Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

Titan Europe 2007-1 (NHP) Limited - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

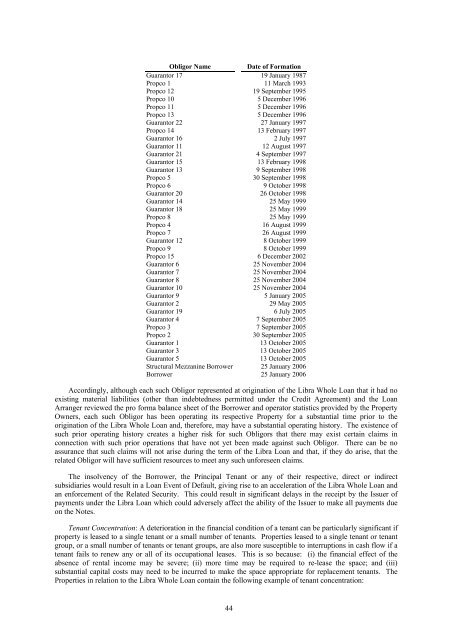

Obligor Name<br />

Date of Formation<br />

Guarantor 17 19 January 1987<br />

Propco 1 11 March 1993<br />

Propco 12 19 September 1995<br />

Propco 10 5 December 1996<br />

Propco 11 5 December 1996<br />

Propco 13 5 December 1996<br />

Guarantor 22 27 January 1997<br />

Propco 14 13 February 1997<br />

Guarantor 16 2 July 1997<br />

Guarantor 11 12 August 1997<br />

Guarantor 21 4 September 1997<br />

Guarantor 15 13 February 1998<br />

Guarantor 13 9 September 1998<br />

Propco 5 30 September 1998<br />

Propco 6 9 October 1998<br />

Guarantor 20 26 October 1998<br />

Guarantor 14 25 May 1999<br />

Guarantor 18 25 May 1999<br />

Propco 8 25 May 1999<br />

Propco 4 16 August 1999<br />

Propco 7 26 August 1999<br />

Guarantor 12 8 October 1999<br />

Propco 9 8 October 1999<br />

Propco 15 6 December 2002<br />

Guarantor 6 25 November 2004<br />

Guarantor 7 25 November 2004<br />

Guarantor 8 25 November 2004<br />

Guarantor 10 25 November 2004<br />

Guarantor 9 5 January 2005<br />

Guarantor 2 29 May 2005<br />

Guarantor 19 6 July 2005<br />

Guarantor 4 7 September 2005<br />

Propco 3 7 September 2005<br />

Propco 2 30 September 2005<br />

Guarantor 1 13 October 2005<br />

Guarantor 3 13 October 2005<br />

Guarantor 5 13 October 2005<br />

Structural Mezzanine Borrower 25 January 2006<br />

Borrower 25 January 2006<br />

Accordingly, although each such Obligor represented at origination of the Libra Whole Loan that it had no<br />

existing material liabilities (other than indebtedness permitted under the Credit Agreement) and the Loan<br />

Arranger reviewed the pro forma balance sheet of the Borrower and operator statistics provided by the Property<br />

Owners, each such Obligor has been operating its respective Property for a substantial time prior to the<br />

origination of the Libra Whole Loan and, therefore, may have a substantial operating history. The existence of<br />

such prior operating history creates a higher risk for such Obligors that there may exist certain claims in<br />

connection with such prior operations that have not yet been made against such Obligor. There can be no<br />

assurance that such claims will not arise during the term of the Libra Loan and that, if they do arise, that the<br />

related Obligor will have sufficient resources to meet any such unforeseen claims.<br />

The insolvency of the Borrower, the Principal Tenant or any of their respective, direct or indirect<br />

subsidiaries would result in a Loan Event of Default, giving rise to an acceleration of the Libra Whole Loan and<br />

an enforcement of the Related Security. This could result in significant delays in the receipt by the Issuer of<br />

payments under the Libra Loan which could adversely affect the ability of the Issuer to make all payments due<br />

on the Notes.<br />

Tenant Concentration: A deterioration in the financial condition of a tenant can be particularly significant if<br />

property is leased to a single tenant or a small number of tenants. Properties leased to a single tenant or tenant<br />

group, or a small number of tenants or tenant groups, are also more susceptible to interruptions in cash flow if a<br />

tenant fails to renew any or all of its occupational leases. This is so because: (i) the financial effect of the<br />

absence of rental income may be severe; (ii) more time may be required to re-lease the space; and (iii)<br />

substantial capital costs may need to be incurred to make the space appropriate for replacement tenants. The<br />

Properties in relation to the Libra Whole Loan contain the following example of tenant concentration:<br />

44