2011 Annual Report - Italcementi Group

2011 Annual Report - Italcementi Group

2011 Annual Report - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

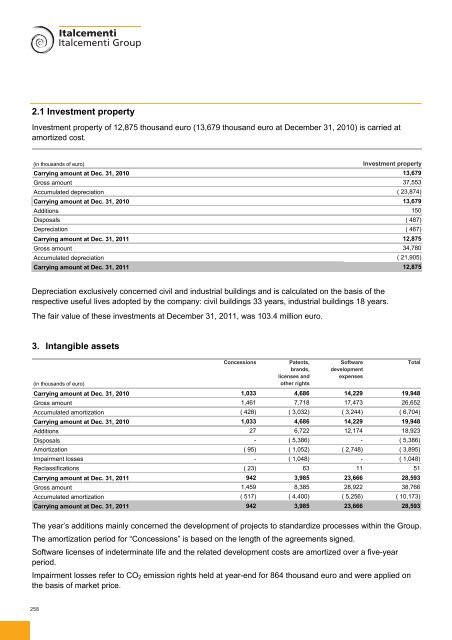

2.1 Investment property<br />

Investment property of 12,875 thousand euro (13,679 thousand euro at December 31, 2010) is carried at<br />

amortized cost.<br />

(in thousands of euro)<br />

Investment property<br />

Carrying amount at Dec. 31, 2010 13,679<br />

Gross amount 37,553<br />

Accumulated depreciation ( 23,874)<br />

Carrying amount at Dec. 31, 2010 13,679<br />

Additions 150<br />

Disposals ( 487)<br />

Depreciation ( 467)<br />

Carrying amount at Dec. 31, <strong>2011</strong> 12,875<br />

Gross amount 34,780<br />

Accumulated depreciation ( 21,905)<br />

Carrying amount at Dec. 31, <strong>2011</strong> 12,875<br />

Depreciation exclusively concerned civil and industrial buildings and is calculated on the basis of the<br />

respective useful lives adopted by the company: civil buildings 33 years, industrial buildings 18 years.<br />

The fair value of these investments at December 31, <strong>2011</strong>, was 103.4 million euro.<br />

3. Intangible assets<br />

Concessions<br />

Patents,<br />

Software<br />

Total<br />

brands,<br />

licenses and<br />

development<br />

expenses<br />

(in thousands of euro)<br />

other rights<br />

Carrying amount at Dec. 31, 2010 1,033 4,686 14,229 19,948<br />

Gross amount 1,461 7,718 17,473 26,652<br />

Accumulated amortization ( 428) ( 3,032) ( 3,244) ( 6,704)<br />

Carrying amount at Dec. 31, 2010 1,033 4,686 14,229 19,948<br />

Additions 27 6,722 12,174 18,923<br />

Disposals - ( 5,386) - ( 5,386)<br />

Amortization ( 95) ( 1,052) ( 2,748) ( 3,895)<br />

Impairment losses - ( 1,048) - ( 1,048)<br />

Reclassifications ( 23) 63 11 51<br />

Carrying amount at Dec. 31, <strong>2011</strong> 942 3,985 23,666 28,593<br />

Gross amount 1,459 8,385 28,922 38,766<br />

Accumulated amortization ( 517) ( 4,400) ( 5,256) ( 10,173)<br />

Carrying amount at Dec. 31, <strong>2011</strong> 942 3,985 23,666 28,593<br />

The year’s additions mainly concerned the development of projects to standardize processes within the <strong>Group</strong>.<br />

The amortization period for “Concessions” is based on the length of the agreements signed.<br />

Software licenses of indeterminate life and the related development costs are amortized over a five-year<br />

period.<br />

Impairment losses refer to CO 2 emission rights held at year-end for 864 thousand euro and were applied on<br />

the basis of market price.<br />

258