palfinger at a glance

palfinger at a glance

palfinger at a glance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

search Print<br />

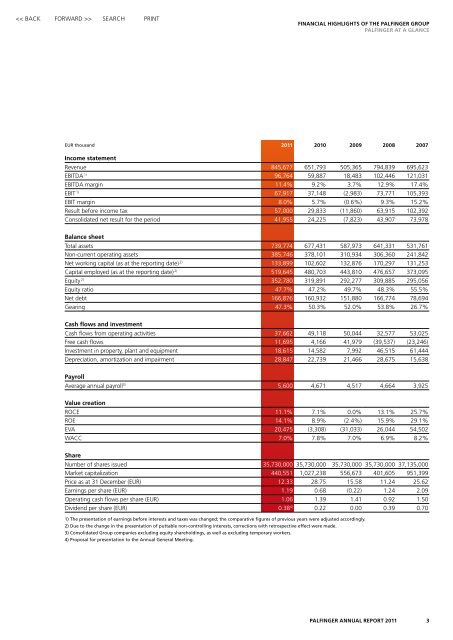

Financial Highlights of the PALFINGER Group<br />

<strong>palfinger</strong> <strong>at</strong> a Glance<br />

EUR thousand 2011 2010 2009 2008 2007<br />

Income st<strong>at</strong>ement<br />

Revenue 845,677 651,793 505,365 794,839 695,623<br />

EBITDA 1) 96,764 59,887 18,483 102,446 121,031<br />

EBITDA margin 11.4% 9.2% 3.7% 12.9% 17.4%<br />

EBIT 1) 67,917 37,148 (2,983) 73,771 105,393<br />

EBIT margin 8.0% 5.7% (0.6%) 9.3% 15.2%<br />

Result before income tax 57,000 29,833 (11,860) 63,915 102,392<br />

Consolid<strong>at</strong>ed net result for the period 41,955 24,225 (7,823) 43,907 73,978<br />

Balance sheet<br />

Total assets 739,774 677,431 587,973 641,331 531,761<br />

Non-current oper<strong>at</strong>ing assets 385,746 378,101 310,934 306,360 241,842<br />

Net working capital (as <strong>at</strong> the reporting d<strong>at</strong>e) 2) 133,899 102,602 132,876 170,297 131,253<br />

Capital employed (as <strong>at</strong> the reporting d<strong>at</strong>e) 2) 519,645 480,703 443,810 476,657 373,095<br />

Equity 2) 352,780 319,891 292,277 309,885 295,056<br />

Equity r<strong>at</strong>io 47.7% 47.2% 49.7% 48.3% 55.5%<br />

Net debt 166,876 160,932 151,880 166,774 78,694<br />

Gearing 47.3% 50.3% 52.0% 53.8% 26.7%<br />

Cash flows and investment<br />

Cash flows from oper<strong>at</strong>ing activities 37,662 49,118 50,044 32,577 53,025<br />

Free cash flows 11,695 4,166 41,979 (39,537) (23,246)<br />

Investment in property, plant and equipment 18,615 14,582 7,992 46,515 61,444<br />

Depreci<strong>at</strong>ion, amortiz<strong>at</strong>ion and impairment 28,847 22,739 21,466 28,675 15,638<br />

Payroll<br />

Average annual payroll 3) 5,600 4,671 4,517 4,664 3,925<br />

Value cre<strong>at</strong>ion<br />

ROCE 11.1% 7.1% 0.0% 13.1% 25.7%<br />

ROE 14.1% 8.9% (2.4%) 15.9% 29.1%<br />

EVA 20,475 (3,308) (31,033) 26,044 54,502<br />

wacc 7.0% 7.8% 7.0% 6.9% 8.2%<br />

Share<br />

Number of shares issued 35,730,000 35,730,000 35,730,000 35,730,000 37,135,000<br />

Market capitaliz<strong>at</strong>ion 440,551 1,027,238 556,673 401,605 951,399<br />

Price as <strong>at</strong> 31 December (EUR) 12.33 28.75 15.58 11.24 25.62<br />

Earnings per share (EUR) 1.19 0.68 (0.22) 1.24 2.09<br />

Oper<strong>at</strong>ing cash flows per share (EUR) 1.06 1.39 1.41 0.92 1.50<br />

Dividend per share (EUR) 0.38 4) 0.22 0.00 0.39 0.70<br />

1) The present<strong>at</strong>ion of earnings before interests and taxes was changed; the compar<strong>at</strong>ive figures of previous years were adjusted accordingly.<br />

2) Due to the change in the present<strong>at</strong>ion of puttable non-controlling interests, corrections with retrospective effect were made.<br />

3) Consolid<strong>at</strong>ed Group companies excluding equity shareholdings, as well as excluding temporary workers.<br />

4) Proposal for present<strong>at</strong>ion to the Annual General Meeting.<br />

<strong>palfinger</strong> Annual Report 2011<br />

3