2011 Annual Report - Italcementi Group

2011 Annual Report - Italcementi Group

2011 Annual Report - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Presentation 4<br />

General information 15<br />

<strong>Annual</strong> <strong>Report</strong> Consolidated <strong>Annual</strong> <strong>Report</strong> Directors’ report 28<br />

Extraordinary session <strong>Italcementi</strong> S.p.A. <strong>Annual</strong> <strong>Report</strong> Consolidated financial statements 63<br />

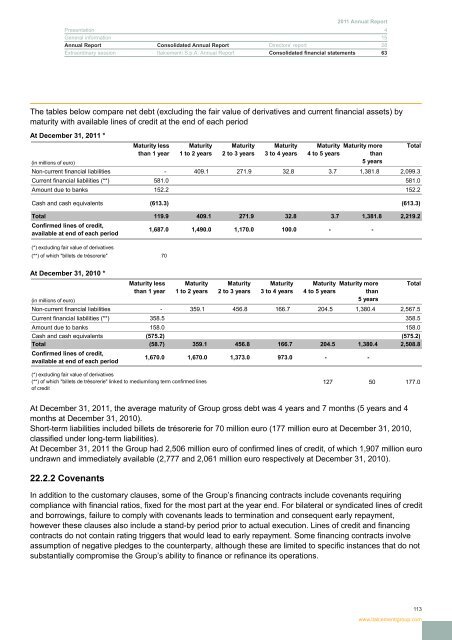

The tables below compare net debt (excluding the fair value of derivatives and current financial assets) by<br />

maturity with available lines of credit at the end of each period<br />

At December 31, <strong>2011</strong> *<br />

Maturity less Maturity Maturity Maturity Maturity Maturity more Total<br />

than 1 year 1 to 2 years 2 to 3 years 3 to 4 years 4 to 5 years<br />

than<br />

(in millions of euro)<br />

5 years<br />

Non-current financial liabilities - 409.1 271.9 32.8 3.7 1,381.8 2,099.3<br />

Current financial liabilities (**) 581.0 581.0<br />

Amount due to banks 152.2 152.2<br />

Cash and cash equivalents (613.3) (613.3)<br />

Total 119.9 409.1 271.9 32.8 3.7 1,381.8 2,219.2<br />

Confirmed lines of credit,<br />

1,687.0 1,490.0 1,170.0 100.0 - -<br />

available at end of each period<br />

(*) excluding fair value of derivatives<br />

(**) of which "billets de trésorerie" 70<br />

At December 31, 2010 *<br />

Maturity less Maturity Maturity Maturity Maturity Maturity more Total<br />

than 1 year 1 to 2 years 2 to 3 years 3 to 4 years 4 to 5 years<br />

than<br />

(in millions of euro)<br />

5 years<br />

Non-current financial liabilities - 359.1 456.8 166.7 204.5 1,380.4 2,567.5<br />

Current financial liabilities (**) 358.5 358.5<br />

Amount due to banks 158.0 158.0<br />

Cash and cash equivalents (575.2) (575.2)<br />

Total (58.7) 359.1 456.8 166.7 204.5 1,380.4 2,508.8<br />

Confirmed lines of credit,<br />

available at end of each period<br />

1,670.0 1,670.0 1,373.0 973.0 - -<br />

(*) excluding fair value of derivatives<br />

(**) of which "billets de trésorerie" linked to medium/long term confirmed lines<br />

of credit<br />

127 50 177.0<br />

At December 31, <strong>2011</strong>, the average maturity of <strong>Group</strong> gross debt was 4 years and 7 months (5 years and 4<br />

months at December 31, 2010).<br />

Short-term liabilities included billets de trésorerie for 70 million euro (177 million euro at December 31, 2010,<br />

classified under long-term liabilities).<br />

At December 31, <strong>2011</strong> the <strong>Group</strong> had 2,506 million euro of confirmed lines of credit, of which 1,907 million euro<br />

undrawn and immediately available (2,777 and 2,061 million euro respectively at December 31, 2010).<br />

22.2.2 Covenants<br />

In addition to the customary clauses, some of the <strong>Group</strong>’s financing contracts include covenants requiring<br />

compliance with financial ratios, fixed for the most part at the year end. For bilateral or syndicated lines of credit<br />

and borrowings, failure to comply with covenants leads to termination and consequent early repayment,<br />

however these clauses also include a stand-by period prior to actual execution. Lines of credit and financing<br />

contracts do not contain rating triggers that would lead to early repayment. Some financing contracts involve<br />

assumption of negative pledges to the counterparty, although these are limited to specific instances that do not<br />

substantially compromise the <strong>Group</strong>’s ability to finance or refinance its operations.<br />

113<br />

www.italcementigroup.com