as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26<br />

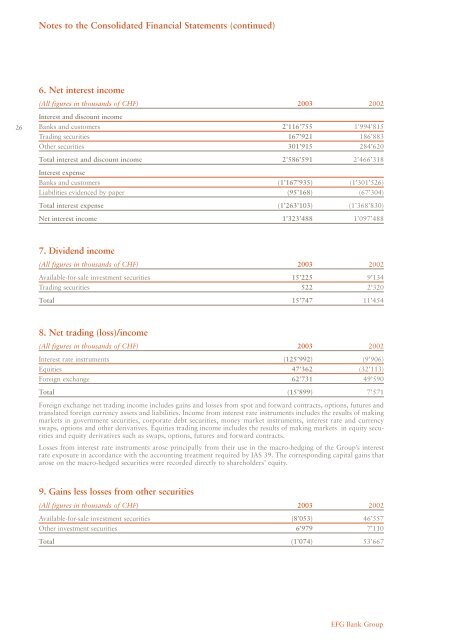

Notes to the Consolid<strong>at</strong>ed Financial St<strong>at</strong>ements (continued)<br />

6. Net interest income<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

Interest and discount income<br />

<strong>Bank</strong>s and customers 2’116’755 1’994’815<br />

Trading securities 167’921 186’883<br />

Other securities 301’915 284’620<br />

Total interest and discount income 2’586’591 2’466’<strong>31</strong>8<br />

Interest expense<br />

<strong>Bank</strong>s and customers (1’167’935) (1’301’526)<br />

Liabilities evidenced by paper (95’168) (67’304)<br />

Total interest expense (1’263’103) (1’368’830)<br />

Net interest income 1’323’488 1’097’488<br />

7. Dividend income<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

Available-for-sale investment securities 15’225 9’134<br />

Trading securities 522 2’320<br />

Total 15’747 11’454<br />

8. Net trading (loss)/income<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

Interest r<strong>at</strong>e instruments (125’992) (9’906)<br />

Equities 47’362 (32’113)<br />

Foreign exchange 62’7<strong>31</strong> 49’590<br />

Total (15’899) 7’571<br />

Foreign exchange net trading income includes gains and losses from spot and forward contracts, options, futures and<br />

transl<strong>at</strong>ed foreign currency <strong>as</strong>sets and liabilities. Income from interest r<strong>at</strong>e instruments includes the results of making<br />

markets in government securities, corpor<strong>at</strong>e debt securities, money market instruments, interest r<strong>at</strong>e and currency<br />

swaps, options and other deriv<strong>at</strong>ives. Equities trading income includes the results of making markets in equity securities<br />

and equity deriv<strong>at</strong>ives such <strong>as</strong> swaps, options, futures and forward contracts.<br />

Losses from interest r<strong>at</strong>e instruments arose principally from their use in the macro-hedging of the <strong>Group</strong>’s interest<br />

r<strong>at</strong>e exposure in accordance with the accounting tre<strong>at</strong>ment required by IAS 39. The corresponding capital gains th<strong>at</strong><br />

arose on the macro-hedged securities were recorded directly to shareholders’ equity.<br />

9. Gains less losses from other securities<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

Available-for-sale investment securities (8’053) 46’557<br />

Other investment securities 6’979 7’110<br />

Total (1’074) 53’667<br />

<strong>EFG</strong> <strong>Bank</strong> <strong>Group</strong>