as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolid<strong>at</strong>ed Financial St<strong>at</strong>ements (continued)<br />

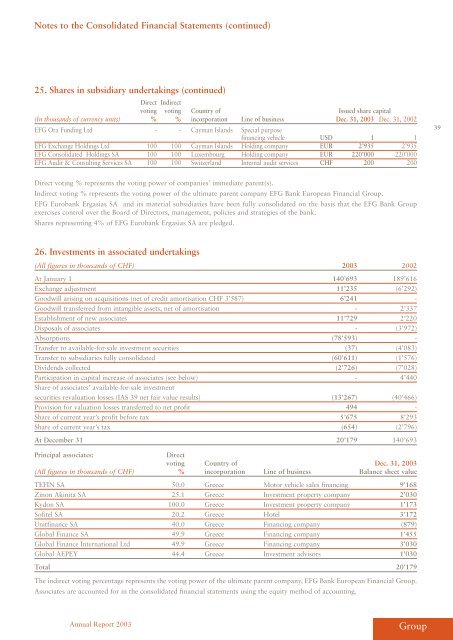

25. Shares in subsidiary undertakings (continued)<br />

Direct Indirect<br />

voting voting Country of Issued share capital<br />

(In thousands of currency units) % % incorpor<strong>at</strong>ion Line of business Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

<strong>EFG</strong> Ora Funding Ltd - - Cayman Islands Special purpose<br />

financing vehicle USD 1 1<br />

<strong>EFG</strong> Exchange Holdings Ltd 100 100 Cayman Islands Holding company EUR 2’935 2’935<br />

<strong>EFG</strong> Consolid<strong>at</strong>ed Holdings SA 100 100 Luxembourg Holding company EUR 220’000 220’000<br />

<strong>EFG</strong> Audit & Consulting Services SA 100 100 Switzerland Internal audit services CHF 200 200<br />

Direct voting % represents the voting power of companies’ immedi<strong>at</strong>e parent(s).<br />

Indirect voting % represents the voting power of the ultim<strong>at</strong>e parent company <strong>EFG</strong> <strong>Bank</strong> European Financial <strong>Group</strong>.<br />

<strong>EFG</strong> Eurobank Erg<strong>as</strong>i<strong>as</strong> SA and its m<strong>at</strong>erial subsidiaries have been fully consolid<strong>at</strong>ed on the b<strong>as</strong>is th<strong>at</strong> the <strong>EFG</strong> <strong>Bank</strong> <strong>Group</strong><br />

exercises control over the Board of Directors, management, policies and str<strong>at</strong>egies of the bank.<br />

Shares representing 4% of <strong>EFG</strong> Eurobank Erg<strong>as</strong>i<strong>as</strong> SA are pledged.<br />

26. Investments in <strong>as</strong>soci<strong>at</strong>ed undertakings<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

At January 1 140’693 189’616<br />

Exchange adjustment 11’235 (6’292)<br />

Goodwill arising on acquisitions (net of credit amortis<strong>at</strong>ion CHF 3’587) 6’241 -<br />

Goodwill transferred from intangible <strong>as</strong>sets, net of amortis<strong>at</strong>ion - 2’337<br />

Establishment of new <strong>as</strong>soci<strong>at</strong>es 11’729 2’220<br />

Disposals of <strong>as</strong>soci<strong>at</strong>es - (3’972)<br />

Absorptions (78’593) -<br />

Transfer to available-for-sale investment securities (37) (4’083)<br />

Transfer to subsidiaries fully consolid<strong>at</strong>ed (60’611) (1’576)<br />

Dividends collected (2’726) (7’028)<br />

Particip<strong>at</strong>ion in capital incre<strong>as</strong>e of <strong>as</strong>soci<strong>at</strong>es (see below) - 4’440<br />

Share of <strong>as</strong>soci<strong>at</strong>es’ available-for-sale investment<br />

securities revalu<strong>at</strong>ion losses (IAS 39 net fair value results) (13’267) (40’466)<br />

Provision for valu<strong>at</strong>ion losses transferred to net profit 494 -<br />

Share of current year’s profit before tax 5’675 8’293<br />

Share of current year’s tax (654) (2’796)<br />

At <strong>December</strong> <strong>31</strong> 20’179 140’693<br />

Principal <strong>as</strong>soci<strong>at</strong>es: Direct<br />

voting Country of Dec. <strong>31</strong>, <strong>2003</strong><br />

(All figures in thousands of CHF) % incorpor<strong>at</strong>ion Line of business Balance sheet value<br />

TEFIN SA 50.0 Greece Motor vehicle sales financing 9’168<br />

Zinon Akinita SA 25.1 Greece Investment property company 2’030<br />

Kydon SA 100.0 Greece Investment property company 1’173<br />

Sofitel SA 20.2 Greece Hotel 3’172<br />

Unitfinance SA 40.0 Greece Financing company (879)<br />

Global Finance SA 49.9 Greece Financing company 1’455<br />

Global Finance Intern<strong>at</strong>ional Ltd 49.9 Greece Financing company 3’030<br />

Global AEPEY 44.4 Greece Investment advisors 1’030<br />

Total 20’179<br />

The indirect voting percentage represents the voting power of the ultim<strong>at</strong>e parent company, <strong>EFG</strong> <strong>Bank</strong> European Financial <strong>Group</strong>.<br />

Associ<strong>at</strong>es are accounted for in the consolid<strong>at</strong>ed financial st<strong>at</strong>ements using the equity method of accounting.<br />

Annual Report <strong>2003</strong><br />

<strong>Group</strong><br />

39