect of such class, in each case in<br />

registered form. The Rule 144A Global Notes and Regulation S<br />

Global Notes will be registered in the name of the Common<br />

Depository (or its nominee) for the account of Euroclear and<br />

Clearstream, Luxembourg. Beneficial ownership interests in the<br />

Notes will be shown on, and transfers thereof will be effected only<br />

through, records maintained in book-entry form by Euroclear or<br />

Clearstream, Luxembourg, and their respective participants. See<br />

“Description of the Notes”.<br />

Definitive Notes will be issued only in certain limited<br />

circumstances. See “Terms and Conditions of the Notes—<br />

Condition 2 (Definitive Notes)” and “Description of the Notes”.<br />

The holders of the Class X Notes (the “Class X Noteholders”) and<br />

the holders of the Class V Notes (the “Class V Noteholders”) have<br />

no power to pass Extraordinary Resolutions and are not counted in<br />

determining any quorum or majority for the purposes of holding<br />

any meeting or passing any resolutions. See “Terms and<br />

Conditions of the Notes—Condition 3(a)(iv) (Status and<br />

Relationship Among the Notes)” and “—Condition 12(a) (Meetings<br />

of Noteholders, Modification and Waiver and Substitution)”.<br />

The Notes and interest thereon will not be obligations or<br />

responsibilities of any person other than the Issuer. In particular,<br />

the Notes will not be obligations or responsibilities of, or be<br />

guaranteed, by the Loan Seller, the Original Lender, the Loan<br />

Arranger or any associated body of any of the aforementioned, or<br />

of or by the Manager, the Servicer, the Special Servicer, the Cash<br />

Manager, the Note Trustee, the Corporate Services Provider, the<br />

Paying Agents, the Agent Bank, the Registrar, the Advance<br />

Provider, the Backup Advance Provider, the Swap Provider, the<br />

Operating Bank, or the shareholders of any of them or the<br />

shareholders of the Issuer, and none of such persons accepts any<br />

liability whatsoever in respect of any failure by the Issuer to make<br />

payment of any amount due on the Notes.<br />

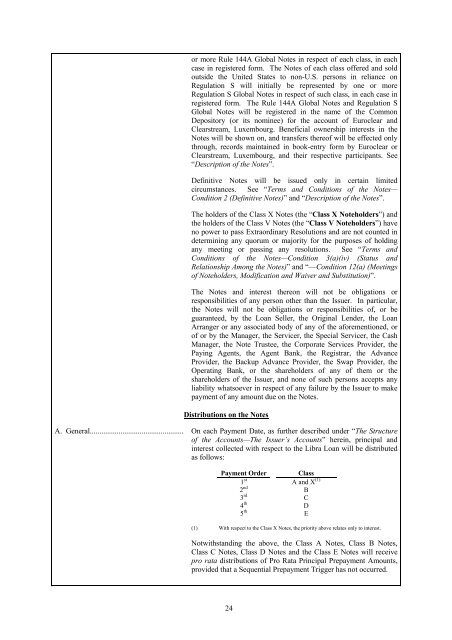

Distributions on the Notes<br />

A. General................................................. On each Payment Date, as further described under “The Structure<br />

of the Accounts—The Issuer’s Accounts” herein, principal and<br />

interest collected with respect to the Libra Loan will be distributed<br />

as follows:<br />

Payment Order Class<br />

1 st A and X (1)<br />

2 nd B<br />

3 rd C<br />

4 th D<br />

5 th E<br />

(1) With respect to the Class X Notes, the priority above relates only to interest.<br />

Notwithstanding the above, the Class A Notes, Class B Notes,<br />

Class C Notes, Class D Notes and the Class E Notes will receive<br />

pro rata distributions of Pro Rata Principal Prepayment Amounts,<br />

provided that a Sequential Prepayment Trigger has not occurred.<br />

24