as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

70<br />

Notes to the Financial St<strong>at</strong>ements (continued)<br />

Buildings are recorded in the balance sheet <strong>at</strong><br />

their acquisition price.<br />

Other fixed <strong>as</strong>sets are depreci<strong>at</strong>ed on a straightline<br />

b<strong>as</strong>is over their estim<strong>at</strong>ed useful economic<br />

life, which are <strong>as</strong> follows:<br />

- Fixture and fittings : between 5 and 10 years;<br />

- Computers and telecommunic<strong>at</strong>ions equipment:<br />

between 3 and 4 years;<br />

- Other fixed <strong>as</strong>sets : between 5 and 10 years.<br />

Valu<strong>at</strong>ion adjustments and provisions<br />

Value of <strong>as</strong>sets, including loans, is adjusted when<br />

a prolonged impairment in value of these <strong>as</strong>sets is<br />

identified, in accordance with the general<br />

principle of prudence. In addition, loans are riskevalu<strong>at</strong>ed<br />

according to the domicile of the risk.<br />

Provisions are set up to cover each additional<br />

probable, m<strong>at</strong>erial liability th<strong>at</strong> h<strong>as</strong> been<br />

identified in respect of situ<strong>at</strong>ions existing <strong>at</strong> the<br />

d<strong>at</strong>e of the balance sheet, in accordance with to<br />

the general principle of prudence.<br />

Taxes<br />

Provisions are set up for taxes due on net<br />

income, but not yet paid, and included in the<br />

balance sheet under “Accrued liabilities”.<br />

Reserve for general banking risks<br />

The reserve for general banking risks is,<br />

according to Art. 11a of the Swiss <strong>Bank</strong>ing<br />

Ordinance, considered <strong>as</strong> part of the<br />

shareholders’ equity of the <strong>Bank</strong>.<br />

Foreign currencies<br />

Assets and liabilities denomin<strong>at</strong>ed in foreign<br />

currencies on the balance sheet are transl<strong>at</strong>ed into<br />

Swiss francs <strong>at</strong> the year-end market exchange<br />

r<strong>at</strong>es.<br />

Transactions in foreign currency are transl<strong>at</strong>ed<br />

into Swiss francs <strong>at</strong> the r<strong>at</strong>es prevailing on the<br />

d<strong>at</strong>es of the transactions.<br />

Foreign currency positions are marked to market<br />

and the result taken to the st<strong>at</strong>ement of income.<br />

Currency swaps, which are used for hedging<br />

foreign currency loans, are valued under the<br />

accrual method.<br />

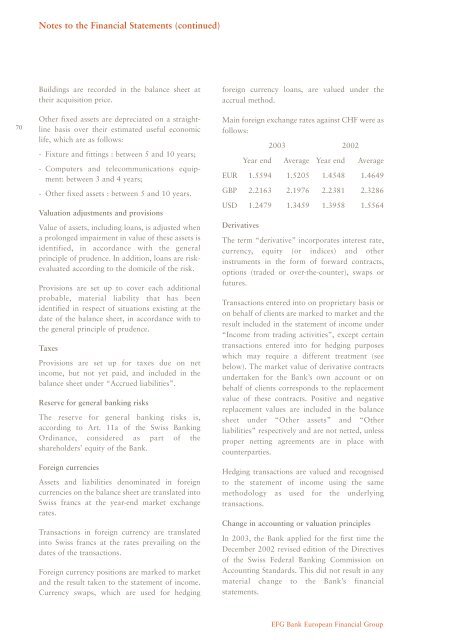

Main foreign exchange r<strong>at</strong>es against CHF were <strong>as</strong><br />

follows:<br />

<strong>2003</strong> 2002<br />

Year end Average Year end Average<br />

EUR 1.5594 1.5205 1.4548 1.4649<br />

GBP 2.2163 2.1976 2.2381 2.3286<br />

USD 1.2479 1.3459 1.3958 1.5564<br />

Deriv<strong>at</strong>ives<br />

The term “deriv<strong>at</strong>ive” incorpor<strong>at</strong>es interest r<strong>at</strong>e,<br />

currency, equity (or indices) and other<br />

instruments in the form of forward contracts,<br />

options (traded or over-the-counter), swaps or<br />

futures.<br />

Transactions entered into on proprietary b<strong>as</strong>is or<br />

on behalf of clients are marked to market and the<br />

result included in the st<strong>at</strong>ement of income under<br />

“Income from trading activities”, except certain<br />

transactions entered into for hedging purposes<br />

which may require a different tre<strong>at</strong>ment (see<br />

below). The market value of deriv<strong>at</strong>ive contracts<br />

undertaken for the <strong>Bank</strong>’s own account or on<br />

behalf of clients corresponds to the replacement<br />

value of these contracts. Positive and neg<strong>at</strong>ive<br />

replacement values are included in the balance<br />

sheet under “Other <strong>as</strong>sets” and “Other<br />

liabilities” respectively and are not netted, unless<br />

proper netting agreements are in place with<br />

counterparties.<br />

Hedging transactions are valued and recognised<br />

to the st<strong>at</strong>ement of income using the same<br />

methodology <strong>as</strong> used for the underlying<br />

transactions.<br />

Change in accounting or valu<strong>at</strong>ion principles<br />

In <strong>2003</strong>, the <strong>Bank</strong> applied for the first time the<br />

<strong>December</strong> 2002 revised edition of the Directives<br />

of the Swiss Federal <strong>Bank</strong>ing Commission on<br />

Accounting Standards. This did not result in any<br />

m<strong>at</strong>erial change to the <strong>Bank</strong>’s financial<br />

st<strong>at</strong>ements.<br />

<strong>EFG</strong> <strong>Bank</strong> European Financial <strong>Group</strong>