- Page 1:

2011 Annual Report

- Page 5 and 6:

2011 Annual Report Italcementi S.p.

- Page 7 and 8:

The Group has decided to take a fur

- Page 9 and 10:

2011 Annual Report Presentation Ita

- Page 11 and 12:

2011 Annual Report Presentation Ita

- Page 13 and 14:

2011 Annual Report Presentation Ita

- Page 15 and 16:

2011 Annual Report Presentation Ita

- Page 17 and 18:

2011 Annual Report Presentation 4 G

- Page 19 and 20:

2011 Annual Report Presentation 4 G

- Page 21 and 22:

2011 Annual Report Presentation 4 G

- Page 23 and 24:

2011 Annual Report Presentation 4 G

- Page 25 and 26:

2011 Annual Report Presentation 4 G

- Page 27:

2011 Annual Report Presentation 4 G

- Page 30 and 31:

Directors’ report Following the a

- Page 32 and 33:

The Calcestruzzi group returned to

- Page 34 and 35:

Financial performance in 2011 Key c

- Page 36 and 37:

In cement and clinker, performance

- Page 38 and 39:

Revenue and operating performance C

- Page 40 and 41:

The loss relating to continuing ope

- Page 42 and 43:

Net debt breakdown (in millions of

- Page 44 and 45:

4. Implementation of defined mitiga

- Page 46 and 47:

Financial disclosure risks The main

- Page 48 and 49:

the negative trend in sales volumes

- Page 50 and 51:

Ready mixed concrete sales volumes

- Page 52 and 53:

ASIA Thailand India Others (1) Tot

- Page 54 and 55:

70% by Fotowatio Italy, a subsidiar

- Page 56 and 57:

During the year Italcementi S.p.A.

- Page 58 and 59:

Raw materials and alternative fuels

- Page 60 and 61:

Engineering, technical assistance,

- Page 62 and 63:

After a revenue decline in 2009 and

- Page 64 and 65:

Outlook The markets on which the Gr

- Page 66 and 67:

Financial statements Statement of f

- Page 68 and 69:

Statement of comprehensive income N

- Page 70 and 71:

Statement of cash flows Notes 2011

- Page 72 and 73:

21. Deferred tax assets and Deferre

- Page 74 and 75:

limits in question. The benefits ar

- Page 76 and 77:

Associates Associates are companies

- Page 78 and 79:

1.5 Translation of foreign currency

- Page 80 and 81:

Subsequent to initial recognition,

- Page 82 and 83:

Deferred tax assets and deferred ta

- Page 84 and 85:

1.21. Trade payables and other paya

- Page 86 and 87:

2. Exchange rates used to translate

- Page 88 and 89:

4. Operating segment disclosure The

- Page 90 and 91:

The table below sets out segment re

- Page 92 and 93:

The table below sets out other segm

- Page 94 and 95:

5.2 Investment property (in thousan

- Page 96 and 97:

As in 2010, for the CGUs in the EU

- Page 98 and 99:

Sensitivity analysis With reference

- Page 100 and 101:

Other equity investments at Decembe

- Page 102 and 103:

14. Share capital and Share premium

- Page 104 and 105:

Net liabilities determined on the b

- Page 106 and 107:

The table below sets out key data f

- Page 108 and 109:

of the favorable ruling obtained in

- Page 110 and 111:

22.1 Financial liabilities Financia

- Page 112 and 113:

No drawings had been made on the sy

- Page 114 and 115:

As a result of the Moody’s rating

- Page 116 and 117:

At December 31, 2011, lines of cred

- Page 118 and 119:

22.3.1 Fair value of derivatives Th

- Page 120 and 121:

22.4.1 Interest-rate risk hedging T

- Page 122 and 123:

With regard to financing for subsid

- Page 124 and 125:

In 2011, in view of the surplus acc

- Page 126 and 127:

26. Services Services amounted to 1

- Page 128 and 129:

28. Other operating income (expense

- Page 130 and 131:

The reconciliation between the tax

- Page 132 and 133:

35. Earnings per share Earnings per

- Page 134 and 135:

36. Transactions with related parti

- Page 136 and 137:

38. Statement of cash flows 38.1 Ca

- Page 138 and 139:

40. Audit fees (as per CONSOB Resol

- Page 140 and 141:

Annex 1 The following table has bee

- Page 142 and 143:

Company Registered office Share cap

- Page 144 and 145:

Company Registered office Share cap

- Page 146 and 147:

Company Registered office Share cap

- Page 150 and 151:

148

- Page 152 and 153:

Directors’ report Any changes in

- Page 154 and 155:

which remained the most dynamic com

- Page 156 and 157:

Statement of financial position, ca

- Page 158 and 159:

Dealings with subsidiaries, joint v

- Page 160 and 161:

Risks and uncertainties Italcementi

- Page 162 and 163:

Ratings risks The Group’s ability

- Page 164 and 165:

January 2011 entitled “Europe at

- Page 166 and 167:

Ciments Français S.A. profit for t

- Page 168 and 169:

INFORMATION ON OWNERSHIP STRUCTURE

- Page 170 and 171:

l) Laws applicable to the appointme

- Page 172 and 173:

- Selection of priority risks and d

- Page 174 and 175:

) implementing the guidelines defin

- Page 176 and 177:

A) ORGANIZATIONAL STRUCTURE Board o

- Page 178 and 179:

