2007 Annual Report - Sappi

2007 Annual Report - Sappi

2007 Annual Report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

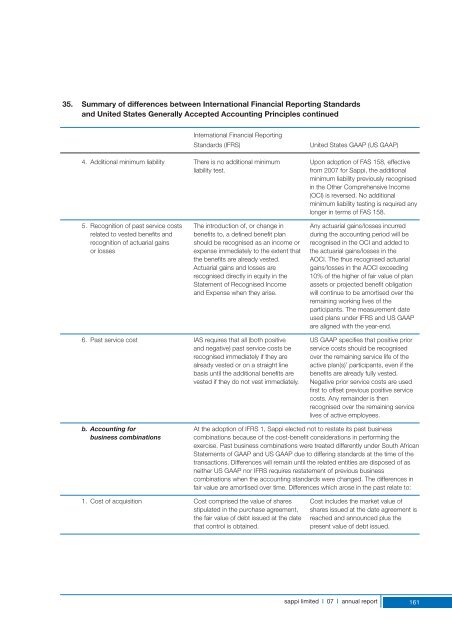

35. Summary of differences between International Financial <strong>Report</strong>ing Standards<br />

and United States Generally Accepted Accounting Principles continued<br />

International Financial <strong>Report</strong>ing<br />

Standards (IFRS)<br />

United States GAAP (US GAAP)<br />

4. Additional minimum liability There is no additional minimum Upon adoption of FAS 158, effective<br />

liability test.<br />

from <strong>2007</strong> for <strong>Sappi</strong>, the additional<br />

minimum liability previously recognised<br />

in the Other Comprehensive Income<br />

(OCI) is reversed. No additional<br />

minimum liability testing is required any<br />

longer in terms of FAS 158.<br />

5. Recognition of past service costs The introduction of, or change in Any actuarial gains/losses incurred<br />

related to vested benefits and benefits to, a defined benefit plan during the accounting period will be<br />

recognition of actuarial gains should be recognised as an income or recognised in the OCI and added to<br />

or losses expense immediately to the extent that the actuarial gains/losses in the<br />

the benefits are already vested. AOCI. The thus recognised actuarial<br />

Actuarial gains and losses are<br />

gains/losses in the AOCI exceeding<br />

recognised directly in equity in the 10% of the higher of fair value of plan<br />

Statement of Recognised Income assets or projected benefit obligation<br />

and Expense when they arise.<br />

will continue to be amortised over the<br />

remaining working lives of the<br />

participants. The measurement date<br />

used plans under IFRS and US GAAP<br />

are aligned with the year-end.<br />

6. Past service cost IAS requires that all (both positive US GAAP specifies that positive prior<br />

and negative) past service costs be service costs should be recognised<br />

recognised immediately if they are over the remaining service life of the<br />

already vested or on a straight line active plan(s)’ participants, even if the<br />

basis until the additional benefits are benefits are already fully vested.<br />

vested if they do not vest immediately. Negative prior service costs are used<br />

first to offset previous positive service<br />

costs. Any remainder is then<br />

recognised over the remaining service<br />

lives of active employees.<br />

b. Accounting for At the adoption of IFRS 1, <strong>Sappi</strong> elected not to restate its past business<br />

business combinations<br />

combinations because of the cost-benefit considerations in performing the<br />

exercise. Past business combinations were treated differently under South African<br />

Statements of GAAP and US GAAP due to differing standards at the time of the<br />

transactions. Differences will remain until the related entities are disposed of as<br />

neither US GAAP nor IFRS requires restatement of previous business<br />

combinations when the accounting standards were changed. The differences in<br />

fair value are amortised over time. Differences which arose in the past relate to:<br />

1. Cost of acquisition Cost comprised the value of shares Cost includes the market value of<br />

stipulated in the purchase agreement, shares issued at the date agreement is<br />

the fair value of debt issued at the date reached and announced plus the<br />

that control is obtained.<br />

present value of debt issued.<br />

sappi limited | 07 | annual report 161