as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

as at December 31, 2003 - EFG Bank Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolid<strong>at</strong>ed Financial St<strong>at</strong>ements (continued)<br />

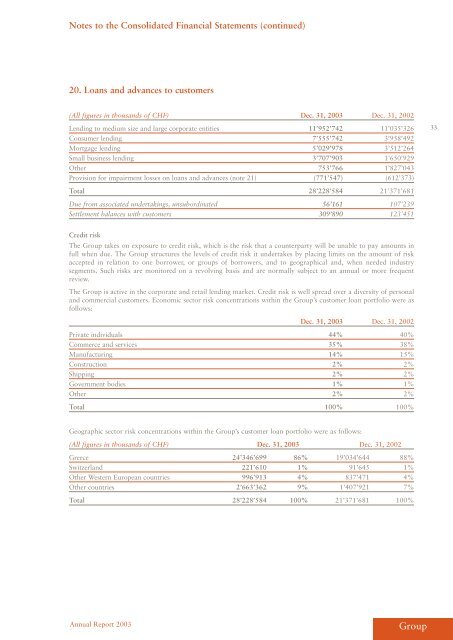

20. Loans and advances to customers<br />

(All figures in thousands of CHF) Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

Lending to medium size and large corpor<strong>at</strong>e entities 11’952’742 11’035’326<br />

Consumer lending 7’555’742 3’958’492<br />

Mortgage lending 5’029’978 3’512’264<br />

Small business lending 3’707’903 1’650’929<br />

Other 753’766 1’827’043<br />

Provision for impairment losses on loans and advances (note 21) (771’547) (612’373)<br />

Total 28’228’584 21’371’681<br />

Due from <strong>as</strong>soci<strong>at</strong>ed undertakings, unsubordin<strong>at</strong>ed 56’161 107’239<br />

Settlement balances with customers 309’890 123’451<br />

Credit risk<br />

The <strong>Group</strong> takes on exposure to credit risk, which is the risk th<strong>at</strong> a counterparty will be unable to pay amounts in<br />

full when due. The <strong>Group</strong> structures the levels of credit risk it undertakes by placing limits on the amount of risk<br />

accepted in rel<strong>at</strong>ion to one borrower, or groups of borrowers, and to geographical and, when needed industry<br />

segments. Such risks are monitored on a revolving b<strong>as</strong>is and are normally subject to an annual or more frequent<br />

review.<br />

The <strong>Group</strong> is active in the corpor<strong>at</strong>e and retail lending market. Credit risk is well spread over a diversity of personal<br />

and commercial customers. Economic sector risk concentr<strong>at</strong>ions within the <strong>Group</strong>’s customer loan portfolio were <strong>as</strong><br />

follows:<br />

Annual Report <strong>2003</strong><br />

Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

Priv<strong>at</strong>e individuals 44% 40%<br />

Commerce and services 35% 38%<br />

Manufacturing 14% 15%<br />

Construction 2% 2%<br />

Shipping 2% 2%<br />

Government bodies 1% 1%<br />

Other 2% 2%<br />

Total 100% 100%<br />

Geographic sector risk concentr<strong>at</strong>ions within the <strong>Group</strong>’s customer loan portfolio were <strong>as</strong> follows:<br />

(All figures in thousands of CHF) Dec. <strong>31</strong>, <strong>2003</strong> Dec. <strong>31</strong>, 2002<br />

Greece 24’346’699 86% 19’034’644 88%<br />

Switzerland 221’610 1% 91’645 1%<br />

Other Western European countries 996’913 4% 837’471 4%<br />

Other countries 2’663’362 9% 1’407’921 7%<br />

Total 28’228’584 100% 21’371’681 100%<br />

<strong>Group</strong><br />

33