as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolid<strong>at</strong>ed Financial St<strong>at</strong>ements (continued)<br />

45. Fair values of financial <strong>as</strong>sets and liabilities<br />

Fair value is the amount for which an <strong>as</strong>set could be exchanged or a liability settled, between knowledgeable, willing<br />

parties in an arm’s length transaction. A market price, where an active market (such <strong>as</strong> a recognised stock exchange)<br />

exists, is the best evidence of the fair value of a financial instrument. However, market prices are not available for a<br />

significant number of financial <strong>as</strong>sets and liabilities held and issued by the <strong>Group</strong>. Therefore, for financial instruments<br />

where no market price is available, the fair values are estim<strong>at</strong>ed using present value or other estim<strong>at</strong>ion and valu<strong>at</strong>ion<br />

techniques b<strong>as</strong>ed on current prevailing market conditions.<br />

The values derived using these techniques are significantly affected by underlying <strong>as</strong>sumptions concerning both the<br />

amounts and timing of future c<strong>as</strong>h flows and the discount r<strong>at</strong>es used. The following methods and <strong>as</strong>sumptions<br />

indic<strong>at</strong>e th<strong>at</strong> the fair values of financial <strong>as</strong>sets and liabilities approxim<strong>at</strong>e their carrying amounts:<br />

a) Trading <strong>as</strong>sets, deriv<strong>at</strong>ives and other transactions undertaken for trading purposes <strong>as</strong> well tre<strong>as</strong>ury bills and<br />

available-for-sale securities are me<strong>as</strong>ured <strong>at</strong> fair value (see notes 16, 18, 19 and 23) by reference to quoted market<br />

prices when available. If quoted market prices are not available, then the fair values are estim<strong>at</strong>ed on the b<strong>as</strong>is of<br />

discounted c<strong>as</strong>h flows. Furthermore, investment properties which comprise freehold land and buildings are carried <strong>at</strong><br />

fair value. Fair value is b<strong>as</strong>ed on active market prices.<br />

b) A significant amount of the <strong>Group</strong>’s other financial <strong>as</strong>sets and liabilities are <strong>at</strong> flo<strong>at</strong>ing r<strong>at</strong>es of interest, which<br />

re-price <strong>at</strong> frequent intervals. Therefore, the <strong>Group</strong> h<strong>as</strong> no significant exposure to fair value fluctu<strong>at</strong>ions and the<br />

carrying value of the financial <strong>as</strong>sets and liabilities is similar to their fair value <strong>as</strong> applicable, unless otherwise st<strong>at</strong>ed.<br />

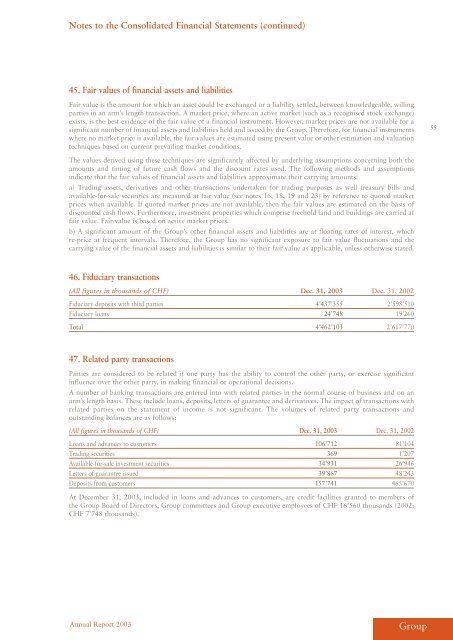

46. Fiduciary transactions<br />

(All figures in thousands of CHF) Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

Fiduciary deposits with third parties 4’437’355 2’598’510<br />

Fiduciary loans 24’748 19’260<br />

Total 4’462’103 2’617’770<br />

47. Rel<strong>at</strong>ed party transactions<br />

Parties are considered to be rel<strong>at</strong>ed if one party h<strong>as</strong> the ability to control the other party, or exercise significant<br />

influence over the other party, in making financial or oper<strong>at</strong>ional decisions.<br />

A number of banking transactions are entered into with rel<strong>at</strong>ed parties in the normal course of business and on an<br />

arm’s length b<strong>as</strong>is. These include loans, deposits, letters of guarantee and deriv<strong>at</strong>ives. The impact of transactions with<br />

rel<strong>at</strong>ed parties on the st<strong>at</strong>ement of income is not significant. The volumes of rel<strong>at</strong>ed party transactions and<br />

outstanding balances are <strong>as</strong> follows:<br />

(All figures in thousands of CHF) Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

Loans and advances to customers 106’712 81’104<br />

Trading securities 369 1’207<br />

Available-for-sale investment securities 34’9<strong>31</strong> 26’946<br />

Letters of guarantee issued 39’867 48’243<br />

Deposits from customers 157’741 465’670<br />

At <strong>December</strong> <strong>31</strong>, <strong>2003</strong>, included in loans and advances to customers, are credit facilities granted to members of<br />

the <strong>Group</strong> Board of Directors, <strong>Group</strong> committees and <strong>Group</strong> executive employees of CHF 16’560 thousands (2002:<br />

CHF 7’748 thousands).<br />

Annual Report <strong>2003</strong><br />

<strong>Group</strong><br />

55