as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

40<br />

Notes to the Consolid<strong>at</strong>ed Financial St<strong>at</strong>ements (continued)<br />

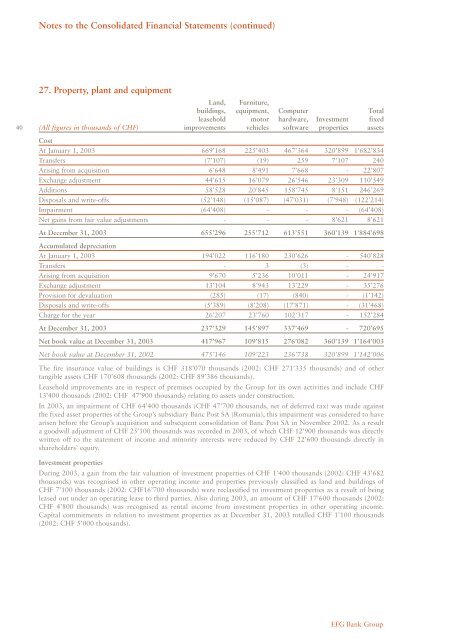

27. Property, plant and equipment<br />

Land, Furniture,<br />

buildings, equipment, Computer Total<br />

le<strong>as</strong>ehold motor hardware, Investment fixed<br />

(All figures in thousands of CHF) improvements vehicles software properties <strong>as</strong>sets<br />

Cost<br />

At January 1, <strong>2003</strong> 669’168 225’403 467’364 320’899 1’682’834<br />

Transfers (7’107) (19) 259 7’107 240<br />

Arising from acquisition 6’648 8’491 7’668 - 22’807<br />

Exchange adjustment 44’615 16’079 26’546 23’309 110’549<br />

Additions 58’528 20’845 158’745 8’151 246’269<br />

Disposals and write-offs (52’148) (15’087) (47’0<strong>31</strong>) (7’948) (122’214)<br />

Impairment (64’408) - - - (64’408)<br />

Net gains from fair value adjustments - - - 8’621 8’621<br />

At <strong>December</strong> <strong>31</strong>, <strong>2003</strong> 655’296 255’712 613’551 360’139 1’884’698<br />

Accumul<strong>at</strong>ed depreci<strong>at</strong>ion<br />

At January 1, <strong>2003</strong> 194’022 116’180 230’626 - 540’828<br />

Transfers - 3 (3) - -<br />

Arising from acquisition 9’670 5’236 10’011 - 24’917<br />

Exchange adjustment 13’104 8’943 13’229 - 35’276<br />

Provision for devalu<strong>at</strong>ion (285) (17) (840) - (1’142)<br />

Disposals and write-offs (5’389) (8’208) (17’871) - (<strong>31</strong>’468)<br />

Charge for the year 26’207 23’760 102’<strong>31</strong>7 - 152’284<br />

At <strong>December</strong> <strong>31</strong>, <strong>2003</strong> 237’329 145’897 337’469 - 720’695<br />

Net book value <strong>at</strong> <strong>December</strong> <strong>31</strong>, <strong>2003</strong> 417’967 109’815 276’082 360’139 1’164’003<br />

Net book value <strong>at</strong> <strong>December</strong> <strong>31</strong>, 2002 475’146 109’223 236’738 320’899 1’142’006<br />

The fire insurance value of buildings is CHF <strong>31</strong>8’070 thousands (2002: CHF 271’335 thousands) and of other<br />

tangible <strong>as</strong>sets CHF 170’608 thousands (2002: CHF 89’386 thousands).<br />

Le<strong>as</strong>ehold improvements are in respect of premises occupied by the <strong>Group</strong> for its own activities and include CHF<br />

13’400 thousands (2002: CHF 47’900 thousands) rel<strong>at</strong>ing to <strong>as</strong>sets under construction.<br />

In <strong>2003</strong>, an impairment of CHF 64’400 thousands (CHF 47’700 thousands, net of deferred tax) w<strong>as</strong> made against<br />

the fixed <strong>as</strong>set properties of the <strong>Group</strong>’s subsidiary Banc Post SA (Romania), this impairment w<strong>as</strong> considered to have<br />

arisen before the <strong>Group</strong>’s acquisition and subsequent consolid<strong>at</strong>ion of Banc Post SA in November 2002. As a result<br />

a goodwill adjustment of CHF 25’100 thousands w<strong>as</strong> recorded in <strong>2003</strong>, of which CHF 12’900 thousands w<strong>as</strong> directly<br />

written off to the st<strong>at</strong>ement of income and minority interests were reduced by CHF 22’600 thousands directly in<br />

shareholders’ equity.<br />

Investment properties<br />

During <strong>2003</strong>, a gain from the fair valu<strong>at</strong>ion of investment properties of CHF 1’400 thousands (2002: CHF 43’682<br />

thousands) w<strong>as</strong> recognised in other oper<strong>at</strong>ing income and properties previously cl<strong>as</strong>sified <strong>as</strong> land and buildings of<br />

CHF 7’100 thousands (2002: CHF16’700 thousands) were recl<strong>as</strong>sified to investment properties <strong>as</strong> a result of being<br />

le<strong>as</strong>ed out under an oper<strong>at</strong>ing le<strong>as</strong>e to third parties. Also during <strong>2003</strong>, an amount of CHF 17’600 thousands (2002:<br />

CHF 4’800 thousands) w<strong>as</strong> recognised <strong>as</strong> rental income from investment properties in other oper<strong>at</strong>ing income.<br />

Capital commitments in rel<strong>at</strong>ion to investment properties <strong>as</strong> <strong>at</strong> <strong>December</strong> <strong>31</strong>, <strong>2003</strong> totalled CHF 1’100 thousands<br />

(2002: CHF 5’000 thousands).<br />

<strong>EFG</strong> <strong>Bank</strong> <strong>Group</strong>