as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

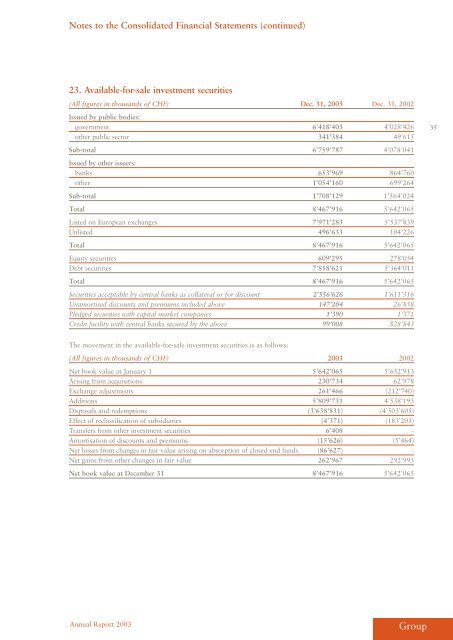

Notes to the Consolid<strong>at</strong>ed Financial St<strong>at</strong>ements (continued)<br />

23. Available-for-sale investment securities<br />

(All figures in thousands of CHF) Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

Issued by public bodies:<br />

government 6’418’403 4’028’426<br />

other public sector 341’384 49’615<br />

Sub-total 6’759’787 4’078’041<br />

Issued by other issuers:<br />

banks 653’969 864’760<br />

other 1’054’160 699’264<br />

Sub-total 1’708’129 1’564’024<br />

Total 8’467’916 5’642’065<br />

Listed on European exchanges 7’971’283 5’537’839<br />

Unlisted 496’633 104’226<br />

Total 8’467’916 5’642’065<br />

Equity securities 609’295 278’054<br />

Debt securities 7’858’621 5’364’011<br />

Total 8’467’916 5’642’065<br />

Securities acceptable by central banks <strong>as</strong> coll<strong>at</strong>eral or for discount 2’556’626 1’611’<strong>31</strong>6<br />

Unamortised discounts and premiums included above 147’204 26’858<br />

Pledged securities with capital market companies 1’390 1’371<br />

Credit facility with central banks secured by the above 99’008 828’843<br />

The movement in the available-for-sale investment securities is <strong>as</strong> follows:<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

Net book value <strong>at</strong> January 1 5’642’065 5’652’913<br />

Arising from acquisitions 230’734 62’978<br />

Exchange adjustments 261’466 (212’740)<br />

Additions 5’809’7<strong>31</strong> 4’538’193<br />

Disposals and redemptions (3’638’8<strong>31</strong>) (4’503’605)<br />

Effect of recl<strong>as</strong>sific<strong>at</strong>ion of subsidiaries (4’371) (183’203)<br />

Transfers from other investment securities 6’408 -<br />

Amortis<strong>at</strong>ion of discounts and premiums (15’626) (5’464)<br />

Net losses from changes in fair value arising on absorption of closed-end funds (86’627) -<br />

Net gains from other changes in fair value 262’967 292’993<br />

Net book value <strong>at</strong> <strong>December</strong> <strong>31</strong> 8’467’916 5’642’065<br />

Annual Report <strong>2003</strong><br />

<strong>Group</strong><br />

35