No limits to re-eligibility of dire

- Page 180 and 181:

* Mittel S.p.A. - Director Pierfran

- Page 182 and 183:

The Code provides for the Board of

- Page 184 and 185:

Lastly, the Board of Directors, in

- Page 186 and 187:

) a brief resume on the personal an

- Page 188 and 189:

) evaluate the proposals made by ex

- Page 190 and 191:

time to express their point of view

- Page 192 and 193:

In addition, the Chief Executive Of

- Page 194 and 195:

During 2011 the Internal control co

- Page 196 and 197:

TABLE 1 STRUCTURE OF THE BOARD OF D

- Page 198 and 199:

to be noted that CONSOB, the Italia

- Page 200 and 201:

* indicates the responsibilities, p

- Page 202 and 203:

consolidated financial statements.

- Page 204 and 205:

to apportion the profit for the yea

- Page 206 and 207:

Department of Human Resources and O

- Page 208 and 209:

A) VARIABLE COMPONENTS Under the Po

- Page 210 and 211:

This plan aims at: - tying the over

- Page 212 and 213:

The variable components are aligned

- Page 214 and 215:

With reference to the other offices

- Page 216 and 217:

The Board of Directors may also gra

- Page 218 and 219:

) Plan Management The corporate bod

- Page 220 and 221:

g) Any Support for the Plan by the

- Page 222 and 223:

position of the role of each benefi

- Page 224 and 225:

2) With respect to the stock option

- Page 226 and 227:

Name, surname Position Period durin

- Page 228 and 229: Yves René Nanot Marco Piccinini At

- Page 230 and 231: Monetary Incentive Plans in Favor o

- Page 232 and 233: Participation of Governing and Supe

- Page 234 and 235: 3) Term of the authorization. The a

- Page 236 and 237: specifically, with laws and regulat

- Page 238 and 239: Each section shall list in progress

- Page 240 and 241: 238

- Page 242 and 243: Financial statements Statement of f

- Page 244 and 245: Statement of comprehensive income (

- Page 246 and 247: Statement of cash flows (euro) Note

- Page 248 and 249: Notes The Italcementi S.p.A. financ

- Page 250 and 251: 1.2. Accounting policies and basis

- Page 252 and 253: 1.7. Property, plant and equipment

- Page 254 and 255: 1.13. Inventories Inventories are m

- Page 256 and 257: Past service cost Changes in liabil

- Page 258 and 259: Interest income Interest income is

- Page 260 and 261: 2.1 Investment property Investment

- Page 262 and 263: The list of investments in subsidia

- Page 264 and 265: Current assets 6. Inventories (in t

- Page 266 and 267: Equity 12. Share capital At Decembe

- Page 268 and 269: Dividends paid Dividends approved i

- Page 270 and 271: 18. Deferred tax assets and deferre

- Page 272 and 273: 19. Net debt An itemized correlatio

- Page 274 and 275: Main bank loans and drawn and avail

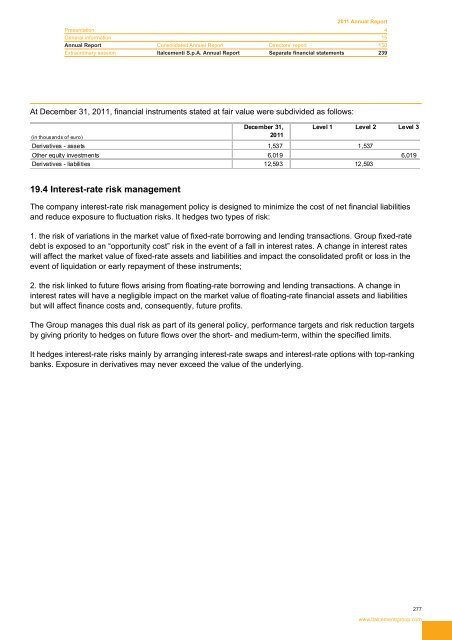

- Page 276 and 277: At December 31, 2011, the average m

- Page 280 and 281: 19.4.1 Interest-rate risk hedging T

- Page 282 and 283: ELECTRICITY In 2011, Italcementi S.

- Page 284 and 285: Income statement 23. Revenue Revenu

- Page 286 and 287: Stock options The company has set u

- Page 288 and 289: 30. Finance income (costs), exchang

- Page 290 and 291: Breakdown of receivables and payabl

- Page 292 and 293: Commitments with related parties (i

- Page 294 and 295: (Breakdown of revenue and costs wit

- Page 296 and 297: (Breakdown of revenue and costs wit

- Page 298 and 299: Impact of transactions with related

- Page 300 and 301: 34. Audit fees Pursuant to the CONS

- Page 302 and 303: Annex 1 Highlights from the most re

- Page 304 and 305: Report of the Board of Statutory Au

- Page 306 and 307: On the other hand, the absence of a

- Page 310 and 311: 308

- Page 312 and 313: Report of the Board of Directors Pr

- Page 314 and 315: Current text ordinary and/or saving

- Page 316 and 317: Current text In each list, the name

- Page 318 and 319: Current text If there are no lists,

- Page 320 and 321: Current text means of another perso

- Page 322 and 323: Current text If a subject connected

- Page 324 and 325: The proposed amendments do not gran

- Page 326 and 327: • operate, in compliance with cur

- Page 328:

Corporate bodies resulting from the