as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28<br />

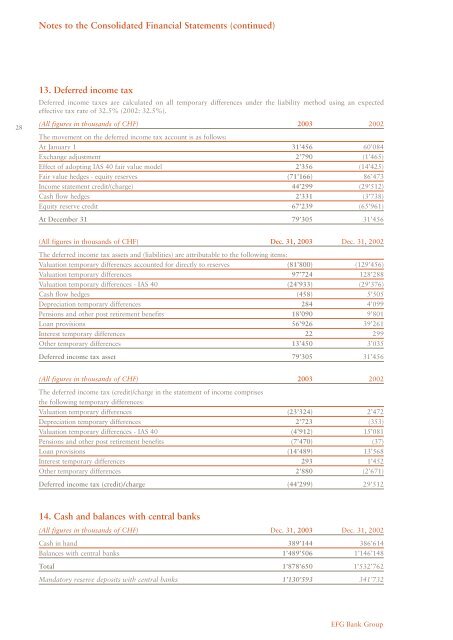

Notes to the Consolid<strong>at</strong>ed Financial St<strong>at</strong>ements (continued)<br />

13. Deferred income tax<br />

Deferred income taxes are calcul<strong>at</strong>ed on all temporary differences under the liability method using an expected<br />

effective tax r<strong>at</strong>e of 32.5% (2002: 32.5%).<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

The movement on the deferred income tax account is <strong>as</strong> follows:<br />

At January 1 <strong>31</strong>’456 60’084<br />

Exchange adjustment 2’790 (1’465)<br />

Effect of adopting IAS 40 fair value model 2’356 (14’425)<br />

Fair value hedges - equity reserves (71’166) 86’473<br />

Income st<strong>at</strong>ement credit/(charge) 44’299 (29’512)<br />

C<strong>as</strong>h flow hedges 2’3<strong>31</strong> (3’738)<br />

Equity reserve credit 67’239 (65’961)<br />

At <strong>December</strong> <strong>31</strong> 79’305 <strong>31</strong>’456<br />

(All figures in thousands of CHF) Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

The deferred income tax <strong>as</strong>sets and (liabilities) are <strong>at</strong>tributable to the following items:<br />

Valu<strong>at</strong>ion temporary differences accounted for directly to reserves (81’800) (129’456)<br />

Valu<strong>at</strong>ion temporary differences 97’724 128’288<br />

Valu<strong>at</strong>ion temporary differences - IAS 40 (24’933) (29’376)<br />

C<strong>as</strong>h flow hedges (458) 5’505<br />

Depreci<strong>at</strong>ion temporary differences 284 4’099<br />

Pensions and other post retirement benefits 18’090 9’801<br />

Loan provisions 56’926 39’261<br />

Interest temporary differences 22 299<br />

Other temporary differences 13’450 3’035<br />

Deferred income tax <strong>as</strong>set 79’305 <strong>31</strong>’456<br />

(All figures in thousands of CHF) <strong>2003</strong> 2002<br />

The deferred income tax (credit)/charge in the st<strong>at</strong>ement of income comprises<br />

the following temporary differences:<br />

Valu<strong>at</strong>ion temporary differences (23’324) 2’472<br />

Depreci<strong>at</strong>ion temporary differences 2’723 (353)<br />

Valu<strong>at</strong>ion temporary differences - IAS 40 (4’912) 15’081<br />

Pensions and other post retirement benefits (7’470) (37)<br />

Loan provisions (14’489) 13’568<br />

Interest temporary differences 293 1’452<br />

Other temporary differences 2’880 (2’671)<br />

Deferred income tax (credit)/charge (44’299) 29’512<br />

14. C<strong>as</strong>h and balances with central banks<br />

(All figures in thousands of CHF) Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

C<strong>as</strong>h in hand 389’144 386’614<br />

Balances with central banks 1’489’506 1’146’148<br />

Total 1’878’650 1’532’762<br />

Mand<strong>at</strong>ory reserve deposits with central banks 1’130’593 341’732<br />

<strong>EFG</strong> <strong>Bank</strong> <strong>Group</strong>