palfinger at a glance

palfinger at a glance

palfinger at a glance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

search Print<br />

Financial Position, Cash Flows and Result of Oper<strong>at</strong>ions<br />

conSoliD<strong>at</strong>eD MANAGEMENT REPORT / PERFORMANCE OF PALFINGER<br />

Cash flows<br />

The funds reported in the st<strong>at</strong>ement of cash flows correspond to the balance sheet item cash and<br />

cash equivalents.<br />

In the 2011 financial year, cash flows from oper<strong>at</strong>ing activities amounted to EUR 37.7 million,<br />

compared to EUR 49.1 million in the previous year. This change was caused by a clearly positive<br />

result before income tax posted in 2011, the reverse effects from the necessary augment<strong>at</strong>ion of<br />

inventories in connection with the expanded business volume and an increase in tax burden due to<br />

the improved earnings situ<strong>at</strong>ion.<br />

Cash outflows for investing activities came to EUR 34.6 million, which is 36.0 per cent below<br />

the previous year’s figure of EUR 54.1 million. While investments in acquisitions of companies were<br />

significantly lower, amounting to EUR 11.5 million (previous year: EUR 36.3 million), replacement<br />

investments in property, plant and equipment and intangible assets were stepped up.<br />

The described effects arising from the cash flows for oper<strong>at</strong>ing activities and investing activities<br />

resulted in higher free cash flows of EUR 11.7 million in 2011, after EUR 4.2 million in the 2010<br />

financial year.<br />

Despite the effect of the dividend payment in 2011, cash outflows for financing activities<br />

decreased by EUR 8.7 million to EUR 3.9 million (previous year: EUR 12.6 million) due to additional<br />

long-term credit being taken out.<br />

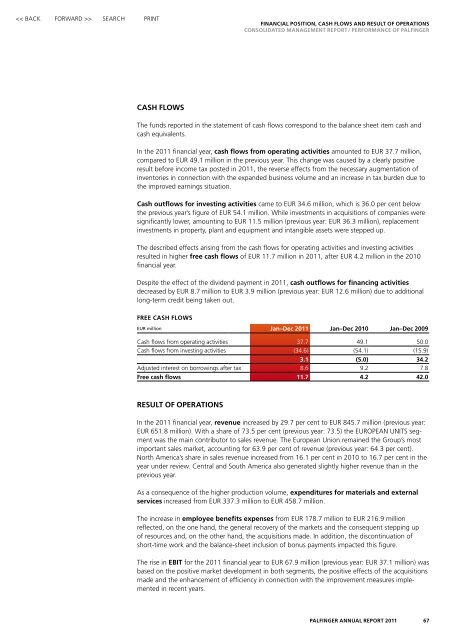

Free cash flows<br />

EUR million Jan–Dec 2011 Jan–Dec 2010 Jan–Dec 2009<br />

Cash flows from oper<strong>at</strong>ing activities 37.7 49.1 50.0<br />

Cash flows from investing activities (34.6) (54.1) (15.9)<br />

3.1 (5.0) 34.2<br />

Adjusted interest on borrowings after tax 8.6 9.2 7.8<br />

Free cash flows 11.7 4.2 42.0<br />

Result of oper<strong>at</strong>ions<br />

In the 2011 financial year, revenue increased by 29.7 per cent to EUR 845.7 million (previous year:<br />

EUR 651.8 million). With a share of 73.5 per cent (previous year: 73.5) the EUROPEAN UNITS segment<br />

was the main contributor to sales revenue. The European Union remained the Group’s most<br />

important sales market, accounting for 63.9 per cent of revenue (previous year: 64.3 per cent).<br />

North America’s share in sales revenue increased from 16.1 per cent in 2010 to 16.7 per cent in the<br />

year under review. Central and South America also gener<strong>at</strong>ed slightly higher revenue than in the<br />

previous year.<br />

As a consequence of the higher production volume, expenditures for m<strong>at</strong>erials and external<br />

services increased from EUR 337.3 million to EUR 458.7 million.<br />

The increase in employee benefits expenses from EUR 178.7 million to EUR 216.9 million<br />

reflected, on the one hand, the general recovery of the markets and the consequent stepping up<br />

of resources and, on the other hand, the acquisitions made. In addition, the discontinu<strong>at</strong>ion of<br />

short-time work and the balance-sheet inclusion of bonus payments impacted this figure.<br />

The rise in EBIT for the 2011 financial year to EUR 67.9 million (previous year: EUR 37.1 million) was<br />

based on the positive market development in both segments, the positive effects of the acquisitions<br />

made and the enhancement of efficiency in connection with the improvement measures implemented<br />

in recent years.<br />

<strong>palfinger</strong> Annual Report 2011<br />

67